HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Donald W. Pendergast, Jr.

Micron Technology's bullish breakout appears to have plenty of money flow fuel in its tank to travel to higher price levels.

Position: N/A

Donald W. Pendergast, Jr.

Freelance financial markets writer and online publisher of the Trendzetterz.com S&P 500 Weekly Forecast service.

PRINT THIS ARTICLE

BREAKOUTS

Micron Technology: An Attractive Covered Call Play

05/10/13 04:15:27 PMby Donald W. Pendergast, Jr.

Micron Technology's bullish breakout appears to have plenty of money flow fuel in its tank to travel to higher price levels.

Position: N/A

| Micron Technology (MU) is a well known technology brand, especially to computer owners who frequently upgrade the memory capacities of their laptop and home computers. Now it's also one of the hottest stocks year-to-date (YTD) in the S&P 500 index (.SPX). Its very smooth and steady uptrend since late 2012 took a rest from mid-March to early May 2013, but now it's breaking higher again — on big volume. Here's a closer look at this stock's bullish chart pattern (Figure 1). |

|

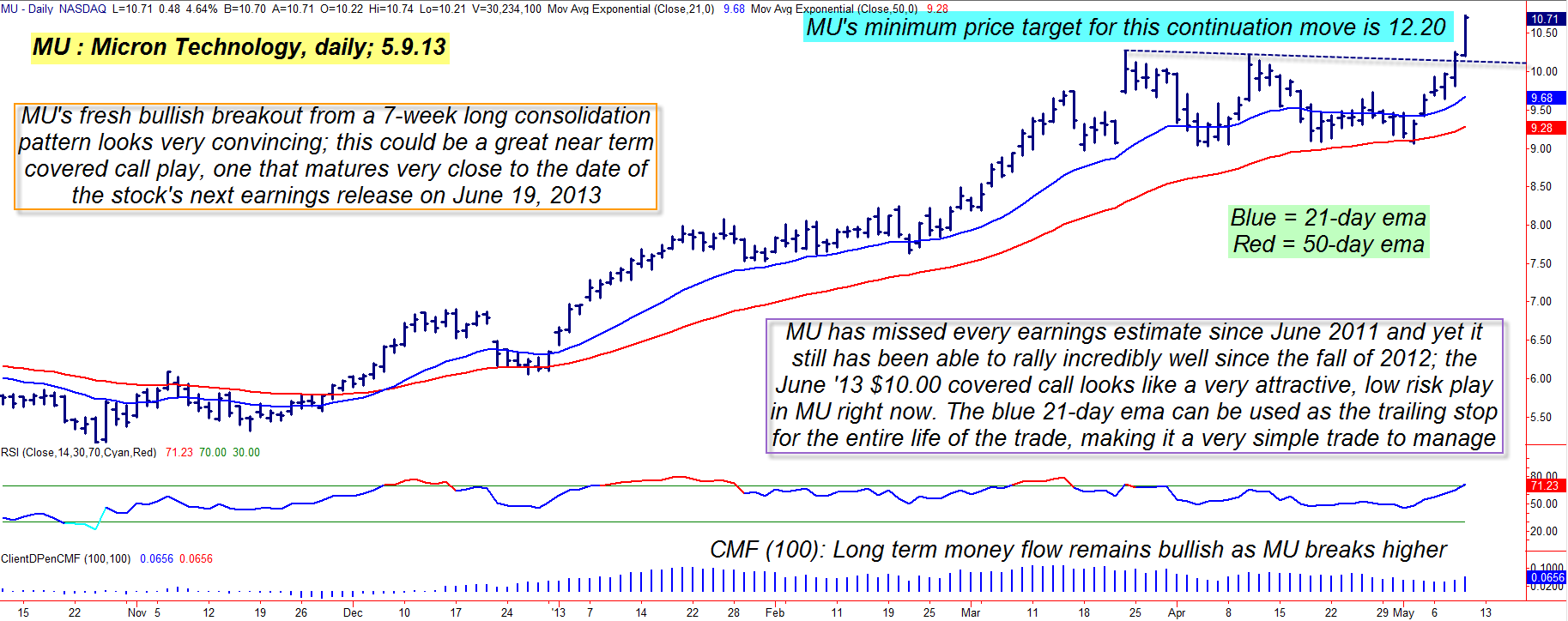

| Figure 1: Whether or not MU finally hits its 12.20 price target within the next six weeks is debatable, however, the June '13 MU $10.00 covered call still looks like a great low risk trading opportunity. |

| Graphic provided by: TradeStation. |

| |

| MU made an enduring multicycle low on October 24, 2012 — about three weeks before its parent stock index, the .SPX did — and from the bargain-basement low price of 5.16 has managed to rise as high as 10.74 as of May 9, 2013. That's a gain of 108% in only 6 1/2 months, and with the stock now emerging from a well formed, proportional consolidation pattern, its new breakout may have the potential to morph into a continuation move, one that has a minimum price target of approximately 12.20 (based on the length of the October '12 to March '13 trend and the midpoint of the width of the consolidation range). Long-term money flow — based on the 100-day Chaikin Money Flow histogram (CMF)(100) remains in a strongly bullish mode and has been above its zero line for nearly five months now. This means that the "smart money" folks were using MU's recent trading range as an opportunity to scoop up some more shares prior to what they believed could be yet another up-leg in this key high tech issue. Right now, the Semiconductor HOLDRs (SMH) ETF is also in a powerful uptrend, meaning that most of MU's industry group peers are also powering up to new heights, and that's why a covered call play in MU looks so attractive now. |

|

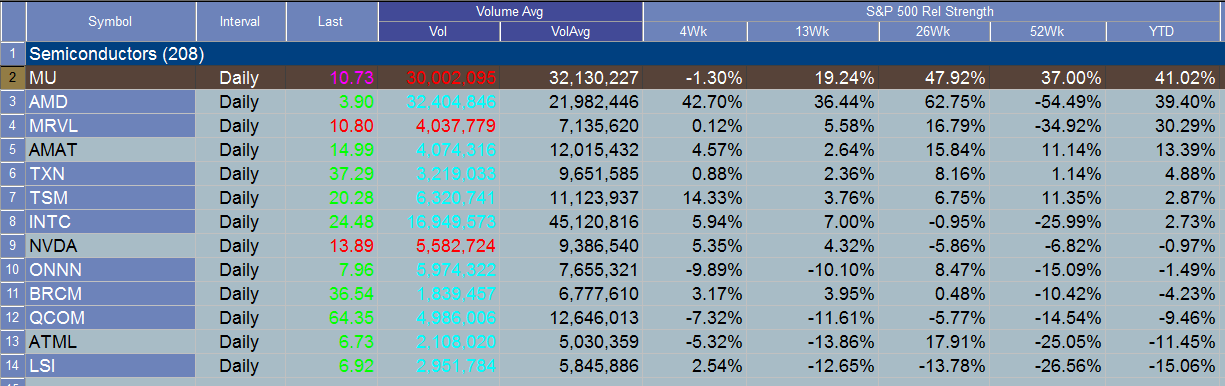

| Figure 2: MU is the best all-around performer in the semiconductor industry group over the past year. |

| Graphic provided by: TradeStation. |

| Graphic provided by: TradeStation Radar Screen. |

| |

| The June '13 MU $10.00 call is selling for about .96 at the moment; the bid/ask spread is typically between one or two cents and the open interest is a healthy 9,252 contracts. This is an in-the-money call (ITM) and one of the better ways to manage a covered call is to simply use the 21-day EMA as the trailing stop for the life of the trade; the EMA is a bit below the $10.00 strike price, but given the strong rally in MU, it should rise rapidly to help protect the position over the next six weeks. If MU makes a daily close below the blue 21-day EMA, close out both sides of the position (a covered call is 100 shares of stock and one call option sold against the position) and wait for a better trade setup. For as long as MU stays above the 21-day EMA, however, simply hold the position through its June 22, 2013 (third Friday in June) expiration date. Risk on this trade should be kept at a maximum of 2% of your account value, no matter how wonderfully bullish this breakout appears to be. The .SPX keeps making new daily highs, but there could be a "hiccup" soon and you don't want to have inordinately large positions in a stock should there be a sudden two to three day reversal in the broad US markets; as always trade wisely until we meet here again. |

Freelance financial markets writer and online publisher of the Trendzetterz.com S&P 500 Weekly Forecast service.

| Title: | Market consultant and writer |

| Company: | Trendzetterz |

| Address: | 81 Hickory Hollow Drive |

| Crossville, TN 38555 | |

| Phone # for sales: | 904-303-4814 |

| Website: | trendzetterz.com |

| E-mail address: | support@trendzetterz.com |

Traders' Resource Links | |

| Trendzetterz has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

Comments

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog