HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Chaitali Mohile

Western Gas Partners (WES) has offered many short-term trading opportunities in the past. Can we grab another such opportunity?

Position: N/A

Chaitali Mohile

Active trader in the Indian stock markets since 2003 and a full-time writer. Trading is largely based upon technical analysis.

PRINT THIS ARTICLE

CHANNEL LINES

WES Moving In Ascending Channel

04/30/13 03:37:18 PMby Chaitali Mohile

Western Gas Partners (WES) has offered many short-term trading opportunities in the past. Can we grab another such opportunity?

Position: N/A

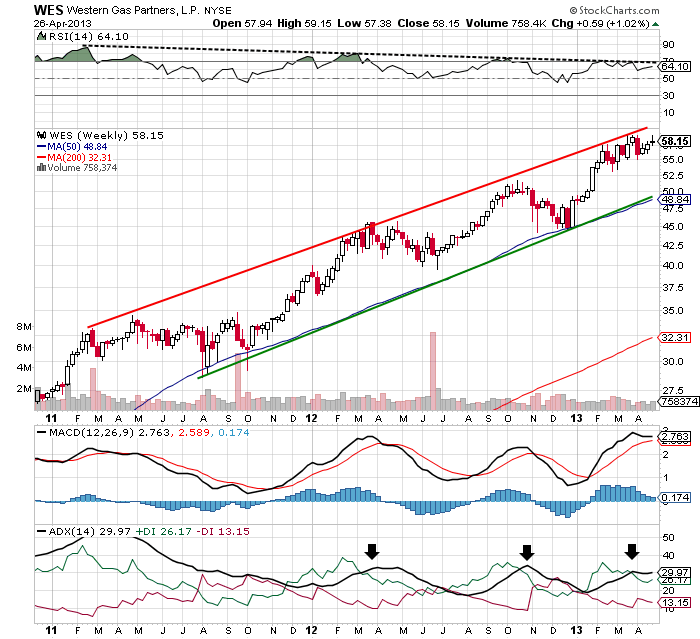

| Since 2011 Western Gas Partners (WES) has been ascending, with the support of its 50-period moving average (MA), forming a series of higher highs and lows. An upwards rally from the moving average support opened fresh buying opportunities, whereas a descending price action from a new high opened short-selling trades for short-term traders. This up and down action formed an ascending channel on the weekly time frame chart in Figure 1. The ascending channel is a bullish formation, pulling the stock as well as the bullish sentiments higher. |

|

| Figure 1: Weekly chart of WES. |

| Graphic provided by: StockCharts.com. |

| |

| The relative strength index (RSI(14)) was, however, moving in the opposite direction. The lower highs formed a negative divergence throughout the price rally. An uptrend popped up with every ascending rally from the 50-period MA support. The moving average convergence/divergence (MACD(12,26,9)) frequently changed direction in positive territory. Due to these mixed conditions, the price fluctuated within the channel. Though the RSI(14) formed a negative divergence, WES sustained above its 50-period MA and lower trendline support. |

| Considering past action, the forthcoming downside price action of WES can be captured for short-selling. The stock is ready to plunge towards its robust support at the 48 levels. Short-term traders can trigger the trade once the stock forms a lower low. Although the uptrend is currently developing, it would gradually show the signs of reversing. This would strengthen downside price action. |

|

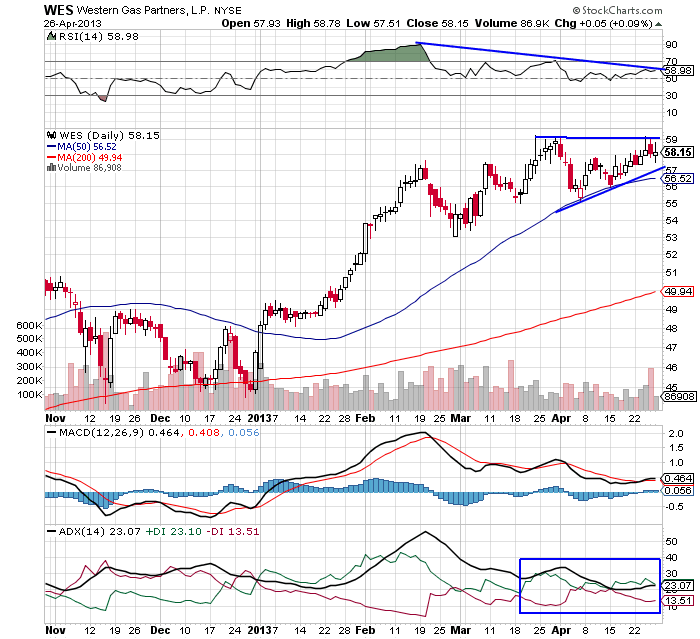

| Figure 2: Daily chart of WES. |

| Graphic provided by: StockCharts.com. |

| |

| The RSI(14) in Figure 2 has formed negative divergence as well. In addition, the MACD (12,26,9) has also formed lower highs during price consolidation at the top. After an exclusive advance rally from 48 levels, WES turned volatile at 57 levels. You can see in Figure 2 that the RSI(14) turned highly overbought at this level, resulting in volatile sessions. Thereafter, the stock moved sideways but in a volatile range. Price, however, continued to form higher highs. An overheated uptrend in ADX(14) reversed in February. The trend indicator has recently hit the developing region, and the gap between the green and red line has reduced. This created a tricky situation for WES. The stock is likely to breach its lower trendline support. This would be the best trigger point for short-selling. |

| You could grab the opportunity of fresh short-selling after the bearish breakout of the consolidation pattern. Your trading target, however, should be set according to the ascending channel on the weekly chart. |

Active trader in the Indian stock markets since 2003 and a full-time writer. Trading is largely based upon technical analysis.

| Company: | Independent |

| Address: | C1/3 Parth Indraprasth Towers. Vastrapur |

| Ahmedabad, Guj 380015 | |

| E-mail address: | chaitalimohile@yahoo.co.in |

Traders' Resource Links | |

| Independent has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

Comments

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog