HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Billy Williams

Trade volume seems to be weak but is rising in large-cap stocks such as Colgate-Palmolive (CL), which appeals to both investors and traders.

Position: Buy

Billy Williams

Billy Williams has been trading the markets for 27 years, specializing in momentum trading with stocks and options.

PRINT THIS ARTICLE

STOCKS

Large Cap Play In CL

04/10/13 04:30:57 PMby Billy Williams

Trade volume seems to be weak but is rising in large-cap stocks such as Colgate-Palmolive (CL), which appeals to both investors and traders.

Position: Buy

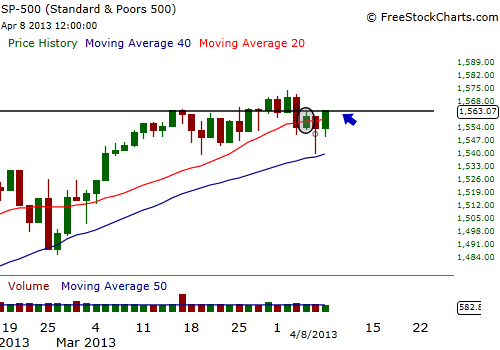

| The market appears to be shrugging off the bad news in unemployment this past Friday as the major indexes traded higher. Though the markets showed progress to the upside, volume was low, which indicates that many investors and traders alike are remaining cautious. Caution may be in the wind but the all-time price high remains in striking distance and key sectors in energy and housing are shoring up the market's strength to finally break free of overhead resistance. If that move occurs, then there will be key stocks that are likely to emerge as leaders or, at least, be swept up in the market's tide. This could provide a windfall for the bulls. Across the wide selection of stocks, large-cap stocks in particular have shown an inflow of capital as major institutions and fund managers look to stronger, more established stocks to park their investor's capital. Stock like Colgate-Palmolive (CL) have shown a combination of strong fundamentals and compelling technical action offering something for investors and traders. |

|

| Figure 1 - The SPX recently pulled back but a buy signal was triggered today as price resumed its upward trend. |

| Graphic provided by: www.freestockcharts.com. |

| |

| CL makes everything from shampoo and toothpaste as a consumer manufacturer specializing in producing low-cost consumer items with strong brand recognition. The company's competitive advantage is the enormous amount of goodwill that it has developed over decades of producing quality items at low prices due to its efficient production and marketing. CL's price action is a bull's dream as the stock has been trending upward since the early 1980s. It declined somewhat after the dotcom era bust but worked its way higher from a bottom in 2004 to reach its former price highs and is currently trading at an all-time high of just under $118 a share. Dividend growth is strong while a recent pullback has offered traders a long entry as the stock's price pulled back and has resumed an upward move back to the bullish trend. |

|

| Figure 2 - Colgate Palmolive has compelling fundamental and technical criteria, which makes it appealing for both investors and traders. The stock is at an all-time high and with its durable competitive advantage in the marketplace, it is likely to continue. |

| Graphic provided by: www.freestockcharts.com. |

| |

| Return-on-equity is a whopping 106.71%, which is a major achievement for a company with a $55 billion market cap as well as strong operating margin of 23.37%, which gives CL a "moat", or as Warren Buffett likes to call it, a durable competitive advantage. The scope and size of CL make it almost impossible to compete with and effectively locks out the competition from stealing market share. Investors of all types are likely to be attracted to accumulating shares in CL because of the safety it provides from market swings due to its durable competitive advantage and its rising dividend. This steady buying of shares will continue to shore up its strength in the stock market and cause it to continue with its upward trajectory. For a long-term play, enter a position into the current pullback and set a 25% trailing stop and adjust it as the stock trades higher as needed. |

| For an intermediate term trade, enter the pullback and use the 50-day SMA as a trailing stop. Once the stock reaches a level equal to your risk, take profits on half your position and raise your stop loss to break even if the 50-day SMA hasn't already given you the signal to do so. On the last half of your position, let the market take out your stop and liquidate your final position. Given CL's past performance, this will allow you to ride the stock's upward movement that has been in place for the last several years. |

Billy Williams has been trading the markets for 27 years, specializing in momentum trading with stocks and options.

| Company: | StockOptionSystem.com |

| E-mail address: | stockoptionsystem.com@gmail.com |

Traders' Resource Links | |

| StockOptionSystem.com has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

Comments

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog