HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Matt Blackman

We've all heard of the VIX which measures market volatility. When it's falling, stocks go up and vice-versa when stocks drop. And now thanks to a host of exchange traded funds (ETFs) and exchange traded notes (ETNs) trading volatility is (almost) easy.

Position: N/A

Matt Blackman

Matt Blackman is a full-time technical and financial writer and trader. He produces corporate and financial newsletters, and assists clients in getting published in the mainstream media. He is the host of TradeSystemGuru.com. Matt has earned the Chartered Market Technician (CMT) designation. Find out what stocks and futures Matt is watching on Twitter at www.twitter.com/RatioTrade

PRINT THIS ARTICLE

VOLATILITY

Is Trading Volatility A Worthwhile Plan?

05/07/13 04:29:18 PMby Matt Blackman

We've all heard of the VIX which measures market volatility. When it's falling, stocks go up and vice-versa when stocks drop. And now thanks to a host of exchange traded funds (ETFs) and exchange traded notes (ETNs) trading volatility is (almost) easy.

Position: N/A

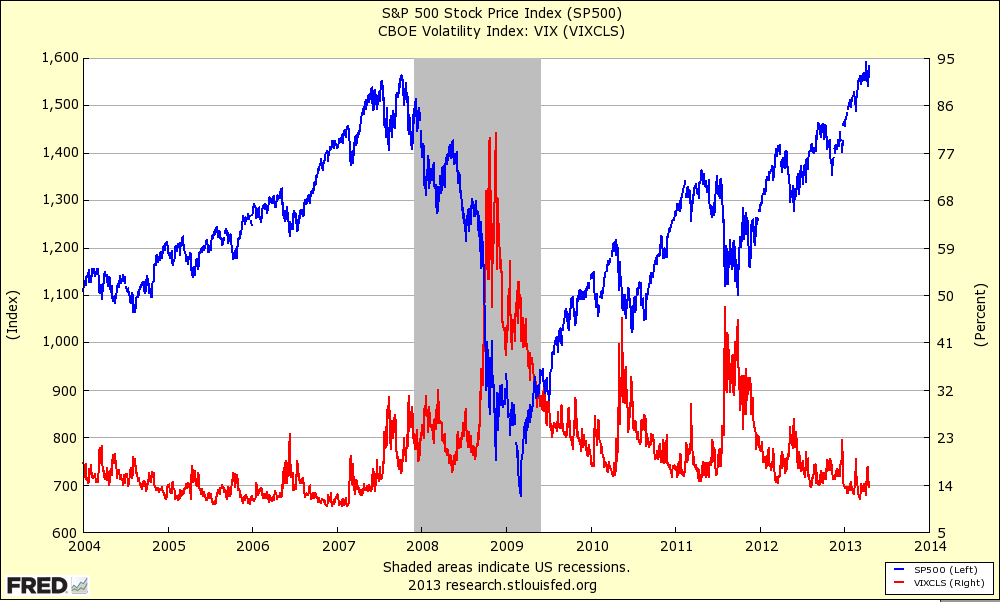

| Mention volatility to a trader and VIX is the first subject discussed. Introduced in 1993 by the Chicago Board Option Exchange, the Market Volatility Index measures the expected volatility over the next 30 days implied by at-the-money S&P100 options. Some refer to it as the fear index because when it's high like it was in 2008 (Figure 1) trepidation rules Wall Street. According to the CBOE, the VIX is composed of near- and next-term put and call options, usually in the first and second SPX contract months. When traders think the market will go up they buy call options and the VIX trends lower. When traders fear a correction, they buy more puts and the VIX rises. |

|

| Figure 1 – S&P 500 vs. CBOE Volatility Index. |

| |

| Volatility makes an interesting trading candidate for a number of reasons. 1. It is negatively correlated with stock prices, which means buying volatility can be a profitable strategy when stocks are getting hammered without having to borrow stock and sell short, which can be costly. If you are on the wrong side of a short trade when prices rally, the risks of loss are theoretically unlimited. 2. Unlike the price of a stock, volatility is predictable. As the ocean tides rhythmically flood and ebb, stock volatility rises and falls. Another way of expressing it is that volatility is mean reverting. 3. Traders who buy volatility get paid a premium by investors wanting to hedge their stock portfolio risk. 4. Finally, thanks to a number of new exchange traded funds and exchange traded notes, stock volatility can be traded as a stock without having to trade the options market. There are now more than 20 volatility-based ETFs, ETNs and indexes listed on US stock exchanges. |

|

| Figure 2 – Weekly stock chart of the CBOE Market Volatility Index (VIX-X) versus the S&P500 Index with a baseline low volatility around 10. When stocks get toppy, the VIX jumps and it surged above 80 in 2008 and 2009 as the financial crisis developed. |

| Graphic provided by: TC2000.com. |

| |

| Here are five of most heavily traded (liquid) exchange traded volatility products today. First is the iPath S&P500 VIX short-term futures ETN (VXX) which trades an average dollar volume of $1.2 billion per day. Next is the ProShares Ultra VIX short-term futures ETF (UVXY) which is designed to trade twice the return of SPX VIX short-term futures for a single day. It has average daily dollar volume of $173 million. Third, the VelocityShares daily inverse VIX short-term ETN (XIV), designed to generate the inverse of the daily SPX VIX short-term futures index, trades an average $141 million per day. Fourth, the ProShares short-term VIX futures ETF (VIXY) trades an average daily dollar volume of $21 million. Rounding out the top five most traded exchange traded products with an average daily dollar volume of $16 million is VelocityShares 2X VIX short-term ETN (TVIX). |

| So far, we've discussed the advantages of trading volatility. The downside is that as the name implies, these products can and do move quickly when investors get jittery, so it is essential that traders execute an extremely careful money management plan to reduce the chances of a nasty surprise on their account statements. But if you get the trade right, profits can be attractive. |

Matt Blackman is a full-time technical and financial writer and trader. He produces corporate and financial newsletters, and assists clients in getting published in the mainstream media. He is the host of TradeSystemGuru.com. Matt has earned the Chartered Market Technician (CMT) designation. Find out what stocks and futures Matt is watching on Twitter at www.twitter.com/RatioTrade

| Company: | TradeSystemGuru.com |

| Address: | Box 2589 |

| Garibaldi Highlands, BC Canada | |

| Phone # for sales: | 604-898-9069 |

| Fax: | 604-898-9069 |

| Website: | www.tradesystemguru.com |

| E-mail address: | indextradermb@gmail.com |

Traders' Resource Links | |

| TradeSystemGuru.com has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

Comments

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog