HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Billy Williams

The most difficult part of trading is knowing when to get in early and when to stay out but there is a simple two step strategy to help you get into winning stocks earlier than the crowd.

Position: Buy

Billy Williams

Billy Williams has been trading the markets for 27 years, specializing in momentum trading with stocks and options.

PRINT THIS ARTICLE

STRATEGIES

Two Step Strategy To Getting In Early

07/16/13 04:00:20 PMby Billy Williams

The most difficult part of trading is knowing when to get in early and when to stay out but there is a simple two step strategy to help you get into winning stocks earlier than the crowd.

Position: Buy

| In stock trading, the ability to know when to get in a position and when to get out of a position is the most highly prized skill. And, sadly, it is possibly the hardest part of professional trading to master. In fact, even the professionals stumble in the attempt which means that it can be a perishable skill if you don't continually work at refining it. Like professional golfers – Jack Nicklaus or Tiger Woods – you have to spend time working at your craft and putting in the "flight time" to know when to act and when not to. In trading, knowing when to get into a move before it happens takes a combination of discipline, skill, and the right tools. This is especially true when it comes to getting in early on a potential home-run. The discipline that you bring to the market is within your control to hone and sharpen. Otherwise you'll be like a feather caught in a hurricane and tossed around by the market's forces. Your discipline will be a big part of the equation in knowing when to enter the market. There is a simple two step strategy that can help you time your entries in the stock market and, better yet, help you get in early on a potential runaway stock. First, a little background to understand the context of the strategy. |

|

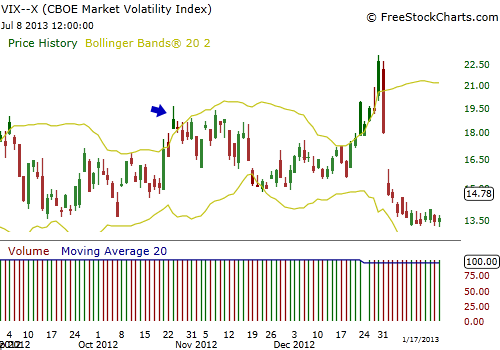

| Figure 1. On October 23, 2012, the VIX traded up through the upper Bollinger Band as the SPX declined. This signaled the first step in the strategy to get into winning moves earlier than the rest of the investment herd. |

| Graphic provided by: www.freestockcharts.com. |

| |

| In momentum trading, most traders understand that you want to find stocks that have a combination of fundamental and technical criteria that will help you find the stocks with the greatest potential of above average returns. William O'Neal detailed a comprehensive strategy to achieve this in his book "How to Make Money in Stocks" which has been the industry standard for momentum trading/investing. But, there are limitations to the strategy. Mainly, everyone who trades understands the strategy and if everyone is using it then you lose your edge in applying it in the marketplace. |

|

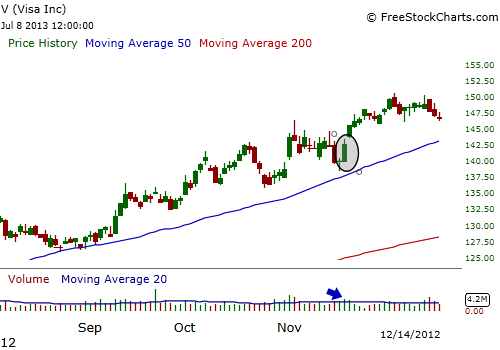

| Figure 2. On November 16, 2013, Visa's price had pulled back but price and volume surged as volume reached levels greater than its previous 10 days, signaling that a pocket pivot had taken place and an entry signal, the second step of the two step strategy. |

| Graphic provided by: www.freestockcharts.com. |

| |

| Floor traders, for instance, can see when price is about to breakout of a base pattern and can temporarily push the market lower after a buy signal has been triggered. This causes a run on the stop loss orders and shakes you out of a position just before the stock takes off. This allows floor traders to profit on both the short- and long-side of the trade at your expense. In order to avoid this and gain an earlier entry before the breakout entry, you want to use a combination of the Volatility Index (VIX) with the Bollinger Band and a price pattern called the "pocket pivot". Place the VIX and a Bollinger Band on a price chart and watch for the VIX to trade up through the upper Bollinger Band. The VIX has an inverse relationship with the SPX and when it trades up through the upper Bollinger Band, it reveals that the SPX is oversold and due for an upward bounce. |

|

| Figure 3. Visa went on to soar higher and gain just under 50 points from the strategy's entry signal. |

| Graphic provided by: www.freestockcharts.com. |

| |

| When that occurs, you want to look for stocks that have the right kind of fundamental and technical profile outlined by O'Neal but look for stocks that move higher on volume that is greater than the previous 10 trading days, the pocket pivot pattern. The signals may not fire off at each other with the pocket pivot taking days or weeks to signal, so remain alert. This will allow you to get an earlier entry into a stock that is setting up to breakout but without the stress of getting churned back-and-forth by floor traders or the major institutions while also allowing you to make a greater return with less risk. |

Billy Williams has been trading the markets for 27 years, specializing in momentum trading with stocks and options.

| Company: | StockOptionSystem.com |

| E-mail address: | stockoptionsystem.com@gmail.com |

Traders' Resource Links | |

| StockOptionSystem.com has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog