HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Donald W. Pendergast, Jr.

Shares of MetLife, Inc. are up nearly 54% in less than a year -- with more near-term gains possible.

Position: N/A

Donald W. Pendergast, Jr.

Freelance financial markets writer and online publisher of the Trendzetterz.com S&P 500 Weekly Forecast service.

PRINT THIS ARTICLE

KELTNER CHANNELS

MetLife Inc.: Strong Money Flow May Prompt Breakout

05/14/13 03:56:53 PMby Donald W. Pendergast, Jr.

Shares of MetLife, Inc. are up nearly 54% in less than a year -- with more near-term gains possible.

Position: N/A

| MetLife, Inc. (MET) has experienced a sort of "two steps forward, one step back" kind of rally in the wake of its last major multicycle low, which was set back on June 5, 2012. From that low of 27.60, MET has risen in a series of sometimes ragged, sometimes strong motive waves (five of them so far, with the most recent rally phase ranking as the strongest of all), all of which have combined to keep the stock in a bullish long-term trend that has gained more than 50% since last June. With MET now approaching a historically significant resistance area, does the stock still have what it takes to keep its uptrend going for a while -- or not? Here's a closer look. |

|

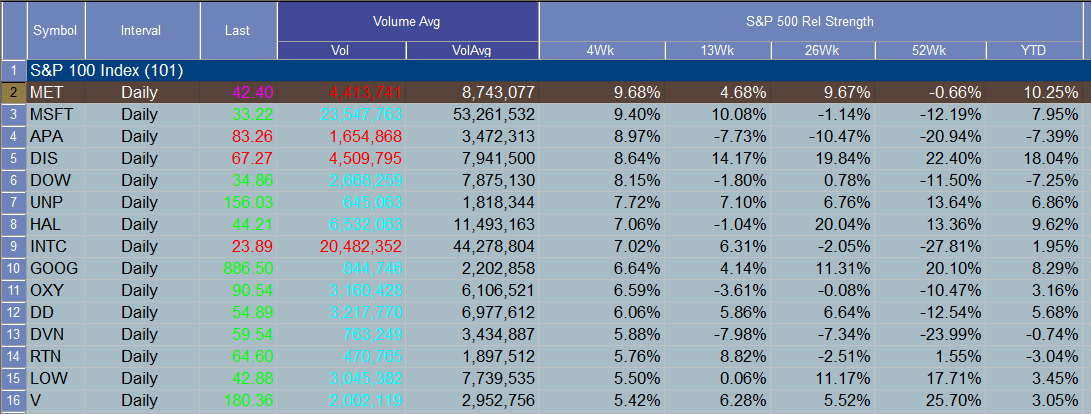

| Figure 1: Shares of Met Life, Inc. (MET) have the strongest 4-week relative strength of the stocks within the S&P 100 index (.OEX). |

| Graphic provided by: TradeStation. |

| Graphic provided by: TradeStation Radar Screen. |

| |

| Long term analysis of MET's Keltner channels reveals that the stock typically spends only a small fraction of its time trading above band K1 and that band K2 has never been reached at all during the past seven years; this is useful information for swing and/or position traders in this large cap insurance issue, and all the more so now that MET is actually less than a 1% price move away from reaching the K2 resistance band again. Here's the scenario for MET on its daily time frame (Figure 2): 1. The S&P 500 index (.SPX) keeps making new all-time highs, with financial sector stocks (like MET) leading the way. 2. MET's long-term money flow (Chaikin Money Flow or (CMF)(100)) trend is exceedingly bullish, with no sign yet of any distribution underway. 3. MET has already risen sharply in its latest swing move, currently up by more than 20% since April 22, 2013 and is very close to hitting resistance at K2. So, there are two bullish dynamics at work -- broad market strength and bullish long-term money flow in MET -- that certainly have a good shot at driving this stock higher. However, that the stock's latest three-week rally has already gained 20% even as a historically powerful resistance area is being neared means that there is going to be a real tug of war between the bulls and bears as MET nears the 42.85 to 43.00 price zone. |

|

| Figure 2: Keltner band K2 has acted as powerful resistance on MET's daily chart many times before, but will this time be different? Note the very bullish money flow trend in this large cap financial sector issue. |

| Graphic provided by: TradeStation. |

| |

| Bulls currently long MET should already have a protective put and/or trailing stop strategy in place; for those convinced that MET is indeed destined to break resistance at K2 and move even higher as we approach the end of spring 2013, here's one way to play MET using a covered call strategy: 1. Wait for MET to make a daily close above 43.00. 2. Check to see if SPY or .SPX has made another new high, too, thus assuring broad market strength. 3. Look for a minor intraday pullback back toward the 42.90 area, followed by a break back above 43.00/43,10. 4. On such a break, buy the June '13 MET $43.00 covered call (long 100 shares of MET and short 1 June '13 $43.00 call). 5. Once in the trade, consider trailing the position with a 21-day exponential moving average (EMA) until options expiration or until MET makes a daily close beneath it; it's currently a little below 40.00. No one knows what's going to happen tomorrow in the stock market, but given the opposing market dynamics at work in MET, it's pretty certain that some sort of significant price action will be seen in this stock over the next week or two. Trade wisely until we meet here again. |

Freelance financial markets writer and online publisher of the Trendzetterz.com S&P 500 Weekly Forecast service.

| Title: | Market consultant and writer |

| Company: | Trendzetterz |

| Address: | 81 Hickory Hollow Drive |

| Crossville, TN 38555 | |

| Phone # for sales: | 904-303-4814 |

| Website: | trendzetterz.com |

| E-mail address: | support@trendzetterz.com |

Traders' Resource Links | |

| Trendzetterz has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog