HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Billy Williams

There is one stock whose assets are actually benefiting from the Fed's money printing and is set to be next best trade that no one has ever heard of.

Position: Buy

Billy Williams

Billy Williams has been trading the markets for 27 years, specializing in momentum trading with stocks and options.

PRINT THIS ARTICLE

Stealth Stock: The Blackstone Group

05/24/13 11:44:07 AMby Billy Williams

There is one stock whose assets are actually benefiting from the Fed's money printing and is set to be next best trade that no one has ever heard of.

Position: Buy

| It has taken five years for the markets to shake off the hangover from the days of cheap money where soccer moms and cab-drivers tried to cash in by flipping houses only to crash-and-burn as the bottom fell out of real estate and took the rest of the stock market with it. Now, in an already stagnant market to begin with, equities have clawed their way out of the abyss and all the way to a 14-year price high. The question is whether the market will follow through or fall off the wagon and ruin its chances of a bull market. While things look positive there is no way of knowing for sure. In truth, predicting what and where the market will end up in the future isn't the job of the professional but looking to minimize risk while putting yourself in the position to catch a low-risk return and, at the same time, a potential windfall is the cornerstone of intelligent speculation. |

|

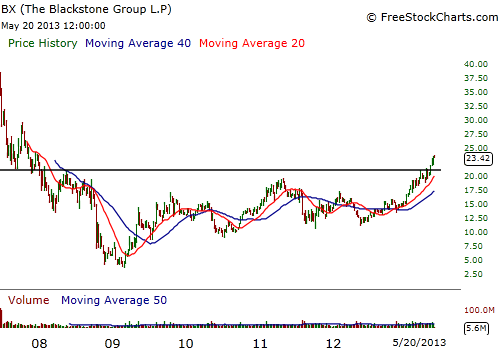

| BX's asset makeup helps it benefit from the Fed's money printing which translates into bullish price action. |

| Graphic provided by: www.freestockcharts.com. |

| |

| In the current market, there are lots of stocks that look to emerge as a leader but the specter of a European debt crisis or the Fed's obsessive-compulsive money printing has traders and investors hesitant to commit to entering the market with any real conviction. The fear of committing hard-won capital to any specific stock or sector has many speculators second-guessing themselves which is followed by hesitation to get involved. And, it's understandable after a 14-year stretch of uncertainty that has been synonymous with the state of things since the last great crash in 2000. For more than a decade, there has been a strong cycle of hope followed by disappointment as the market looks to break higher but then crash at a breathtaking speed and then crawl its way back only to repeat the cycle over and over again. |

|

| The stock has traded above it's 52-week high and is working its way higher. Look to buy on a breakout to higher ground or enter on a pullback. |

| Graphic provided by: www.freestockcharts.com. |

| |

| There is one stock that offers a number of compelling fundamentals and technical criteria. It has a unique set of traits that set it apart from other stocks but, more importantly, whose business model may provide the armor to protect it from any unexpected market downturn while offering both investors and traders the opportunity to make some serious money. This "stealth stock" is comprised of several businesses and assets that benefit from the Fed's money printing and is likely to benefit from it for years to come. |

| The Blackstone Group (BX) is an alternative asset management company that is heavily involved in leveraged buyouts, private equity placement, real estate management, and financial advisory services. The company took a big hit in 2008 as the stock market crashed due to the subprime mess in the real estate market. At that time, over-weighted with leveraged buyouts, the company's stock declined but management acted quickly by selling off non-performing assets and continued to raise cash from its institutional investors. |

| BX then invested heavily into real estate, credit markets, and other assets beyond its traditional LBO business model and now has $218 billion under management. Its stock has rallied because of the boost from the Fed's printing. This unique composite of assets has helped BX adapt to the market at hand and strengthened its position in its marketplace as well as rewarded its investors. Last year alone, its assets have risen 15% and earnings last quarter are up 164% along with a 31% jump in sales in the same quarter. Now, the company is trading above a 52-week high and is in a plum position to ride the momentum higher if the general market continues to trend upward. The makeup of its assets help insulate it from the market's downturns and resist being pulled downward. Enter long as the stock breaks higher either on a large trading day on high volume or an explosive gap in the direction of the upward trend. |

Billy Williams has been trading the markets for 27 years, specializing in momentum trading with stocks and options.

| Company: | StockOptionSystem.com |

| E-mail address: | stockoptionsystem.com@gmail.com |

Traders' Resource Links | |

| StockOptionSystem.com has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

Comments

Date: 05/30/13Rank: 4Comment:

|

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog