HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Chaitali Mohile

Pilgrims Pride Corp. is rallying even in extreme bullish conditions.

Position: Hold

Chaitali Mohile

Active trader in the Indian stock markets since 2003 and a full-time writer. Trading is largely based upon technical analysis.

PRINT THIS ARTICLE

BREAKOUTS

PPC In Bullish Mood

08/12/13 03:19:01 PMby Chaitali Mohile

Pilgrims Pride Corp. is rallying even in extreme bullish conditions.

Position: Hold

| A bullish breakout of Pilgrims Pride Corp (PPC) has been following a certain consolidation pattern. After the bullish 50-day moving average (MA) breakout in Figure 1, PPC consolidated at higher levels, accumulating bullish strength for a future rally. Both short-term consolidation periods lasted for a few weeks. The directions of range-bound price movements were different. PPC moved horizontally in mid-May and in June, the price declined after a sharp rise. However, in both the cases the stock sustained at the immediate support without losing its bullish sentiments. |

| The extremely bullish conditions of the technical indicators in Figure 1 initiated consolidation in PPC. An overheated average directional index (ADX) (14) and an overbought full stochastic (14,3,3) were the reasons for periodic sideways actions. As the breakout rally surged in April 2013, the ADX (14) developed a fresh uptrend, further confirming strength in bullish sentiments. Gradually, the uptrend turned highly overheated and the stochastic oscillator also reached overbought levels. This generated the first consolidated rally in mid-May 2013. As the indicator retraced toward its steady bullish zones, PPC sprang upwards. |

|

| FIGURE 1: PPC, DAILY. |

| Graphic provided by: StockCharts.com. |

| |

| The ADX (14) rallied from the developed region (30 levels), pulling the price rally in the same direction. We can see in Figure 1 that PPC surged from $13 to $16, and later, it consolidated in a very narrow range. The stock formed a rising wedge formation during its recent consolidation. Although this wedge pattern is a bearish reversal formation, PPC is unlikely to decline drastically. The stock would follow its previous consolidation pattern. The highly overheated uptrend and the extremely overbought stochastic would support the upcoming rally. We can find one more reason for the continuation of this strong rally in Figure 2. |

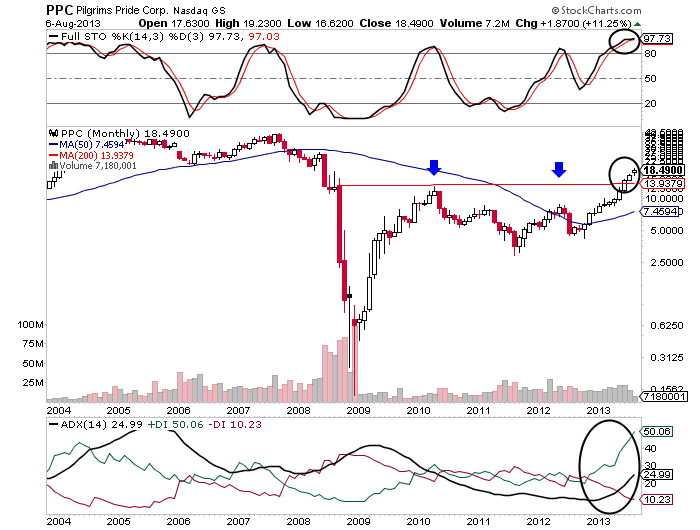

| PPC has converted the robust 200-day moving average (MA) resistance to support on the monthly time frame chart in Figure 2. The stock was under the resistance for about four years. Although the long-term MA was challenged twice, the stock failed to breach resistance. Due to weak buying pressure and lack of accurate direction, PPC continued to move in the bearish region of the price chart in Figure 2. However, the descending 50-day MA extended support in early 2013 induced the bulls to start a fresh upward rally. |

|

| FIGURE 2: PPC, MONTHLY. |

| Graphic provided by: StockCharts.com. |

| |

| Eventually, the ADX (14) developed a fresh long-term uptrend. The struggling stochastic oscillator reversed from its center line (50 levels), opening long-term buying opportunities for traders and investors. Currently, PPC has established strong support above its historical resistance. The developing uptrend is well placed to carry the price rally higher. Since the stochastic has reached its peak in an overbought region (98 levels) it may plunge a few levels to generate space for the ongoing breakout rally. The fresh robust support of the 200-day MA may shield this price fall. Considering the entire picture, PPC is likely to continue its bullish journey even in extreme bullish conditions. |

Active trader in the Indian stock markets since 2003 and a full-time writer. Trading is largely based upon technical analysis.

| Company: | Independent |

| Address: | C1/3 Parth Indraprasth Towers. Vastrapur |

| Ahmedabad, Guj 380015 | |

| E-mail address: | chaitalimohile@yahoo.co.in |

Traders' Resource Links | |

| Independent has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog