HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Donald W. Pendergast, Jr.

After a major year-long rally, Citigroup shares appear to be in the initial stages of a proportional correction.

Position: N/A

Donald W. Pendergast, Jr.

Freelance financial markets writer and online publisher of the Trendzetterz.com S&P 500 Weekly Forecast service.

PRINT THIS ARTICLE

CHART ANALYSIS

Citigroup: Correcting Back To Support?

05/28/13 05:19:28 PMby Donald W. Pendergast, Jr.

After a major year-long rally, Citigroup shares appear to be in the initial stages of a proportional correction.

Position: N/A

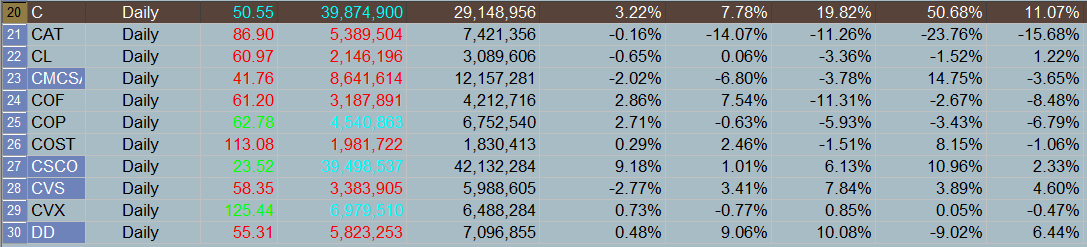

| Financial sector stocks make up the single largest group of equities within the S&P 100/500 indexes (.OEX, SPX), and when names like Bank of America (BAC), Goldman Sachs (GS), JPMorgan Chase (JPM) and Citigroup (C) all catch a bid, it's a near-certainty that the large cap US stock indexes will also rally. That's definitely been the case since June 2012 and one stock in particular has also done well for itself over the past year; Citigroup rallied by as much as 74% between June 4, 2012 and May 22, 2013. That big rally is probably complete now and it's time for C to pullback to a substantial support level. Here's a closer look. |

|

| Figure 1. Citigroup (C) rallied by nearly 75% between June 2012 and May 2013, but now a fairly large – yet proportional – correction may be due. The violent two-day bearish reversal of May 22-23, 2013 may be a precursor of much larger declines ahead. |

| Graphic provided by: TradeStation. |

| |

| If you want to get on and stay on the "right" side of the major market indexes there are few more powerful ways to accomplish this than to identify the primary trend in key financial sector stocks, such as C. Notice that since it made its last super-multicycle bottom in June 2012 (Figure 1) that the stock has spent approximately 90% of its time trading above its all-important 50-day exponential moving average (EMA) and that all of its pullbacks found support just below the EMA. So when heading into Citigroup's latest rally in mid-April 2013, a bullish trader would have had little hesitation in pulling the trigger on a new long swing trade, even though such a trader would also have been running an appropriate trailing stop and/or profit target, no matter how good the trade setup looked. A skilled swing trader in such a long position would also have been watching the progressive "bleed-off" of the Chaikin Money flow (CMF)(89) histogram as C rallied, realizing that the "smart money" interests were not the ones driving price higher (it was latecomers doing the bulk of the buying - those who expected C to still be a good three to six month long trade or covered call position). Less experienced investors may not have realized that and may not have taken action to protect their long positions until it was too late; some of these traders/investors were likely the ones who sold C off sharply during May 22-23 2013. This two-day reversal is the most violent correction yet for the stock in the past year and by all appearances is the "shot across the bow" that warns of even further declines just ahead. |

|

| Figure 2. Citigroup has been outperforming the .SPX by more than 50% over the past year; look for Citi to fall faster than the .SPX in the next month or two, however. |

| Graphic provided by: TradeStation. |

| |

| C has staged an intraday relief rally of sorts during the May 23, 2013, session, and this offers savvy traders a great opportunity to get in on a low risk short trade setup: 1. On a break below 50.22, short C, risking no more than 1% of your account value on the trade. If, however, the stock manages to rise to 50.92 first, without making it down to 50.22, scrub all plans for the trade and wait for another opportunity. 2. If filled on the trade, set your stop loss at 50.95, run a three-bar trailing stop of the daily highs, and plan to take half profits if 49.18 is reached prior to stop out. 3. If C just keeps on falling, keep the trailing stop in place and the look to take more profits - if not all of the rest of them - if the blue 50-day EMA is reached (currently near 46.64). There is very strong daily chart Fibonacci support near 46.00, so you may be pushing your luck by trying to hold on for an outsized gain; most traders should just play things safe and take profits near 49.18 and then 46.75/47.00 instead. |

| The broad US markets appear to have already made an important intermediate term high, one that may stand until late summer/early fall 2013. If you're still long the markets, make sure you are well protected (with trailing stops or long puts) and if you choose to jump on some attractive short plays, make sure you don't overstay your welcome - short covering rallies are always a possibility, and they can eat up open trade profits in a real hurry if you're not prepared for them. Trade wisely until we meet here again. |

Freelance financial markets writer and online publisher of the Trendzetterz.com S&P 500 Weekly Forecast service.

| Title: | Market consultant and writer |

| Company: | Trendzetterz |

| Address: | 81 Hickory Hollow Drive |

| Crossville, TN 38555 | |

| Phone # for sales: | 904-303-4814 |

| Website: | trendzetterz.com |

| E-mail address: | support@trendzetterz.com |

Traders' Resource Links | |

| Trendzetterz has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor