HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Billy Williams

If the market declines, knowing how to spot stock leadership will be critical as the year comes to an end.

Position: Buy

Billy Williams

Billy Williams has been trading the markets for 27 years, specializing in momentum trading with stocks and options.

PRINT THIS ARTICLE

STRATEGIES

Follow The Leaders

08/19/13 05:25:24 PMby Billy Williams

If the market declines, knowing how to spot stock leadership will be critical as the year comes to an end.

Position: Buy

| The "Summer Doldrums", a summer seasonal pattern that is marked by a lack of volume and lackluster trading, has been felt by most traders and investors this year. Now, there is talk about a pullback and/or decline due to the lack of upward movement which you should ignore for now and just look at the patterns in play. Summer doldrums are followed by a much more robust market going into the end of the year and you need to be prepared for a big push into higher ground if you want to rack up some solid gains. The last quarter of each year slowly begins to creep higher as fund managers and traders push the market to higher ground. They do this because the higher their returns are at year-end, the larger their bonuses are based on their performance. For higher gains, preparation at this stage is critical. |

| Whether there is a pullback or decline is not as important as knowing how to find and trade the emerging stock leaders. These are stocks that reveal themselves during periods of decline in the overall market. They do this because they hold up better than other stocks whose price action begins to fall apart at the first sign of a market decline. When the market is in a correction, weaker stocks fall like a rock while the strongest stocks tend to trade higher near their all-time price highs. |

|

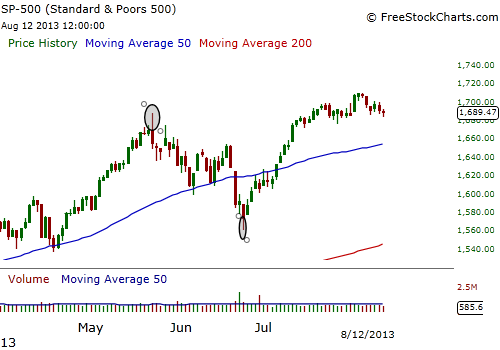

| Figure 1. The SPX began to decline near the end of May and falling below its 50 day SMA. It reached a new price low in June before rallying back and regaining its legs. |

| Graphic provided by: www.freestockcharts.com. |

| |

| Once the stock market finds a bottom and then reverses off that low, the stock leaders emerge by trading up through their previous all-time price highs, and take the rest of the stock market to higher ground. This pattern plays out over and over again. The problem for most traders is that after a steep decline, they tend to be a bit gun-shy, especially if they overstayed their visit by staying in a position too long or took a big hit in their trading accounts. It's hard to step in and buy again when your confidence has been damaged by a big loss, which is why you need to look for certain nuances about selecting emerging stock leaders. |

| The biggest challenge is knowing which leader to buy when breakouts seem to happening all at once when the market recovers. The easy answer, and the best answer, is to buy the one that breaks out first. |

|

| Figure 2. During SPX's decline, Infoblox, and Internet servicing company, traded near its all-time high without any serious decline. This showed a lot of strength in a weak market and eventually exploded higher even before the market recovered. This stock showed leadership before the market rallied and marked up a 30% return in just over a month. |

| Graphic provided by: www.freestockcharts.com. |

| |

| Those are the stocks with the strongest potential and you have to respect that if you want to make the highest return on your capital. The big money is made during the early stages of a new bull market during the first 12 to 18 months, but if you're not careful, you can get left in the dust as stock leaders tend to breakout ahead of the rest, weeks before the general market reverses course. For now, the market is still in an uptrend but if the market begins to correct and pullback, wait for the general market to make a new low while identifying the strongest stocks holding firm near their all-time highs. Once the market finds its bottom, spot the stock that breaks out first and take a position and add to it as the market begins to reverse course to catch the new bull market. |

Billy Williams has been trading the markets for 27 years, specializing in momentum trading with stocks and options.

| Company: | StockOptionSystem.com |

| E-mail address: | stockoptionsystem.com@gmail.com |

Traders' Resource Links | |

| StockOptionSystem.com has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog