HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Billy Williams

The SPX experienced a mild pullback in March but seems to be signaling another bull run. If so, then this stock could emerge a leader and explode higher!

Position: Buy

Billy Williams

Billy Williams has been trading the markets for 27 years, specializing in momentum trading with stocks and options.

PRINT THIS ARTICLE

STOCKS

March, The Unexpected, Lumbering Giants

04/04/13 04:34:25 PMby Billy Williams

The SPX experienced a mild pullback in March but seems to be signaling another bull run. If so, then this stock could emerge a leader and explode higher!

Position: Buy

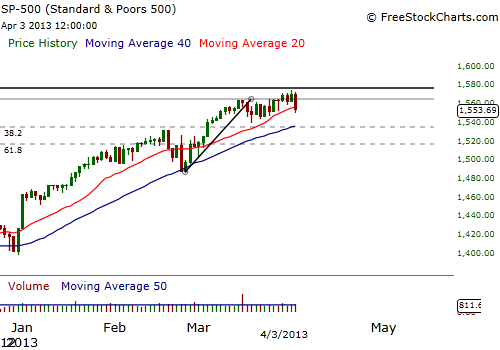

| All eyes are still fixed on the SPX 1575 level, the all-time price high that has had the market locked in a virtual prison while serving as firm resistance that has repelled previous efforts to break free and trade higher. But despite fears of a European debt crisis, a potential double recession, lingering economic concerns, relatively high unemployment, and the consequences of cheap money and low interest rates brought on by Quantitative Easing, the market continues to lumber forward like some shuffling giant undeterred by the surrounding noise. From a statistical viewpoint, March was supposed to start strong up to mid-month then give in to weakness and rollover. The pullback, however, was mild. Registering barely a hiccup, the SPX displayed a great deal of strength around March 13, 2013 pulling back only slightly, which could signal that it will gather strength and rally all the way to May (Figure 1). |

|

| Figure 1: The month of March usually leads to the SPX rolling over and giving into weakness but this year the SPX has only pulled back slightly, possibly signaling a strong bull run up to the month of May. |

| Graphic provided by: www.freestockcharts.com. |

| |

| May is traditionally the strongest month in the six-months preceding it and also signals the blow off before the Summer Doldrums set in. If that is the case then the markets can rally once again and offer the bulls more opportunities in stocks. Energy and real estate are leading the way as housing continues to improve and energy becomes more and more in-demand with each passing day. With energy, the challenge for oil companies is that all the "easy" oil seems to be discovered and/or developed already. In addition, with the British Petroleum Gulf Coast oil spill still fresh in the minds of coastal communities in the U.S., and the negative environmental impact still being felt, government and the private sector are reluctant to drill near any populated areas even if it is offshore. |

| This is causing companies like Conoco Phillips, Exxon Mobil, Shell, and other major oil conglomerates to go further than they have in the past from just offshore in to ultra deepwater drilling, or UDW. Companies who have the resources and are willing to push the envelope by exploring some of the most hostile and dangerous parts of the world, the rewards are huge but not without risk. Most deepwater platforms can cost as little as $287,000 a day to as much as $650,000 a day but without the expertise and experience to apply those resources, the potential for loss is tremendous. But, one company out of The Netherlands has the expertise and is in a plum position to make a huge run to outperform the market and even help take it higher. |

|

| Figure 2: CLB is a strong shovel-and-pick stock that has served the oil industry for decades in exploring oil resources in remote and isolated parts of the world, particularly in ultra deepwater drilling. The stock is trading back near its all-time high and could help take the SPX higher as the 1575 resistance level is challenged. |

| Graphic provided by: www.freestockcharts.com. |

| |

| Core Laboratories, CLB, earned its stripes by helping supply the energy needs of The Netherlands and most of Europe. Since Europe has no natural domestic oil deposits in abundance, save its offshore oil deposits, CLB has been instrumental by offering a combination of expertise and experience over the last several decades to navigate the harsh weather conditions and ocean to supply energy throughout Europe. |

| It has also assisted almost every major oil company throughout the world in finding and developing oil resources in the most difficult conditions imaginable while maximizing the ROI of the capital invested to develop new oil fields with UDW. The stock has clawed its way back from a recent steep decline where it gapped down but has closed the price gap and is trading near its all-time high once again (Figure 2). Look for CLB to trade up through resistance and go higher as the SPX finds its legs and mounts another rally, hopefully till the month of May. |

Billy Williams has been trading the markets for 27 years, specializing in momentum trading with stocks and options.

| Company: | StockOptionSystem.com |

| E-mail address: | stockoptionsystem.com@gmail.com |

Traders' Resource Links | |

| StockOptionSystem.com has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

PRINT THIS ARTICLE

|

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog