HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Donald W. Pendergast, Jr.

Biotech/drug stocks are leading the S&P 100/500 indexes higher, and in a big way.

Position: N/A

Donald W. Pendergast, Jr.

Freelance financial markets writer and online publisher of the Trendzetterz.com S&P 500 Weekly Forecast service.

PRINT THIS ARTICLE

NEW HIGHS-NEW LOWS

IBB: New Multiyear High

04/01/13 11:02:56 AMby Donald W. Pendergast, Jr.

Biotech/drug stocks are leading the S&P 100/500 indexes higher, and in a big way.

Position: N/A

| With the biotech/drugs industry group leading the S&P 100 index higher — and the S&P 500 index apparently toward a new all-time high, are these stocks "keepers", or should existing longs begin to take protective measures and/or start scaling out of them now? Here's a closer look, using the daily chart of the ETF iShares NASDAQ Biotechnology Index Fund (IBB) to see if we can find useful technical clues. |

|

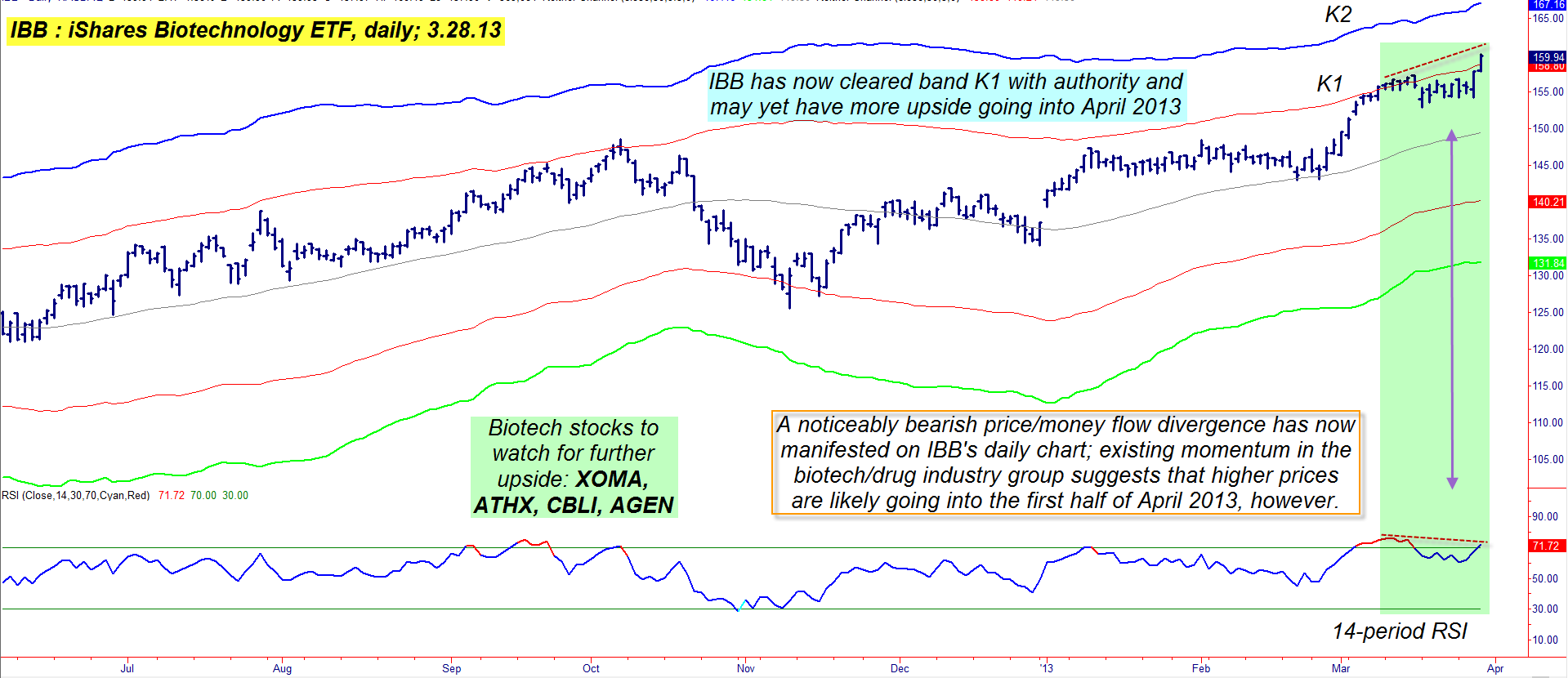

| Figure 1: While signs of distribution are now evident, IBB's fresh break above band K1 suggests that the bulls still have the upper hand in driving price direction over the next 2 to 4 weeks. |

| Graphic provided by: TradeStation. |

| |

| Like many other stock industry groups, the biotech/drug group made a major multicycle low on November 9, 2012; the main exchange-traded fund (ETF) that tracks the group — the iShares Biotech ETF IBB — has gained more than 27% since that major low and now appears intent on running up toward even higher valuation levels before a meaningful correction sets in. Both its medium- and long-term money flow trends are still in bullish mode, but there is a minor amount of distribution already underway, and this is likely to increase as IBB and its component stocks ascend toward their next major cycle high — probably between now and the latter half of April 2013. IBB's 14-day RSI indicator tells much the same story; its current reading is noticeably lower than the one seen at its prior peak on March 12, 2013. Conversely, the actual price action on the chart is very bullish indeed, what with IBB just having made a major, wide-range daily thrust above Keltner band K1. Essentially, this chart is revealing that: 1. Institutions are still pouring money into the biotech/drug industry group stocks, albeit at a slowing pace. 2. Near-term, prices should rise — possibly for the next 2 to 4 weeks. 3. Signs of distribution (that is, the "smart money" unloading their shares to latecomers to the rally) are already evident and will likely become more pronounced in the weeks ahead. At the time of this writing, the S&P 500 index (.SPX) is less than 0.5% away from its all-time high made in October 2007 and the odds look very good that that high will be reached/exceeded sometime within the next 1 to 3 weeks; IBB should also be drawn higher along with the major stock indexes during this same time frame. Existing longs in IBB who might have considered buying some put option protection should think twice as the bid-ask spreads are awful, making the risk/reward factor of this strategy less than attractive. The best thing to do now for those currently long IBB or its components is to either run a close trailing stop (a 9-period EMA is often an effective short-term trailing stop) or begin to take some profits as the ETF grinds higher toward its upcoming cycle high. Speculative bulls looking to day/swing trade biotech stocks with attractive fundamentals might want to put the following stocks on their watchlists: XOMA Corp. (XOMA), Athersys Inc. (ATHX), Cleveland Biolabs Inc. (CBLI) and Agenus, Inc. (AGEN). ATHX is experiencing a major bullish breakout as of Thursday, March 28, 2013, which could be of interest to day/swing traders. |

|

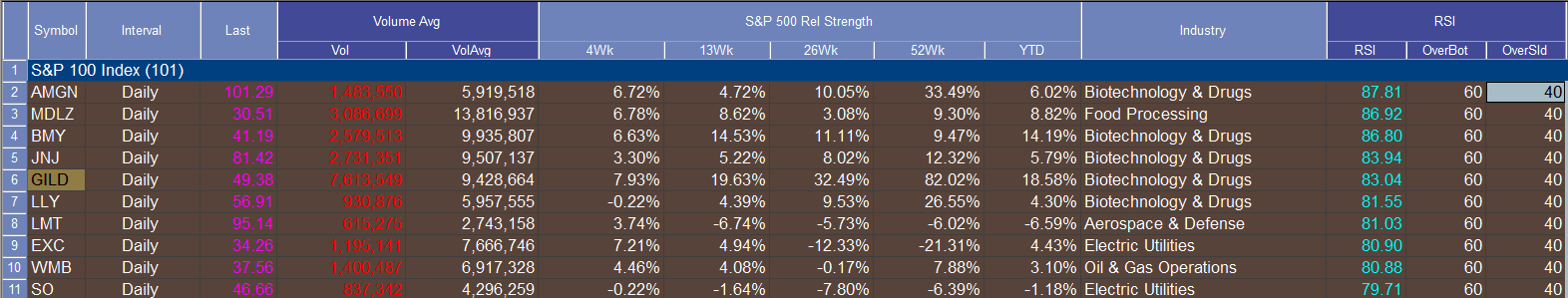

| Figure 2: Many large cap biotech stocks have extremely high 8-day RSI readings, but the odds still favor higher prices into April 2013 for the biotech/drugs industry group. |

| Graphic provided by: TradeStation. |

| Graphic provided by: TradeStation Radar Screen. |

| |

| The bottom line for the biotech/drug industry group is that higher prices are probable over the next 2 to 4 weeks, after which a proportional correction and/or bearish trend reversal should begin to manifest. Trade wisely until we meet here again. |

Freelance financial markets writer and online publisher of the Trendzetterz.com S&P 500 Weekly Forecast service.

| Title: | Market consultant and writer |

| Company: | Trendzetterz |

| Address: | 81 Hickory Hollow Drive |

| Crossville, TN 38555 | |

| Phone # for sales: | 904-303-4814 |

| Website: | trendzetterz.com |

| E-mail address: | support@trendzetterz.com |

Traders' Resource Links | |

| Trendzetterz has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor