HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Donald W. Pendergast, Jr.

Shares of Alaska Air (ALK) are consolidating after enjoying a massive rally; will this stock continue to run higher in 2013?

Position: N/A

Donald W. Pendergast, Jr.

Freelance financial markets writer and online publisher of the Trendzetterz.com S&P 500 Weekly Forecast service.

PRINT THIS ARTICLE

CONSOLID FORMATION

Alaska Air: Consolidating Before Takeoff?

04/29/13 04:26:41 PMby Donald W. Pendergast, Jr.

Shares of Alaska Air (ALK) are consolidating after enjoying a massive rally; will this stock continue to run higher in 2013?

Position: N/A

| Some stocks trend with unusually low volatility and others tend to be all over the place as they gradually ratchet higher or lower over long periods of time. Alaska Air (ALK) shares are definitely in the former category, as one look at its daily chart will confirm; the stock is up more than 85% since it made its last major multi-cycle low back in September 2012, easily outperforming all the major stock indexes — and many of its airline industry group peers — during the last 7 1/2 months. With ALK now in the midst of a four-week old consolidation pattern, the big question for traders is if this stock will soar on to even higher highs or if it is due for a proportional pullback towards its key support levels. Here's a closer look. |

|

| Figure 1: A modest risk/reward covered call setup in ALK will be signaled as soon as its eight-day RSI histogram makes a daily close above 60.00; the blue 21-day EMA can serve as the trailing stop for the life of the trade. |

| Graphic provided by: TradeStation. |

| |

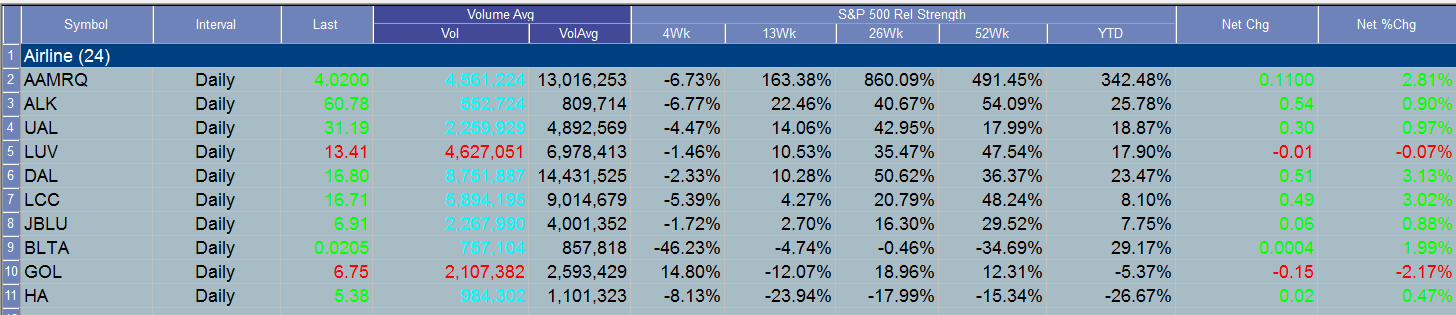

| ALK's daily chart provides us with some valuable feedback: 1. At times it can trend ever higher in a low volatility price envelope, one that is effectively defined by its 21-day exponential moving average (EMA - blue line). 2. Breakouts of its eight-day RSI histogram above the 60.00 level tend to result in further increases in ALK's share price, particularly when such a break happens with the stock trading above its 21-day EMA. 3. The "smart money" is still putting money to work in ALK, despite its recent pullback into a trading range near a minor support level. ALK is also outperforming several other key airline industry group peers such as Delta (DAL), United (UAL) and Southwest (LUV) year to date and is also outperforming all of its peers over the past 52 weeks — with the exception of AMR Corp. (AAMRQ). Clearly, institutional money managers have been favoring ALK for some time, and as the probabilities would seem to hint at, it is almost a certainty that ALK will likely experience an upside breakout within the next week or two. While no one knows if such a break higher will result in a major continuation move, there is a modest risk trade setup that should do well if ALK does rise for another couple of months while limiting risk if things don't work out as bullishly as anticipated. |

|

| Figure 2: Alaska Air is outperforming most of its airline industry group peers over the past 52 weeks. |

| Graphic provided by: TradeStation. |

| Graphic provided by: TradeStation Radar Screen. |

| |

| Playing a bullish range breakout in ALK would be relatively simple: 1. Wait for the RSI(8) to close above 60.00 on its daily chart. 2. As soon as ALK rises by five ticks above the high of the price bar that kicked the RSI reading over 60.00, put on a June '13 ALK $60 covered call or multiples thereof, risking no more than 2% of your account value on the trade. 3. Once in the trade use the blue 21-day EMA as your trailing stop for the position, using a daily close by ALK beneath it as your signal to close out both sides of the trade. Keep this trailing stop in place for the entire life of the trade until stopped out or the stock is called away. The bid/ask spread on the trade isn't "great" but it isn't horrible, either - it's ten cents. Open interest for this call option is 47 contracts and the daily time decay (theta) is $2 per day, per contract. Overall, this looks like a very rational, somewhat boring trade, one offering modest risk and modest reward for patient, daily based traders. Trade wisely until we meet here again. |

Freelance financial markets writer and online publisher of the Trendzetterz.com S&P 500 Weekly Forecast service.

| Title: | Market consultant and writer |

| Company: | Trendzetterz |

| Address: | 81 Hickory Hollow Drive |

| Crossville, TN 38555 | |

| Phone # for sales: | 904-303-4814 |

| Website: | trendzetterz.com |

| E-mail address: | support@trendzetterz.com |

Traders' Resource Links | |

| Trendzetterz has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

Comments

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog