HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Billy Williams

This sports retailer has one key factor that could make it a big winner for you without stock market "turbulence".

Position: Buy

Billy Williams

Billy Williams has been trading the markets for 27 years, specializing in momentum trading with stocks and options.

PRINT THIS ARTICLE

STOCKS

Cabela's Flying High

08/26/13 04:40:40 PMby Billy Williams

This sports retailer has one key factor that could make it a big winner for you without stock market "turbulence".

Position: Buy

| Currently, one sports retailer, Cabela's Incorporated (CAB), is doing brisk business and as a result their stock price is steadily rising. Together with its subsidiaries, CAB operates as a specialty retailer and direct marketer of hunting, fishing, camping, and related outdoor merchandise. According to Reed Anderson, director of equity research at Northland Capital markets, Cabela's sales at its 44 stores average $370 per square foot, compared to the typical big-box sporting goods store averages closer to $200 per square foot. |

|

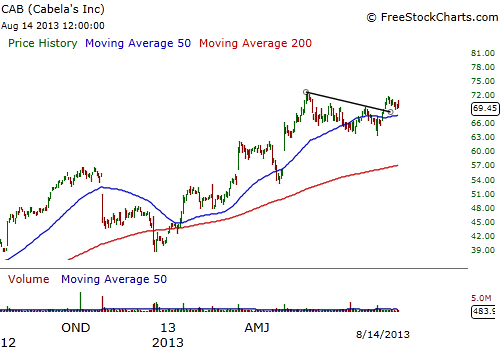

| Figure 1: Cabela's Inc. has the wind at its back with no stock market "turbulence" to slow its bull run. |

| Graphic provided by: www.freestockcharts.com. |

| |

| But, CAB still has some hurdles to overcome before becoming an ideal candidate for taking a long position. It has a slightly lower return-on-equity of just over 14%. Ideally, that number should be at least 17%. Then, there is the debt, which is currently just under $2.5 billion on their books which can only weigh down their future performance unless it is effectively managed or paid down. CAB's price action, however, has one key factor going for it more than anything else and this one factor can lead to serious gains for investors and traders. But keep in mind that a stock's price reveals all of its fundamentals and future prospects in the mind of Wall Street. Everything is eventually translated through a stock's price action and now it's revealing that the bullish trend is firmly in place. |

|

| Figure 2. Cabela's has formed a flag pattern recently and traded up through its trendline, but on low volume. Wait for a spike in volume greater than the previous 10 day's volume to enter and/or as price trades up through its former price high of $72.54. |

| Graphic provided by: www.freestockcharts.com. |

| |

| The big key factor working for CAB is that it is trading near its all-time price high which gives it an edge over stocks that are trading far below their former highs. Without any overhead resistance, CAB doesn't have to encounter stock market "turbulence" and is flying high as a result. This type of turbulence is felt as a stock, after a decline, trades up through its former price lows and experiences volatile price swings at these price points. This is the result of former investors and traders who held on during that decline and have been waiting to dump their shares to break even. Stocks trading at all-time price highs don't have to worry about this and their price movement is much smoother as a result. |

| However, CAB is a stock that you should let prove itself to you first since it doesn't have the ideal fundamental profile that you would prefer. Take a half-position on any pullback or as price trades up to a new price high, and then if the stock appreciates 7-8%, consider adding another quarter-position. In the current stock market environment, it pays to be cautious, so stay prudent. |

Billy Williams has been trading the markets for 27 years, specializing in momentum trading with stocks and options.

| Company: | StockOptionSystem.com |

| E-mail address: | stockoptionsystem.com@gmail.com |

Traders' Resource Links | |

| StockOptionSystem.com has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

Comments

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog