HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Donald W. Pendergast, Jr.

Up by more than 100% since June 2012, is it time for shares of Goodyear Tire and Rubber, Inc. to take a breather?

Position: N/A

Donald W. Pendergast, Jr.

Freelance financial markets writer and online publisher of the Trendzetterz.com S&P 500 Weekly Forecast service.

PRINT THIS ARTICLE

Goodyear? Up Until Now, Anyway

08/05/13 03:47:56 PMby Donald W. Pendergast, Jr.

Up by more than 100% since June 2012, is it time for shares of Goodyear Tire and Rubber, Inc. to take a breather?

Position: N/A

| By any standard of measure, the US stock market has made impressive gains over the past year, particularly since mid-November 2012. Every time a technician paints a seemingly plausible scenario in which stocks "should" tumble, Mr. Market just squashes such bearish evaluations, rallying even further. One of the best-performing large caps in the S&P 500 (.SPX) has been Goodyear Tire and Rubber (GT); since June 2012 the stock is up by more than 100% and its chart technicals suggest that it just may have some more upside potential before a meaningful correction ensues. Here's a closer look now. |

|

| Figure 1. Goodyear (GT) has beaten analyst earnings estimates in nine of its last 11 quarters, including Q2 2013. Earnings came in 53% above estimates, prompting a wave of buying on July 30, 2013. |

| Graphic provided by: TradeStation. |

| |

| Bull markets tend to gain ground a little at a time, unlike bear markets, which tend to cover massive amounts of territory in roughly one-third to one-quarter of the time needed for a bull market move of a similar percentage, and that's one of the reasons calling a top in a bull market is so tough — unless of course, you're able to identify a fifth of a fifth wave Elliott scenario or some other pattern that is equally as dramatic – and rare. No doubt, many a bear has had his paws burned by trying to call "the" top in the .SPX (.SPX) or Nasdaq 100 indexes (.NDX). Goodyear, a .SPX component stock, has had plenty of decent swing moves within the larger-scale uptrend since summer 2012, but what we want to focus on here and now is the low-risk covered call play that the stock has recently presented to conservative traders — one that stands to benefit from GT's persistently bullish trend. First off, note the huge gap higher of July 30, 2013, in the chart in Figure 1. This earnings report surge put the stock at a fresh multiyear high even as it blasted above a key resistance zone at 17.64 at a time when its long term money flow (CMF)(89) remains in an exceedingly bullish mode — one that is a solid foundation for a near term buy-write play. GT has beaten the street in nine of its last 11 earnings reports. Clearly, this is a bullish set of fundamental and technical dynamics at work in GT, making a covered call play extremely attractive to savvy traders with low risk tolerances. Here's a simple plan on how to get setup with this trade. |

|

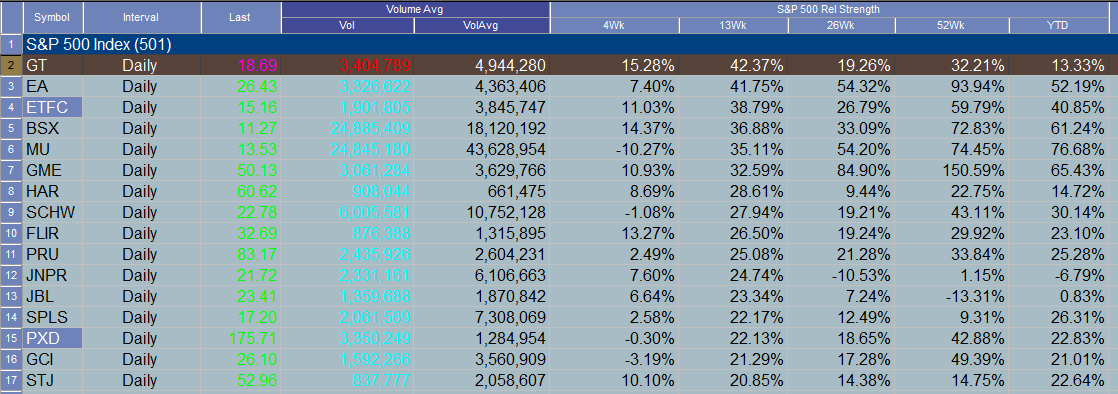

| Figure 2. GT has been outperforming the S&P 500 index (.SPX) by a wide margin over the past 4-, 13-, 26- and 52-week periods. |

| Graphic provided by: TradeStation. |

| Graphic provided by: TradeStation Radar Screen. |

| |

| First, wait for GT to rise above its August 1, 2013 high of 18.90, to ensure you're on the right side of bullish momentum. Once you've seen that, for every 100 shares of GT you want to buy, sell one September '13 GT $18.00 call option; this call has a bid/ask spread of ten cents and has an open interest figure of 914 contracts. One you've got the entire position on, place your initial stop just below the July 30, 2013 low (near 18.00 should work okay) and sit back and relax. If GT continues to rise, the red 21-day exponential moving average (EMA) will also rise; once the EMA rises to 18.05, begin using it as your trailing stop, for the life of the trade. Unless GT suddenly gaps down beneath 18.05, this trade is about as low-risk as it gets for a covered call play, given the exceptionally bullish earnings and money flow trend in the stock. Keep your account risk at 1-2% on this trade, bearing in mind that the entire US markets could be vulnerable for a correction of some magnitude as we get closer to the end of the summer. Trade wisely until we meet here again. |

Freelance financial markets writer and online publisher of the Trendzetterz.com S&P 500 Weekly Forecast service.

| Title: | Market consultant and writer |

| Company: | Trendzetterz |

| Address: | 81 Hickory Hollow Drive |

| Crossville, TN 38555 | |

| Phone # for sales: | 904-303-4814 |

| Website: | trendzetterz.com |

| E-mail address: | support@trendzetterz.com |

Traders' Resource Links | |

| Trendzetterz has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog