HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Billy Williams

Statistically, April is one of the best-performing months for the Dow Jones Industrial Average (DJIA). It could serve as a springboard for the market to break higher, and it could also take one stock, Carriage Services, even higher than the 75% return it has yielded since January. Let's take a look.

Position: Hold

Billy Williams

Billy Williams has been trading the markets for 27 years, specializing in momentum trading with stocks and options.

PRINT THIS ARTICLE

STOCKS

April: A Month Of Renewal For the SPX?

04/09/13 03:53:37 PMby Billy Williams

Statistically, April is one of the best-performing months for the Dow Jones Industrial Average (DJIA). It could serve as a springboard for the market to break higher, and it could also take one stock, Carriage Services, even higher than the 75% return it has yielded since January. Let's take a look.

Position: Hold

| As the start of spring, April is popularly considered a season of renewal. After a 13-year contracted price range, could the market see some renewal and hope to break out of this range? The S&P 500 (SPX) is currently trading at close range to an established resistance point at the 1575 price level. But the month of April has been the highest-performing month for the DJIA, a key indicator of the overall market. In the year following a Presidential election, April has been the least dangerous month to trade in, offering an average rise of 2% or more in the DJIA since 1953. Based on this statistic, April could serve as a springboard to push the SPX beyond the 1575 resistance level and move higher into the month of May. While April is prone to mid-month weakness due to tax deadlines, most analysts are usually optimistic — sometimes too optimistic — as Q1 results begin to roll out. Enthusiasm for the start of the new fiscal year in the business cycle can always lead to some exuberance. The market is prone to bullishness all the way into May unless something extremely negative turns sentiment sour and investors flee for the sidelines. |

|

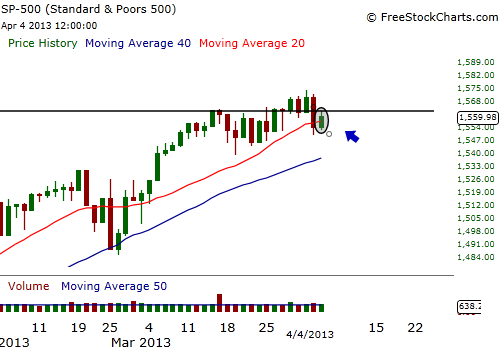

| Figure 1: The SPX has formed an inside bar, a bullish setup given the SPX's solid bullish trend. A buy entry is signaled if the price trades over the bar's intraday price low without trading below its intraday price low. |

| Graphic provided by: www.freestockcharts.com. |

| |

| So far this year, the market, particularly the DJIA and the SPX, has performed with conviction on the side of the bulls and has shown above-average strength. The SPX has shrugged off its typical pattern of rolling over in mid-March and has barely slowed its ascent to challenge the decade-old overhead resistance. Barely pausing, the market traded down yesterday (April 8), but today has formed an inside bar where the day's price range traded within the previous day's price range without going below or above its intraday high. Given the trajectory of the SPX's price action, which has been solidly bullish and trending higher, the inside bar that is forming is setting up for a long entry, provided that the market trades above, and not below, its intraday high. |

| If it does trade below its intraday high, then bulls will have a solid opportunity to catch the wave of momentum, as the SPX could make a historic move to end the 10-plus years of sideways price action that has been in place since the dotcom-era meltdown back in 1999. On that note, it's worth pointing out that many stocks across the sectors have been trading higher with many at all-time price highs — another solid bullish indicator. One such stock is Carriage Services (CSV), which broke out in the early part of January 2013 and registered an almost 75% return in as little as three months. |

|

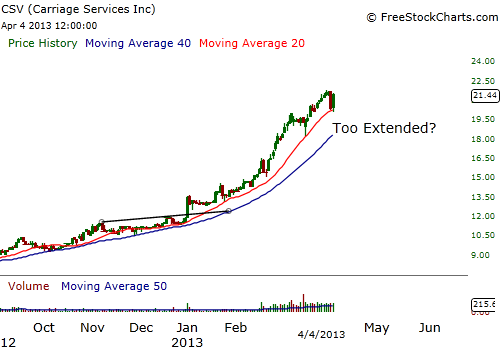

| Figure 2: CSV has registered a 75% return since breaking higher in early January 2013. Price seems to be a bit extended from its 40-day SMA and price needs to pullback and consolidate a bit, but if it does, then it could offer a second entry just in time to ride the momentum of a potential SPX breakout through the 1575 level. |

| Graphic provided by: www.freestockcharts.com. |

| |

| CSV is currently trading around $21 a share, and it's now a bit extended from its 40-day simple moving average (SMA). But as it pulls back and consolidates, it could offer a second entry point just as the S&P 500 breaks free of the 1575 price level and the market propels the stock higher. Watch for this opportunity to catch CSV for the next move up. The SPX could provide the wind for this stock's sails. |

Billy Williams has been trading the markets for 27 years, specializing in momentum trading with stocks and options.

| Company: | StockOptionSystem.com |

| E-mail address: | stockoptionsystem.com@gmail.com |

Traders' Resource Links | |

| StockOptionSystem.com has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

Comments

Date: 04/10/13Rank: 4Comment:

|

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog