HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Matt Blackman

Precious metals have struggled of late and many are calling for a bear market. But here is some compelling evidence to the contrary.

Position: N/A

Matt Blackman

Matt Blackman is a full-time technical and financial writer and trader. He produces corporate and financial newsletters, and assists clients in getting published in the mainstream media. He is the host of TradeSystemGuru.com. Matt has earned the Chartered Market Technician (CMT) designation. Find out what stocks and futures Matt is watching on Twitter at www.twitter.com/RatioTrade

PRINT THIS ARTICLE

SHORT SQUEEZE

Short Squeeze Alert - Is It Time To Buy Silver?

04/10/13 04:20:48 PMby Matt Blackman

Precious metals have struggled of late and many are calling for a bear market. But here is some compelling evidence to the contrary.

Position: N/A

| As a fan of silver as a hedge against the ongoing mission by central banks around the globe to devalue paper money, a recent Zerohedge.com article entitled "80% Chance of 40% Silver Short Squeeze" caught my attention. According to the article, silver short positions have surpassed 40.5% - an extreme that in the past has been followed by big silver rallies with just one exception. The five previous periods and the rallies that followed were; July 1997 (70% gain), November 2000 (13.5% drop), October 2002 (13.2% gain), April 2003 (19% gain), and August 2005 (114% gain). |

|

| Figure 1 – Daily chart of the silver ETF SLV showing the trading channel over the last 18 months. |

| Graphic provided by: TC2000.com. |

| |

| Armed with that information, I decided to do a little homework. First I looked at the chart of the iShares Silver Trust ETF (SLV) and was interested to see the rather clear channel the stock has exhibited over the last 18 months. Each time it hit support around $25.60, it has rallied. As you can see from the chart in Figure 1, SLV had just rallied from that point again in early April. |

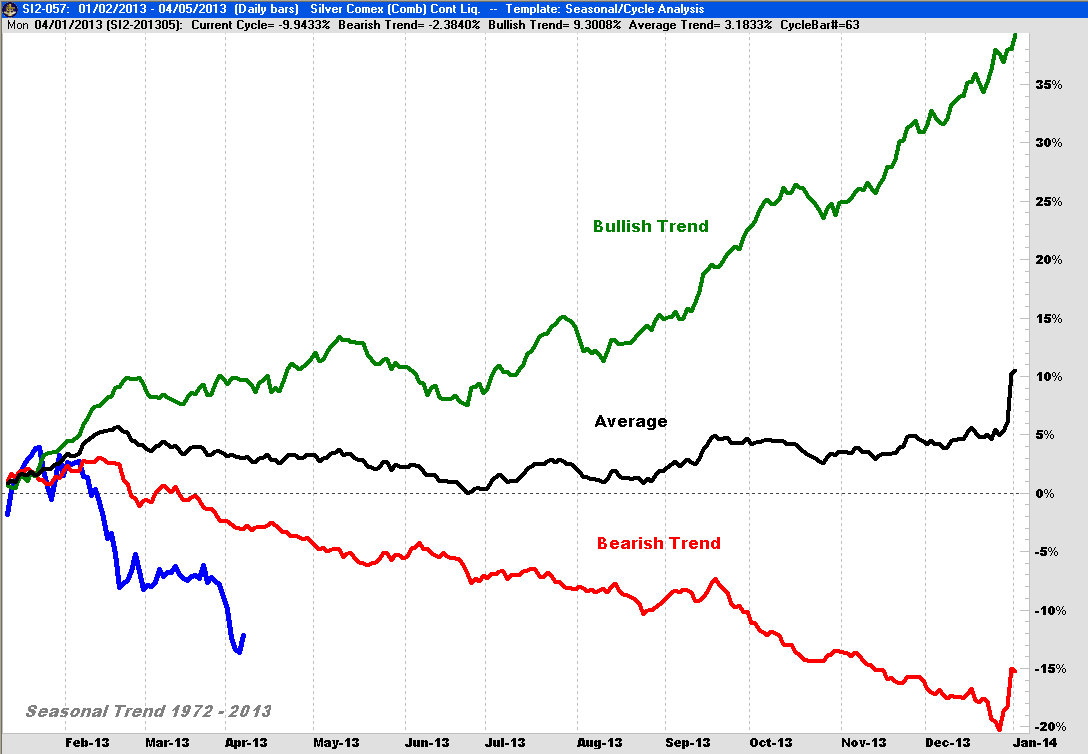

| My next question was how has seasonality impacted silver? As we see from the chart in Figure 2 showing the composite performance in the best years (bullish trend), average years and the worst years (bearish trend), the year so far has been dismal. Should we trade now or wait for the seasonal low in late June? |

|

| Figure 2 – Seasonal performance of silver (SI2-057) showing the trend since 1972 with the current year’s performance in blue. |

| Graphic provided by: www.GenesisFT.com. |

| |

| Currently (blue line), silver is well below even its average bearish trend down 15% year-to-date. Assuming support at $25.60 holds, and given the extreme short position in silver, there is a good chance of a reversion-to-the-mean bounce from here. By the time the seasonal low occurs in June given the current position, much of the short squeeze bounce may have already occurred. |

| Clearly, the silver short positions are bets that inflation will not accelerate even in the face of trillions of dollars in fiscal stimulus around the globe. But the only way it would pay off is if the US and other major economies experience GDP collapses from here or at the very least, the US and its major trading partners enter major recessions soon. This is not a scenario that looks very likely at this point. This trade set-up is relatively straight forward. Buy silver or SLV on strength with a stop loss just below the current major support level at $25.60. According to historic data, there is an 80% chance that the trade will make money over the next 12 to 53 weeks. It could also prove to be a great place to put your money to avoid the usual "sell in May and go away" weakness in stocks. |

Matt Blackman is a full-time technical and financial writer and trader. He produces corporate and financial newsletters, and assists clients in getting published in the mainstream media. He is the host of TradeSystemGuru.com. Matt has earned the Chartered Market Technician (CMT) designation. Find out what stocks and futures Matt is watching on Twitter at www.twitter.com/RatioTrade

| Company: | TradeSystemGuru.com |

| Address: | Box 2589 |

| Garibaldi Highlands, BC Canada | |

| Phone # for sales: | 604-898-9069 |

| Fax: | 604-898-9069 |

| Website: | www.tradesystemguru.com |

| E-mail address: | indextradermb@gmail.com |

Traders' Resource Links | |

| TradeSystemGuru.com has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

Comments

Date: 04/17/13Rank: 1Comment:

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog