HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Matt Blackman

Builders have been a major beneficiary of the Federal Reserve's Zero Interest Rate Policy (ZIRP) since 2008 but there are signs that they will also be early victims as easy money programs wind down.

Position: Sell

Matt Blackman

Matt Blackman is a full-time technical and financial writer and trader. He produces corporate and financial newsletters, and assists clients in getting published in the mainstream media. He is the host of TradeSystemGuru.com. Matt has earned the Chartered Market Technician (CMT) designation. Find out what stocks and futures Matt is watching on Twitter at www.twitter.com/RatioTrade

PRINT THIS ARTICLE

TREND-CHANNEL

Homebuilders: The First Rising Rate Casualties?

07/29/13 02:31:16 PMby Matt Blackman

Builders have been a major beneficiary of the Federal Reserve's Zero Interest Rate Policy (ZIRP) since 2008 but there are signs that they will also be early victims as easy money programs wind down.

Position: Sell

| Although stocks, for the most part, have taken rising interest rates in stride, the same cannot be said about homebuilders. According to a July 25 Bloomberg article (http://goo.gl/f4BhLS), the nation's two largest builders, Pulte Group (PHM) and D.R. Horton (DHI), disappointed the street with lower than expected orders causing investors to punish the stocks with 10 and 9% drops respectively on the day earning were reported. But as we see from the charts in Figure 1 and Figure 2, there are signs that trend for homebuilders may have ended even before the weak orders news. DHI experienced a serious trend line breach June 21, 2013 and the brief post-breach rally ended with the gap down on earnings news on July 25, 2013 with a similar drop in PHM. |

|

| Figure 1 – Daily chart comparing D.R. Horton (DHI) with the Pulte Group (PHM) which have both broken uptrend support lines. |

| Graphic provided by: TC2000.com. |

| |

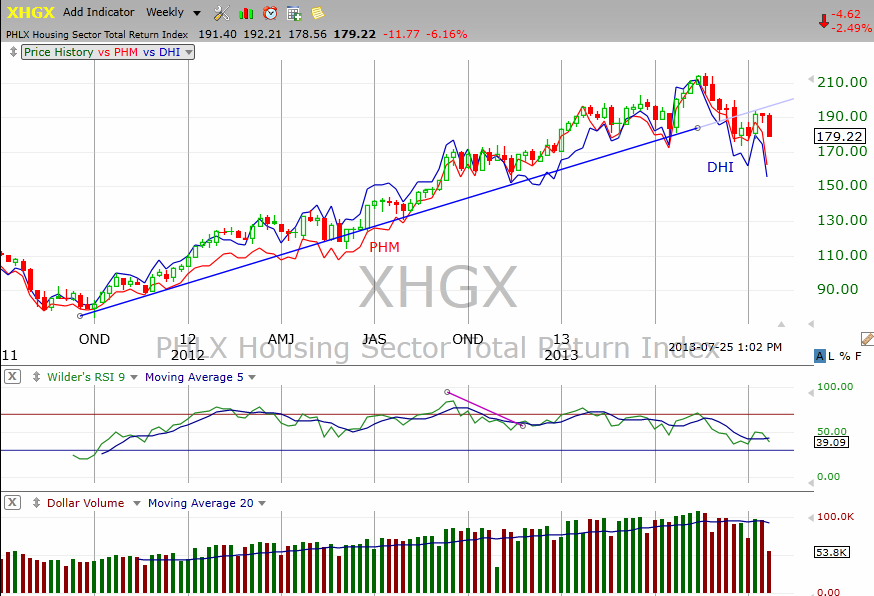

| On a larger scale, the weekly chart in Figure 2 shows how the industry has been faring under the new rising interest rate regime. The Philadelphia Housing Sector Total Return Index (XHGX) also broke trend line support in late June 2013 led by the industry leaders DHI and PHM. The 30-year fixed mortgage rate hit 4.31% in the third week of July, up from the near record low of 3.35% in May; an increase of nearly 30% in just 60 days. |

|

| Figure 2 – Weekly chart comparing the Philadephia Housing Sector Total Return Index with the Pulte Group and D.R. Horton with the break in the long-term uptrend support line that began in late 2011. |

| Graphic provided by: TC2000.com. |

| |

| Only time will tell if the recent drops in building stocks is an overreaction to Federal Reserve Chairman Ben Bernanke's recent speech (that hinted at a possible reduction in accommodative interest rate policy) as postulated by D.R. Horton's CEO Donald Tomnitz in the Bloomberg article. If this is indeed the case, expect to see homebuilders rebound and hold the uptrend line in Figure 2. But if this is just the beginning of sustained higher interest rates, the best days for homebuilders may be over, at least for the next few months. |

Matt Blackman is a full-time technical and financial writer and trader. He produces corporate and financial newsletters, and assists clients in getting published in the mainstream media. He is the host of TradeSystemGuru.com. Matt has earned the Chartered Market Technician (CMT) designation. Find out what stocks and futures Matt is watching on Twitter at www.twitter.com/RatioTrade

| Company: | TradeSystemGuru.com |

| Address: | Box 2589 |

| Garibaldi Highlands, BC Canada | |

| Phone # for sales: | 604-898-9069 |

| Fax: | 604-898-9069 |

| Website: | www.tradesystemguru.com |

| E-mail address: | indextradermb@gmail.com |

Traders' Resource Links | |

| TradeSystemGuru.com has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog