HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Matt Blackman

Although not good for many stocks, rising interest rates are having a positive impact on one sector.

Position: N/A

Matt Blackman

Matt Blackman is a full-time technical and financial writer and trader. He produces corporate and financial newsletters, and assists clients in getting published in the mainstream media. He is the host of TradeSystemGuru.com. Matt has earned the Chartered Market Technician (CMT) designation. Find out what stocks and futures Matt is watching on Twitter at www.twitter.com/RatioTrade

PRINT THIS ARTICLE

REL. STR COMPARATIVE

Is It Time To Buy Banks?

09/05/13 04:41:22 PMby Matt Blackman

Although not good for many stocks, rising interest rates are having a positive impact on one sector.

Position: N/A

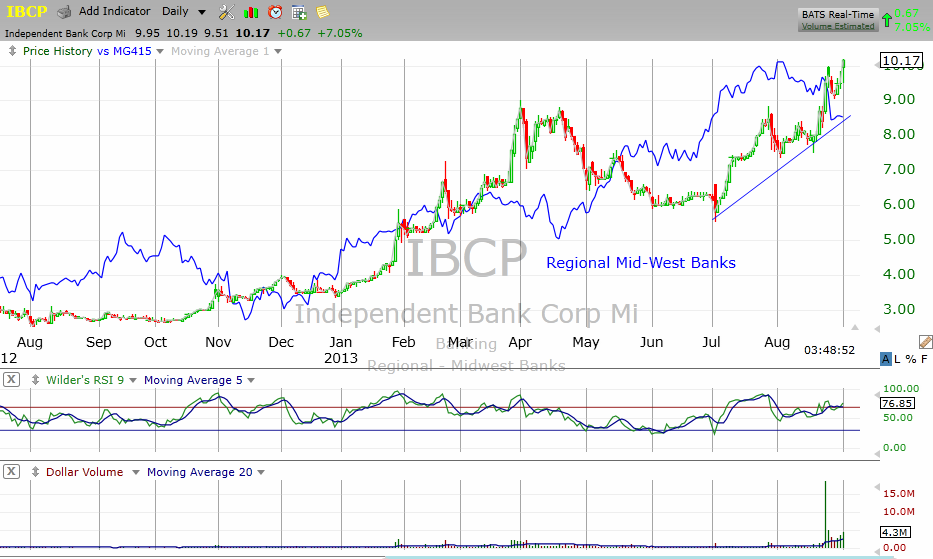

| In a recent "high fliers" scan of stocks that have exhibited impressive growth in the last week, Independent Bank Corp. came up near the top with a daily increase of more than five percent. As the chart in Figure 1 shows, it has more than tripled in value in the last year. As well, Regional Mid-West Banks, the sub-industry in which it resides show a distinct uptrend over the last year. Armed with this information, I decided to dig deeper. As mentioned in previous articles, even though they often lag stock price especially during rallies, an examination of the fundamentals can be very worthwhile. Fundamentals can be particularly valuable when stock prices have fallen and markets are soft when looking for stocks that could break out strongly when the market recovers. The reason is that during corrections all stocks are punished including those that have strong earnings and sales growth. |

|

| Figure 1 – Daily chart of Independent Bank Corp. (IBCP) showing the better than 300% price appreciation over the last year versus the sector. |

| Graphic provided by: TC2000.com. |

| |

| According to TC2000.com, IBCP experienced earnings per share growth of 2,300% in the latest quarter, EPS growth of 321% in the last year, and enjoyed a net profit margin (after tax) of 62%. And even though the stock had appreciated more than 300% in the past year, the stock still boasted a conservative price/earnings ratio of 2.8 times. In Figure 2 we see the longer-term chart of IBCP which, according to a September 3, 2013 Comtex news release, had just redeemed all its shares issued to the US Treasury for funds from the Troubled Asset Relief Program (TARP) and announced that the Treasury no longer had any equity interest in the company. |

|

| Figure 2 – Weekly chart of IBCP and regional banks showing performance since 2008. |

| Graphic provided by: TC2000.com. |

| |

| What makes this and other banks even more compelling is that rising long-term rates and a steepening yield curve have created a better (read more profitable) environment for this sector (see Figure 3). A search of the banking sector on TC2000 revealed a number of other interesting low priced candidates. Camco Financial (CAFI) showed an EPS change in the last year of +1,975%, post-tax profit margin of 32% and PE of 5, BBX Capital Corp (BBX) posted an EPS annual change of +1,600%, a post-tax profit margin of +1,256%, and PE of 0.60. Synovus Financial Corp (SNV) posted an EPS year change of 844%, net profit margin of 75% and PE of 3.8. These stocks also showed strong technicals. |

|

| Figure 3 – Daily chart of the CBOE 10 Year Treasury Yield showing the recent uptrend. |

| Graphic provided by: TC2000.com. |

| |

| If the economy continues to improve and quantitative easing is going to be phased out, there will be continued upward pressure on interest rates and this will be good for banks and financial services. A scan of the fundamentals can quickly tell you if a stock's strong chart performance is real or just another example of irrational exuberance gone wild. |

Matt Blackman is a full-time technical and financial writer and trader. He produces corporate and financial newsletters, and assists clients in getting published in the mainstream media. He is the host of TradeSystemGuru.com. Matt has earned the Chartered Market Technician (CMT) designation. Find out what stocks and futures Matt is watching on Twitter at www.twitter.com/RatioTrade

| Company: | TradeSystemGuru.com |

| Address: | Box 2589 |

| Garibaldi Highlands, BC Canada | |

| Phone # for sales: | 604-898-9069 |

| Fax: | 604-898-9069 |

| Website: | www.tradesystemguru.com |

| E-mail address: | indextradermb@gmail.com |

Traders' Resource Links | |

| TradeSystemGuru.com has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

Comments

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog