HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Billy Williams

To score the highest gains, you have to look for strength in the stock market. Here's a look at three stocks that are currently helping lead the market higher.

Position: Buy

Billy Williams

Billy Williams has been trading the markets for 27 years, specializing in momentum trading with stocks and options.

PRINT THIS ARTICLE

STOCKS

Three Trending Stocks To Watch

05/15/13 02:44:03 PMby Billy Williams

To score the highest gains, you have to look for strength in the stock market. Here's a look at three stocks that are currently helping lead the market higher.

Position: Buy

| The S&P 500 (SPX) is now trading above the 1575 level but on May 10, 2013, traded higher on lower volume and on May 14, 2013, traded a 1/4 point higher and essentially closed flat for the day. The Dow Jones Industrial Average (DJIA) has been trading well above 15000 but has been trading on lower volume and, like the SPX, has basically been flat ever since breaking higher through that critical price level. The Nasdaq Composite Index (IXIC) has been trading higher, although somewhat slowly, and is a long way from the 5100 level it traded at back in 2000, but has still been making positive headway even though it has also traded on lower volume in the last few days. Based on the price action of these major indexes, the market seems to be consolidating at these new highs almost as if the retail and institutional traders are trying to get a sense of where to go from here. If that is the case, then that is a normal reaction when new milestones are hit in the market and will be followed by looking for the highest performing stocks in the current environment. In trading or investing, the goal is to look for where the market is showing the highest level of strength. Trading/investing in the strongest stocks leads to greater performance over buying low and selling high or any other market approach over the long run. |

|

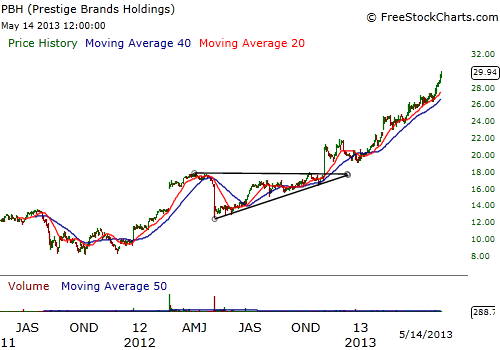

| Figure 1. Prestige Brands Holding (PBH) broke out of a triangle pattern and has soared higher. The stock is trending sharply but a pullback to the moving average or a forming a new base pattern will offer a new long entry. |

| Graphic provided by: www.freestockcharts.com. |

| |

| The key is to find where the strength is and preferably in undiscovered areas of the market that the public is not talking about yet. Currently, there are pockets of unknown potential where stocks are trending strongly and could offer traders a lot of profit potential based on their price action. Prestige Brands Holdings (PBH), is a healthcare related company that engages in over-the-counter sale of healthcare and cleaning products. The fundamentals of the stock are strong though they carry more debt than I would like to see ($1 billion) and a lower return on equity (ROE) than typically desired. They have strong competitive advantages through brand recognition like their Luden cough drop product that gives them a strong durable competitive advantage. Whatever the negatives at first glance, the stock has been on a tear, climbing higher since a November 2012 breakout and gives all indication that it is going higher (Figure 1). Watch for the stock to consolidate and form another base and then look to go long once it moves to higher ground, or buy on a pullback but keep your stop loss close at hand. |

|

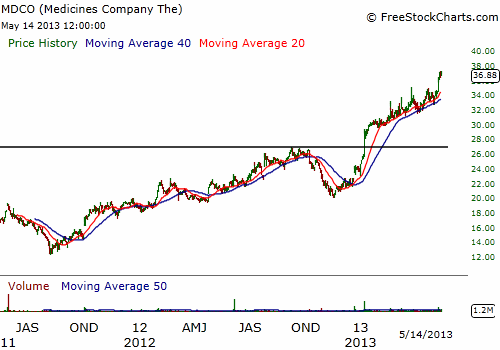

| Figure 2. The Medicines Co. (MDCO) broke out to higher ground and is steadily trending upward. A pullback into the moving average should offer a low-risk entry on the long-side but be sure that the overall market is at your back for momentum to continue. |

| Graphic provided by: www.freestockcharts.com. |

| |

| Another healthcare stock to watch is The Medicines Company (MDCO), which provides medical solutions for patients in acute and intensive care hospitals worldwide. The stock carries a low stock float and has two times the cash on its balance sheet than it does debt, but profit margins are low though they stand to improve going forward due to favorable conditions in the marketplace that could further boost the stock. But, with the trend in place (Figure 2), traders and investors seem to be reinforcing the technicals of the stock as volume is also trending higher. The rising volume indicates that the stock is under accumulation and that institutional ownership has strong interest and is adding to their position over time. |

|

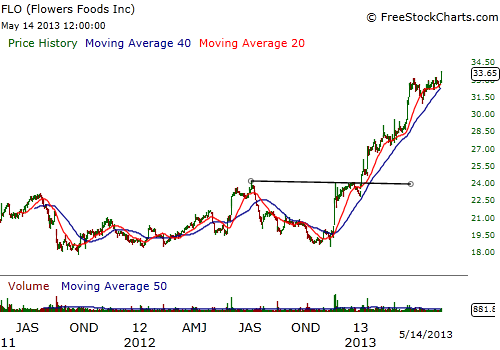

| Figure 3. Flower Foods Inc. (FLO) is a great momentum play as well as hedge against inflation due to the company's focus on agricultural production and distribution. |

| Graphic provided by: www.freestockcharts.com. |

| |

| The stock broke out above the $27 mark at the beginning of the year and has made strong gains. Wait for a pullback and ride the trend's momentum higher with stops in place. Our next stock is our "oldest stock" having formed in 1919 and is a double play on both the sale of food products as well as an inflation play. Flower Foods, Inc (FLO) is engaged in the production and distribution of bakery goods under the brand names of Mrs. Freshley's, European Bakers, Broad Street Bakery, Leo's Foods, Juarez, and Tesoritos. The company boasts a market cap of 4.5 billion and is attractive for a few reasons. One, the stock broke out of a cup & handle pattern at the beginning of the year and has made attractive gains with lots of upside potential still in effect (Figure 3). Second, the company has a fairly low institutional sponsorship at around 63%, which is low on a $4.5 billion company, and a float of 138 million. That means that if this stock becomes more well-known through its performance, then the larger players will start to jump on board, which should have a positive effect on the market. |

| The company deals in food which is going up in price thanks to the Fed's constant money printing. Owning the stock will act as a hedge against rising inflation and also translate into a higher stock price which benefits traders looking to exploit the trend for higher gains and for investors who are looking to get a stronger return while protecting their capital from the depreciative effects of inflation. All of these stocks have compelling price action as well as a unique set of fundamental advantages but, as always, protect yourself with stop losses just in case the unexpected happens. Happy hunting. |

Billy Williams has been trading the markets for 27 years, specializing in momentum trading with stocks and options.

| Company: | StockOptionSystem.com |

| E-mail address: | stockoptionsystem.com@gmail.com |

Traders' Resource Links | |

| StockOptionSystem.com has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

Comments

Date: 05/16/13Rank: 5Comment: Good reading - thanks

|

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog