HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Billy Williams

Oil companies are literally going to the ends of the Earth to find new oil deposits and one company is helping them get more oil for their investment.

Position: Hold

Billy Williams

Billy Williams has been trading the markets for 27 years, specializing in momentum trading with stocks and options.

PRINT THIS ARTICLE

STOCKS

Oil, Power, Destiny

04/16/13 03:44:23 PMby Billy Williams

Oil companies are literally going to the ends of the Earth to find new oil deposits and one company is helping them get more oil for their investment.

Position: Hold

| The energy industry has been one of the few bright spots in an otherwise stagnant market and the recent rally in the SPX could be due to the rise in oil prices. The price of oil is likely to continue in the years to come, and the need to extract as much oil as possible out of a company's oil field is critical in order to remain competitive in an already competitive industry. The effects of the rising cost of oil touches everything from the price of gas at the pump to the cost of manufacturing goods. Because of its broad reach, drillers are constantly looking for new sources of oil but oil companies are also striving to match production with exploration. This is because no matter how much oil is discovered and extracted, the major constraint is the ability take raw oil and produce petroleum products that the global economy finds useful. |

|

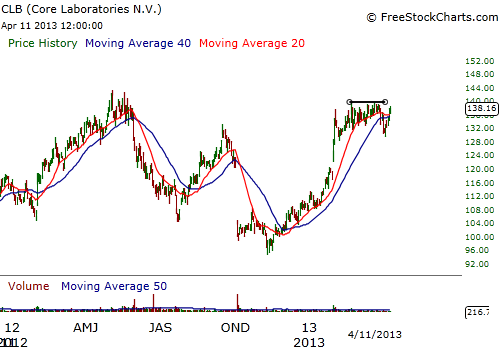

| FIGURE 1: CLB is a pioneer in offshore drilling and production. Today, it is trading near its all-time price high and forming a cup & handle pattern. |

| Graphic provided by: www.freestockcharts.com. |

| |

| One company, Core Laboratories (CLB), a company leading in maximizing oil production, specializes in helping oil companies achieve the greatest amount of production from oil that they extract around the world. Established in 1936 in the Netherlands, the company now operates in over 50 countries, providing products and services relating to reservoir well completions, and perforations. They also develop solutions to improve the effectiveness of enhanced oil recovery projects. With a market capitalization of $6.39 billion, a return on equity of 117.22% and a return on assets of 29.42%, CLB's fundamentals show a strong, capable management team in place that knows how to increase the value of the company for its shareholders. |

|

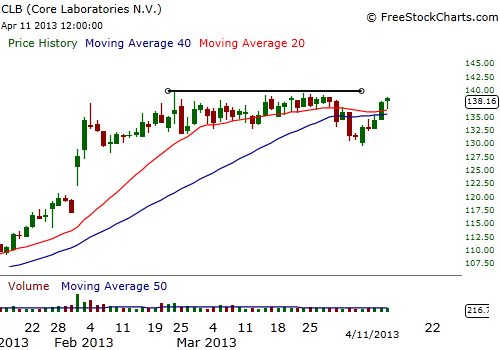

| FIGURE 2: In the Handle portion of the pattern, CLB is trading in a contracted price range and setting up to breakout to higher ground, signaling a long entry for the bulls. |

| Graphic provided by: www.freestockcharts.com. |

| |

| Currently, CLB is trading near an all-time high and forming a cup & handle pattern where price looks as if it is going to signal an entry signal as it trades through the $138.35 price point. While CLB has a strong set of fundamentals and technical criteria, it also has bright prospects on the horizon. With a significant presence in Southeast Asia, CLB is in a good position to help countries like China, where demand for raw oil is in high demand. |

| China is eager to modernize their country to take center stage as the world's greatest emerging economy. In order to achieve that, it must have the ability to produce quality petroleum products. CLB has the organization and expertise to help them. Most of the emerging world have a demand for CLB's services. CLB has been tapped to help with projects in countries such as Brazil, Canada, and Saudi Arabia. Their corporate clients include major oil drillers and explorers such as Shell, Conoco Phillips, and British Petroleum. |

| Wait for CLB to consolidate along the handle portion of its cup & handle pattern and then enter as it trades up through its resistance level and enter at a buy point of $138.35. Stops should be 7% from your entry; risk no more than 2% of our overall capital. If price rises by 10%, wait for a pullback to enter a second entry if you want to pyramid in but adjust your stop for your total position at 7% from the second entry and, again, risk no more than 2% of your total capital. If price trades below the recent price low of $131.68, then abort the trade setup and wait for price to setup again. Remember, CLB is a strong stock over the long run but it takes patience and timing for the low-risk entry to develop. |

Billy Williams has been trading the markets for 27 years, specializing in momentum trading with stocks and options.

| Company: | StockOptionSystem.com |

| E-mail address: | stockoptionsystem.com@gmail.com |

Traders' Resource Links | |

| StockOptionSystem.com has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog