HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Matt Blackman

Earnings for companies in the personal computer space have been under pressure lately. But is this a temporary setback or lasting trend?

Position: Sell

Matt Blackman

Matt Blackman is a full-time technical and financial writer and trader. He produces corporate and financial newsletters, and assists clients in getting published in the mainstream media. He is the host of TradeSystemGuru.com. Matt has earned the Chartered Market Technician (CMT) designation. Find out what stocks and futures Matt is watching on Twitter at www.twitter.com/RatioTrade

PRINT THIS ARTICLE

HEAD & SHOULDERS

Bearish On Microsoft - Is An Industry Shake-Up At Hand?

07/19/13 04:23:49 PMby Matt Blackman

Earnings for companies in the personal computer space have been under pressure lately. But is this a temporary setback or lasting trend?

Position: Sell

| After hours on July 18, Microsoft (MSFT) reported Q2-2013 earnings and by all accounts they were a disappointment. The Wall Street consensus was for $0.75/share. Actual reported earnings were $0.59. Less than an hour after close, the stock had already fallen more than 5% from its close of $35.44. Two big problems revealed in the report were; a $900 million write-down "related to Surface RT [ultrabook] inventory adjustments" and lackluster sales of its much-hyped Windows 8 operating system. As we see on the hourly chart in Figure 1, this pushed the stock below its short-term bearish head & shoulders neckline and as we see on the weekly chart, produced a bearish inverted hammer candlestick pattern. But from a macro point of view, there are larger issues at stake. |

|

| Figure 1. Hourly chart showing the bearish head & shoulders pattern setting up beginning in early July 2013 and the bearish neckline breach after hours July 18. |

| Graphic provided by: TC2000.com. |

| |

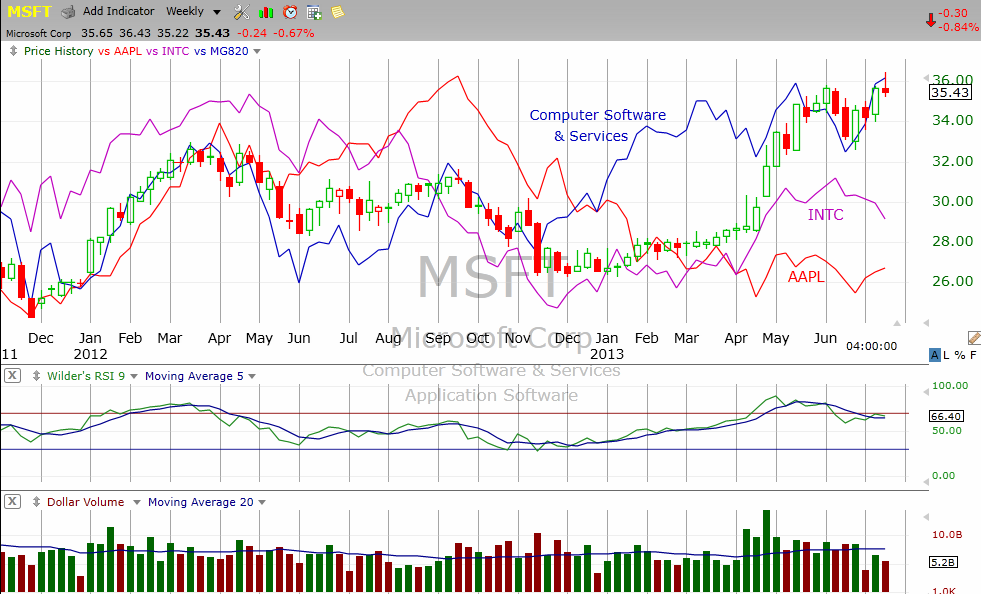

| As we see in the weekly performance of MSFT together with Computer Software & Services Industry (blue line), computer chip-maker Intel (INTC) and Apple Inc (AAPL), the industry is showing signs of strain. According to research firm Gartner Inc (gartner.com), global PC shipments dropped 11% last quarter as customers transitioned to other devices such as smart phones and tablets. Unfortunately for Microsoft, the Surface, an attempt to marry the laptop computer with the tablet, apparently wasn't one of them. We recently went shopping for a new device for our daughter and looked at everything from iPads, to Android-powered tablets and the Surface. Even after some steep discounts, the Surface was still significantly more expensive than Android devices such as the Samsung and Asus Nexus tablets. One big challenge is that Windows 8 powered tablets need larger memory capacities to handle the Win 8 OS which requires about 15 gigabytes versus around 2 gigs for the Android operating system. We ended up buying the Asus Nexus 7 Android tablet with 32 gigabytes of memory for under $260 versus $450 for the discounted Surface 32 gig and $560 for the 32 gig iPad mini. |

|

| Figure 2. Weekly chart showing longer-term picture of MSFT together with the Computer Software industry, Intel (INTC) and Apple Inc (AAPL). Also note the RSI sell signal on MSFT generated in June 2013 and the red bearish inverted hammer candlestick pattern for the latest week. |

| Graphic provided by: TC2000.com. |

| |

| My point is that with the incredible competition in tablets and smart phones, companies like Microsoft and Apple are feeling the margin pinch. And if what the teens and pre-teens are buying these days is any indication, the trend away from personal computers is not about to end soon. |

Matt Blackman is a full-time technical and financial writer and trader. He produces corporate and financial newsletters, and assists clients in getting published in the mainstream media. He is the host of TradeSystemGuru.com. Matt has earned the Chartered Market Technician (CMT) designation. Find out what stocks and futures Matt is watching on Twitter at www.twitter.com/RatioTrade

| Company: | TradeSystemGuru.com |

| Address: | Box 2589 |

| Garibaldi Highlands, BC Canada | |

| Phone # for sales: | 604-898-9069 |

| Fax: | 604-898-9069 |

| Website: | www.tradesystemguru.com |

| E-mail address: | indextradermb@gmail.com |

Traders' Resource Links | |

| TradeSystemGuru.com has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

Comments

|

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog