HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Matt Blackman

There is a big difference between trading options and stocks. With options, you first need to understand the Greeks and then you need a good options chain data provider just for starters. But how about using complicated options data to trade stocks?

Position: N/A

Matt Blackman

Matt Blackman is a full-time technical and financial writer and trader. He produces corporate and financial newsletters, and assists clients in getting published in the mainstream media. He is the host of TradeSystemGuru.com. Matt has earned the Chartered Market Technician (CMT) designation. Find out what stocks and futures Matt is watching on Twitter at www.twitter.com/RatioTrade

PRINT THIS ARTICLE

OPTIONS ANALYSIS

Can Options Data Help You Trade Stocks?

05/10/13 04:23:39 PMby Matt Blackman

There is a big difference between trading options and stocks. With options, you first need to understand the Greeks and then you need a good options chain data provider just for starters. But how about using complicated options data to trade stocks?

Position: N/A

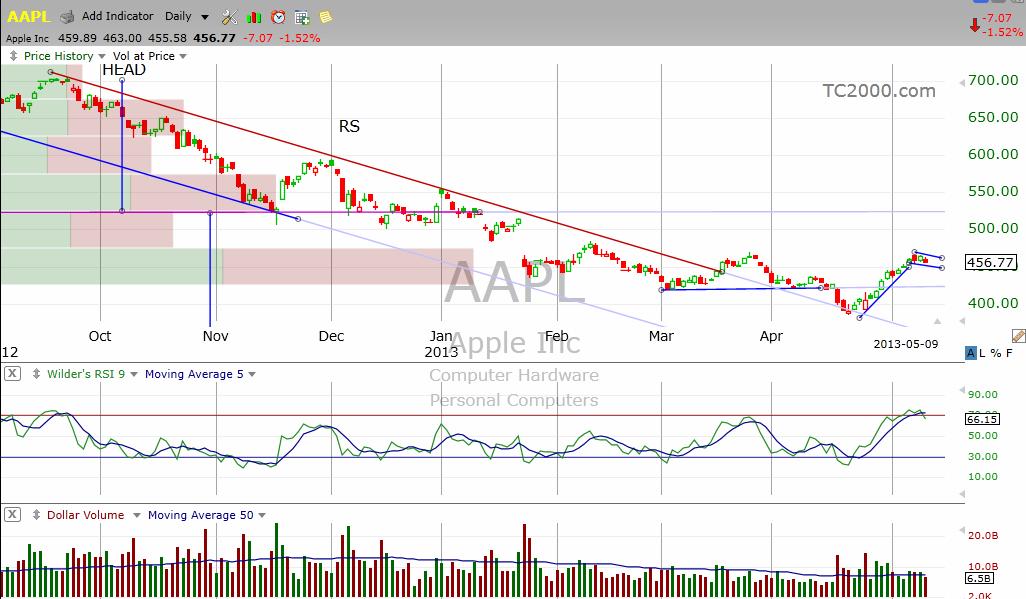

| When it comes to trading stocks, there are basically two ways to play the game. You can simply trade a stock or you can trade options of the same stock. Traders who assume that both games are played the same way do so at their peril. But you don't have to be an experienced options trader to benefit from options data. Figure 1 is a daily chart of Apple Inc. (AAPL) showing a standard price chart with the RSI and volume with some trend lines added for analysis purposes. As we see on the left-hand side of the chart, there is a Head & Shoulders pattern that played out quite nicely although it had, as of mid-May 2013, failed to reach its minimum projected target of $360. It was a rough ride down from its September 2012 high but going short following the decisive break and re-test of the neckline around $524 would have produced very respectable profits for the short-term trader. |

|

| Figure 1 – Daily chart of Apple Inc. showing the standard price and volume data with the Relative Strength Indicator (RSI) in the middle window. Note the potential bull flag building on the right side of the chart. |

| Graphic provided by: TC2000.com. |

| |

| In Figure 2 we see a daily chart over a similar time period with price and volume but with two options indicators added — the Options Volatility Indicator (OVI) and Implied Volatility (IV) used for trading options. Developed by trader and author Guy Cohen, the OVI measures the complex option chain transactions for the stock in question. According to Cohen in his book "The Inside Edge" (John Wiley & Sons in 2012), "essentially the OVI is an algorithm that measures the buying and the selling of share options and simplifies it into one line." |

|

| Figure 2 – Daily chart of AAPL showing the stock from an options perspective. Bearish moves are highlighted by the pink rectangles and bullish in green. |

| Graphic provided by: http://www.Flag-Trader.com. |

| |

| In other words, the OVI is a measure of the sentiment of options traders based on their buying and selling activity at any given time, much like the Put/Call ratio which measures the number of puts divided by calls except that the OVI utilizes a much larger data set of options chain data. |

|

| Figure 3 – Daily chart of Google (GOOG) showing the bullish movement of the stock since late November 2012. |

| Graphic provided by: http://www.Flag-Trader.com. |

| |

| As we see, taking short AAPL trades when the OVI broke below its moving average at or below the zero line would have produced respectable hypothetical profits for those who traded the bearish Head & Shoulders pattern shown in Figure 1 at times when the OVI was in negative territory (pink rectangles). |

| However, long-only traders will be interested to see that AAPL has posted the strongest positive OVI reading since its peak in September on the right side of the chart. As long as the OVI stays above the zero line, long trades have a better chance of producing profits when combined with breakouts from bullish patterns (like the bull flag that was building in mid-May). For another perspective, Figure 3 shows a daily chart of Google (GOOG) which exhibited much more bullish action than AAPL. Again note the periods when the stock was falling as shown by the pink rectangles on the OVI indicator versus bullish periods as shown by the green rectangles. |

Matt Blackman is a full-time technical and financial writer and trader. He produces corporate and financial newsletters, and assists clients in getting published in the mainstream media. He is the host of TradeSystemGuru.com. Matt has earned the Chartered Market Technician (CMT) designation. Find out what stocks and futures Matt is watching on Twitter at www.twitter.com/RatioTrade

| Company: | TradeSystemGuru.com |

| Address: | Box 2589 |

| Garibaldi Highlands, BC Canada | |

| Phone # for sales: | 604-898-9069 |

| Fax: | 604-898-9069 |

| Website: | www.tradesystemguru.com |

| E-mail address: | indextradermb@gmail.com |

Traders' Resource Links | |

| TradeSystemGuru.com has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

Comments

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog