HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Donald W. Pendergast, Jr.

Down by more than 21% over the past nine weeks, shares of Transocean Ltd. (RIG) are closing in on an important support level.

Position: N/A

Donald W. Pendergast, Jr.

Freelance financial markets writer and online publisher of the Trendzetterz.com S&P 500 Weekly Forecast service.

PRINT THIS ARTICLE

TransOcean Ltd Near Major Support

04/18/13 02:24:29 PMby Donald W. Pendergast, Jr.

Down by more than 21% over the past nine weeks, shares of Transocean Ltd. (RIG) are closing in on an important support level.

Position: N/A

| Stocks hailing from the fast moving, highly volatile oil services industry group tend to be among the least boring of all, perhaps matched only by stocks from the precious metals mining group when it comes to changing direction on a dime, en route to yet another frenetic swing or trending move. Among the large cap oil services stocks, TransOcean Ltd. (RIG) is one of the better-known companies, and its stock is more than capable of making powerful, tradable thrusts on a regular basis; as it now approaches a major support level, traders may be afforded an attractive opportunity to profit from a potential rebound. Here's a closer look now. |

|

| Figure 1: If the key support level near $47.00 in RIG holds up, the prospect of selling a May '13 RIG $45.00 put option begins to look like a very attractive trading opportunity. |

| Graphic provided by: TradeStation. |

| |

| All it takes is one quick look at RIG's daily chart (Figure 1) to realize that it is volatile — even chaotic at times — in nature and that many of its tradable swings tend to run only four to seven bars in length. At the same time, many of those small swing moves tend to build upon one another (after a minor pullback in between) to produce more meaningful trend-style trades. Given the difficulty of timing short-term trades (for most traders, not all), the current proportional decline in RIG may be custom-made for traders who want to rely on options instead of stock in order to (hopefully) profit from a near-term rally in the stock. RIG's long-term money flow (based on its 89-day Chaikin money flow histogram (CMF(89)) is downright incredible — as in long-term bullish — especially considering the length and depth of its recent decline, and this is a very strong clue that the "smart money" interests in this stock are confident that RIG will be on the rise in the not too distant future. Since there are two levels of Fibonacci support (from different degrees of trend) that coincide near 47.00 and that the stock is already at that level, now may be a great time to size up the near-term, out-of-the-money (OTM) put selling opportunities in RIG. This makes even more sense when we realize that the stock is also testing an important Keltner band support level near 47.00, too. |

|

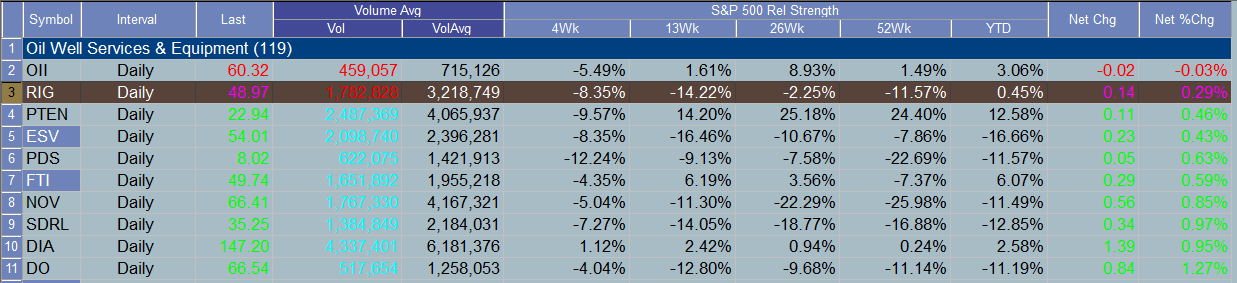

| Figure 2: TransOcean Ltd.'s recent price performance history is poor, but is has been outperforming several of its large cap oil service group peers. |

| Graphic provided by: TradeStation. |

| Graphic provided by: TradeStation Radar Screen. |

| |

| If the Fib/Keltner support levels between 46.40/47.00 do offer enough support to permit RIG a nice bounce, selling a May '13 RIG $45.00 put option might be an attractive trading proposition; the put's open interest figure is more than 3,200 contracts, its bid/ask spread is only .04 and its daily time decay factor (theta) is a healthy $3 per day/per contract. This put's strike price is also about $2 below the major support level on the chart, meaning that it has an important buffer available to help protect the position. Playing this put trade is simple: 1. On a rise above 48.40, sell the put or puts. 2. If RIG starts to rise and/or consolidate, staying above the 47.75 level, simply hold the trade until such time as it declines in value by about 50%; if that happens, buy the put back at a profit and walk away. 2. If the put gains value — rising by 80% to 90% — simply close it out for a loss and wait for a better trade setup. In either scenario, don't risk more than 1% of your account value on this trade as it is a reversal-style trade, one that is riskier than simply trading in line with the existing trend. As always, trade wisely until we meet here again. |

Freelance financial markets writer and online publisher of the Trendzetterz.com S&P 500 Weekly Forecast service.

| Title: | Market consultant and writer |

| Company: | Trendzetterz |

| Address: | 81 Hickory Hollow Drive |

| Crossville, TN 38555 | |

| Phone # for sales: | 904-303-4814 |

| Website: | trendzetterz.com |

| E-mail address: | support@trendzetterz.com |

Traders' Resource Links | |

| Trendzetterz has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog