HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Donald W. Pendergast, Jr.

Shares of Allied Nevada Gold Corp. have staged a sharp turnaround, with many other gold/silver stocks following suit.

Position: N/A

Donald W. Pendergast, Jr.

Freelance financial markets writer and online publisher of the Trendzetterz.com S&P 500 Weekly Forecast service.

PRINT THIS ARTICLE

REVERSAL

Allied Nevada Gold Corp. Rocketing Higher

04/11/13 04:46:52 PMby Donald W. Pendergast, Jr.

Shares of Allied Nevada Gold Corp. have staged a sharp turnaround, with many other gold/silver stocks following suit.

Position: N/A

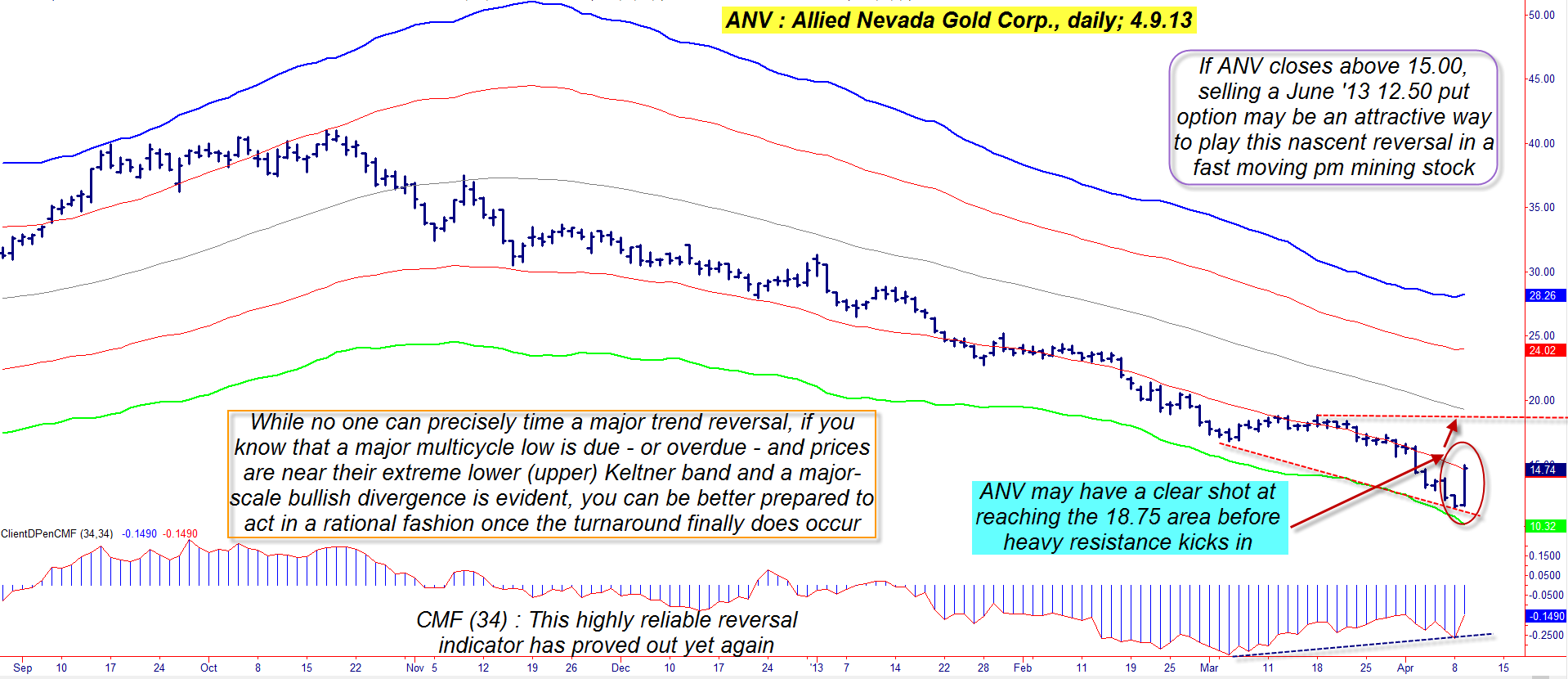

| For some stocks, the length and depth of their declines are mind-shattering, so much so that even a veteran trader or investor might have trouble believing that a final low will ever be made. The shares of Allied Nevada Gold Corp. (ANV) declined by more than 71% between October 17, 2012 and April 8, 2013 - going from 41.02 to 11.72 in the process. The rest of the precious metals (pm) mining stocks also experienced major haircuts in the same general time period, severely deflating the hopes of long-term pm stock investors. As of April 9, 2013, however, the world of pm stock trading/investing suddenly looks much brighter, with ANV up intraday by more than 21%. Here's a closer look at ANV's daily Keltner band chart (Figure 1), along with some ideas on how to trade this volatile, bullish trend reversal. |

|

| Figure 1: While the raw power of ANV's turnaround on April 9, 2013, is evident, wise traders may want to wait for a bit of a pullback followed by bullish follow-through before taking long positions. |

| Graphic provided by: TradeStation. |

| |

| In my April 8, 2013 TCA piece entitled "Gold Bugs Index Nearing Possible Support" I suggested that shares of Allied Nevada Gold Corp. (ANV) might be due to make a final low in the days and weeks just ahead, and, surprise, the next day the stock pulled out all the jams and shot higher by more than 22% (as of 1 pm ET). Perhaps I made a lucky guess, but the action of ANV's 34-day Chaikin Money Flow histogram (CMF(34)) left little doubt that the stock was experiencing accumulation by the "smart money" — as evidenced by the massively bullish price/money flow divergence that was already in place. This bullish divergence was a highly reliable confirmation that a reversal of some degree was due to appear; that it occurred as ANV approached the extreme lower Keltner band and that the stock was also due to put in a major multicycle low (within a week or two at the latest) was also a valuable clue that a powerful short-covering induced rally could erupt at any moment. And erupt it did, in major league fashion; the stock is now already touching the next higher Keltner band and looks as if it still wants to go higher; this does appear to be "the" final low for ANV's six-month slide and there are several ways traders can play out this bullish move: 1. Sell a near-term, out-of-the-money (OTM) put option, such as the June '13 ANV $12.50 put; the bid/ask is .10, but the big idea here is to wait for ANV to pull back a bit as short-term traders book quick windfall profits and then sell the put once ANV shows signs of bullish follow through. 2. Swing traders can wait for ANV to pull back over the next session or two and then buy on a break above 15.00, using a two to three bar trailing stop of the daily lows as their profit/loss protection mechanism. These trade setup plans are also valid for any of the following six pm mining stocks: 1. EGO 2. GFI 3. HL 4. IAG 5. AU There are other gold/silver mining stocks that look attractive here, but those are the ones with the best intraday gains so far on April 9, 2013. |

|

| Figure 2: The entire gold/silver stock industry group stages a massive, bullish reversal on April 9, 2013. |

| Graphic provided by: TradeStation. |

| Graphic provided by: TradeStation Radar Screen. |

| |

| Since this is an extremely volatile trade setup, traders should limit their risk to a maximum of 1% of their account value just in case ANV decides it needs to test Monday's support levels near 12.00 before continuing on higher. Trade wisely until we meet here again. |

Freelance financial markets writer and online publisher of the Trendzetterz.com S&P 500 Weekly Forecast service.

| Title: | Market consultant and writer |

| Company: | Trendzetterz |

| Address: | 81 Hickory Hollow Drive |

| Crossville, TN 38555 | |

| Phone # for sales: | 904-303-4814 |

| Website: | trendzetterz.com |

| E-mail address: | support@trendzetterz.com |

Traders' Resource Links | |

| Trendzetterz has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor