HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Donald W. Pendergast, Jr.

Shares of Walgreens Co. had risen nearly 80% since last summer's major low, but now appear to have hit a major supply area and are in the early stages of a correction.

Position: N/A

Donald W. Pendergast, Jr.

Freelance financial markets writer and online publisher of the Trendzetterz.com S&P 500 Weekly Forecast service.

PRINT THIS ARTICLE

TECHNICAL ANALYSIS

Walgreens Co. : Prescription For A Correction?

05/23/13 03:50:04 PMby Donald W. Pendergast, Jr.

Shares of Walgreens Co. had risen nearly 80% since last summer's major low, but now appear to have hit a major supply area and are in the early stages of a correction.

Position: N/A

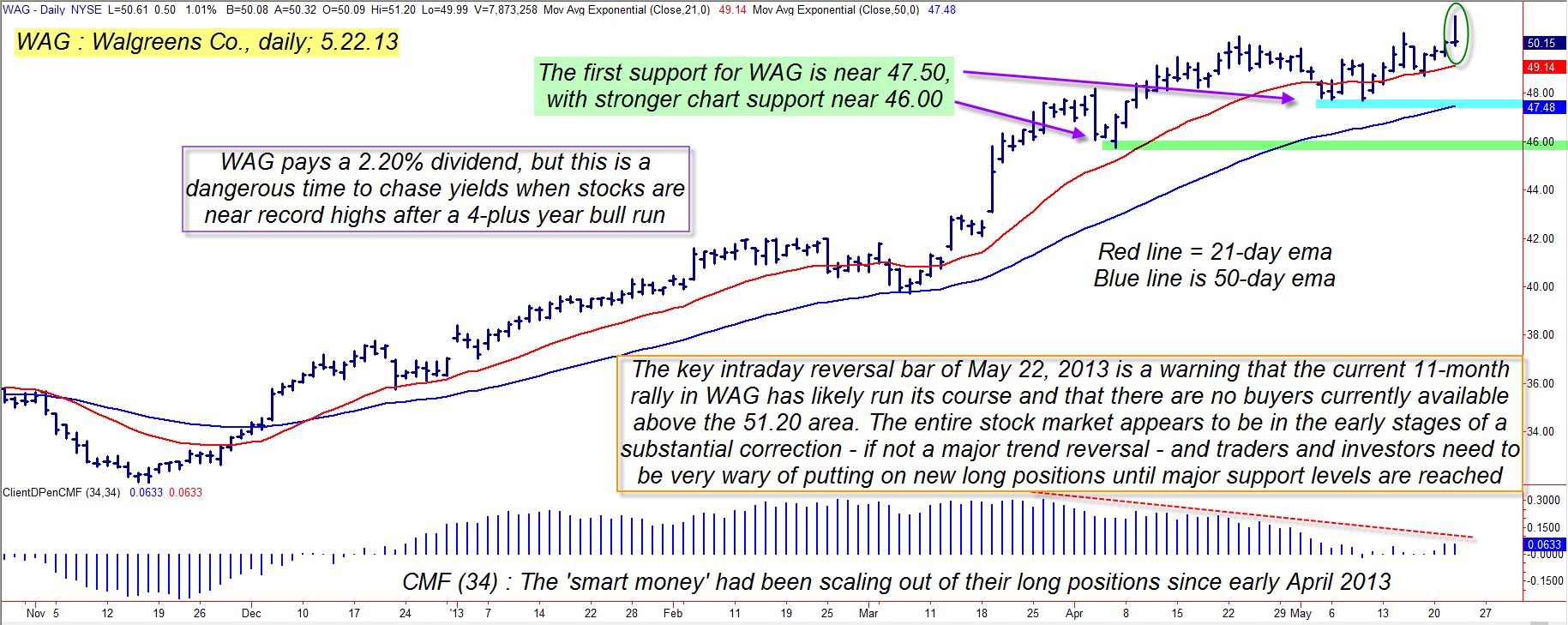

| Walgreen Co. (WAG) common stock has enjoyed relatively low volatility each time it has made major multicycle lows – first in June 2012 and then again in November 2012 – with the gains being especially steady coming out of its November '12 cycle low of 31.88 (Figure 1). WAG had been trading as high as 51.20 on the morning of May 22, 2013, but ended the session by printing a major reversal bar, one that is not uncommon at major market highs in individual stocks and stock indexes. WAG opened Wednesday's session at 50.09, shot higher to 51.20, ran out of bids and then collapsed back to 50.14 – barely up five cents on the day; such disturbing price action in a high relative strength large cap stock – one which has outperformed the .SPX by more than 26% over the past year – clearly indicates that its 11-month bull market is due for a pause, if not a substantial pullback to significant support. |

|

| Figure 1: Walgreens Co. (WAG) shares have had a nearly 80% rally since June 2012, buy the new intraday reversal bar appears to be warning that this bullish party might be over for now. |

| Graphic provided by: TradeStation. |

| |

| As we examine the medium-term money flow (based on the 34-day Chaikin Money flow histogram or (CMF)(34)) trend for WAG, we find that the "smart money" interests in this stock have been distributing their shares to latecomers since the beginning of April 2013; this is proved out by the ever lower highs in the money flow histogram at a time when WAG kept on powering to higher highs. Now, with the only ones left to buy being the "dumb money", as soon as the stock hit a major area of supply (which simply means that there are tons of sellers above a certain price but very few who are willing to step up and buy it from them) a great many of these latecomers would panic, sell out and really get the correction process going. This appears to be what happened on Wednesday, and it would not be surprising to see WAG sell off for the next 3 to 5 sessions, perhaps breaking down below its red 21-day EMA in the process. Going further out, a deeper correction should see WAG hitting one, if not both of its next support areas near 47.50 and 46.00. The 47.50 support coincides with WAG's 50-day EMA, so it may offer a chance to get in on a minor rebound rally, but it's impossible to predict what will actually happen until it gets down to that level. Going even lower, we find major support levels near 43.10 and then at 39.74. |

|

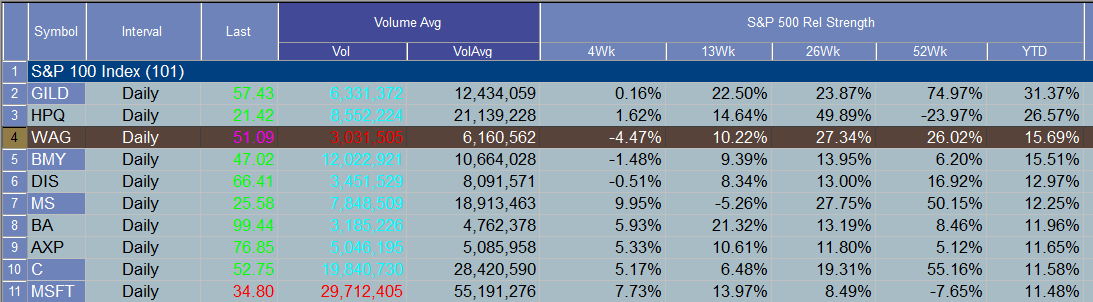

| Figure 2: WAG has been easily outperforming the .SPX over the past 13-, 26- and 52-week time periods; it has, however, begun to lag the index over the last 4 weeks. |

| Graphic provided by: TradeStation. |

| Graphic provided by: TradeStation Radar Screen. |

| |

| Skilled option traders may want to consider the following long put play in WAG, given that the odds of a major reversal in the stock are relatively high right now: 1. If WAG drops below 49.90, buy to October '13 $49.00 put option; its bid/ask spread is excellent and open interest is nearly 900 contracts. This option has nearly five months of time value, giving a bearish trader in WAG plenty of time for this stock's anticipated reversal to develop. More conservative traders can wait for the 21-day EMA to be violated before putting on the same trade. 2. Manage the trade by selling if it increases in value by 100% or if it declines by 50%, and also consider selling at least half to two-thirds (if not all) of your position should WAG drop down to the 46.00 area in a hurry. A strong rebound might be expected from that support level, so really think twice if you want to try and hold on for further declines into the lower 40s, as you could be risking a lot of open profits in your quest to go for even bigger gains. Remember to risk no more than 1 to 2% of your account value on this or any other trade, no matter how bearish you may be on the stock market right now. This looks like a great short opportunity in WAG, so be sure and check it out. |

Freelance financial markets writer and online publisher of the Trendzetterz.com S&P 500 Weekly Forecast service.

| Title: | Market consultant and writer |

| Company: | Trendzetterz |

| Address: | 81 Hickory Hollow Drive |

| Crossville, TN 38555 | |

| Phone # for sales: | 904-303-4814 |

| Website: | trendzetterz.com |

| E-mail address: | support@trendzetterz.com |

Traders' Resource Links | |

| Trendzetterz has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog