HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Billy Williams

Quantitative easing, poor economic numbers, and the Federal Reserve are in the news, but an online media war is going unnoticed, and it's heating up.

Position: Buy

Billy Williams

Billy Williams has been trading the markets for 27 years, specializing in momentum trading with stocks and options.

PRINT THIS ARTICLE

STOCKS

Content Wars And Soap Operas

06/11/13 03:15:33 PMby Billy Williams

Quantitative easing, poor economic numbers, and the Federal Reserve are in the news, but an online media war is going unnoticed, and it's heating up.

Position: Buy

| Mixed economic data left the Federal Reserve in doubt on how to go forward with quantitative easing (QE) given that GDP was registering only "modest" growth despite the massive influx of money being printed in an effort to bolster the economy and add to job growth. Despite the Fed's willingness to pump money into the economy, the desired end result proved to be a letdown and now Fed Chief Bernanke is hesitant on how to proceed. The market's knee jerk reaction to Bernanke's uncertainty on how to go forward was to sell off and, in the days and weeks to come, it may be revealed this was a flight-to-safety to limit risk in the face of that doubt. Despite all that is happening on Wall Street, there is a war brewing in online media that is being overlooked by the press and most investors and traders. Amazon (AMZN) and Netflix (NFLX) are two competitors in the realm of streaming entertainment video and are at a crossroads on how to go forward themselves. Netflix blazed new trails when it came out with its subscription-based video rental business and quickly displaced Blockbuster Video as the premier provider of DVD rentals. Netflix then added streaming video to its product line. |

|

| Figure 1. AMZN is trending higher as it broadens its product line in online media as well as take on producing its own content. With annual subscribers to its Amazon Prime, as well as its base of customers that own its Kindle Fire, AMZN has a built-in base of buyers, all of whom have a credit card registered with them. It's price chart shows a stock that is in a base pattern with its 50-day and 200-day SMA beginning to trend higher, indicating the stock could breakout to higher ground. |

| Graphic provided by: www.freestockcharts.com. |

| |

| AMZN (the "Walmart of Online Commerce") started carving out its online space with selling books and videos, but later expanded into everything from selling BBQ pits, electronics, lawn furniture, and more. In addition, it has expanded into its own subscription-based service in offering streaming videos and other media content. Both of these companies are heavyweights in the online world and at first glance appear to be ready to butt heads, but a closer look shows that both companies will experience some overlap in the marketplace, but mostly take divergent paths away from one another and will likely see their stock prices soar as a result. Netflix has a monthly subscription-based service that allows for DVD rental via mail along with streaming video that is made available via computers, TV sets, mobile phones and even Amazon.com's Kindle. But, Netflix's licensing agreement with Viacom – which had provided most of their streaming content – has not been renewed as yet. NFLX wanted to steer away from licensing agreements and begin to produce some of its own content like "House of Cards", a recent NFLX production which was well-received by its customers. |

|

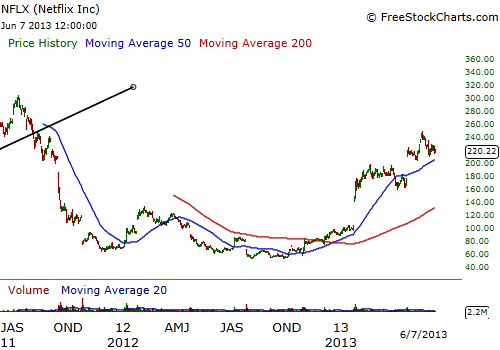

| Figure 2. NFLX is a dominant player in the DVD and streaming video rental business with millions of monthly paying subscribers. It has dropped some of its licensed content partners but has a headstart on producing its own content. Conceivably, it could be an "online HBO" with its own line of content series and content library, cementing its position as a leader in its marketplace. |

| Graphic provided by: www.freestockcharts.com. |

| |

| Like HBO, they've built up their subscribers using licensing agreements and have begun producing their own unique content for customers. Now, after their success, AMZN is following suit. AMZN is picking up Viacom as a licensing partner and adding Disney, with an emphasis of providing entertainment for kids since a lot of their viewership shows young children using Kindles to access programming. Like NFLX, AMZN is also producing its own content and developing several unique series that are exclusive to its viewers. This is where the overlap is occurring between these two companies and competition can be expected to be fierce. For traders, however, the fundamentals are shaping up for both companies and translating into compelling price action. Price for both stocks is inching higher, near their all-time highs, and appears to be building a first stage base pattern. |

| It's too early to take a position but if AMZN and NFLX's revenues continue to trend higher as they gain viewership, then price should follow and offer you a chance to get in early. Watch for strong price action up through their resistance line in the basing pattern, and take a small position but add more when the opportunity presents itself. Adjust trailing stops to 25% of the most recent price high after entry and tighten up if distribution keeps occurring in the overall market to get you out if weakness keeps pouring in the major indexes. |

Billy Williams has been trading the markets for 27 years, specializing in momentum trading with stocks and options.

| Company: | StockOptionSystem.com |

| E-mail address: | stockoptionsystem.com@gmail.com |

Traders' Resource Links | |

| StockOptionSystem.com has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

Comments

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog