HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Matt Blackman

It may have been a challenging year for the economy but you would never know it by looking at railroad stocks.

Position: N/A

Matt Blackman

Matt Blackman is a full-time technical and financial writer and trader. He produces corporate and financial newsletters, and assists clients in getting published in the mainstream media. He is the host of TradeSystemGuru.com. Matt has earned the Chartered Market Technician (CMT) designation. Find out what stocks and futures Matt is watching on Twitter at www.twitter.com/RatioTrade

PRINT THIS ARTICLE

MARKET TIMING

Are Railroads Still On The Fast Track?

03/28/13 02:43:23 PMby Matt Blackman

It may have been a challenging year for the economy but you would never know it by looking at railroad stocks.

Position: N/A

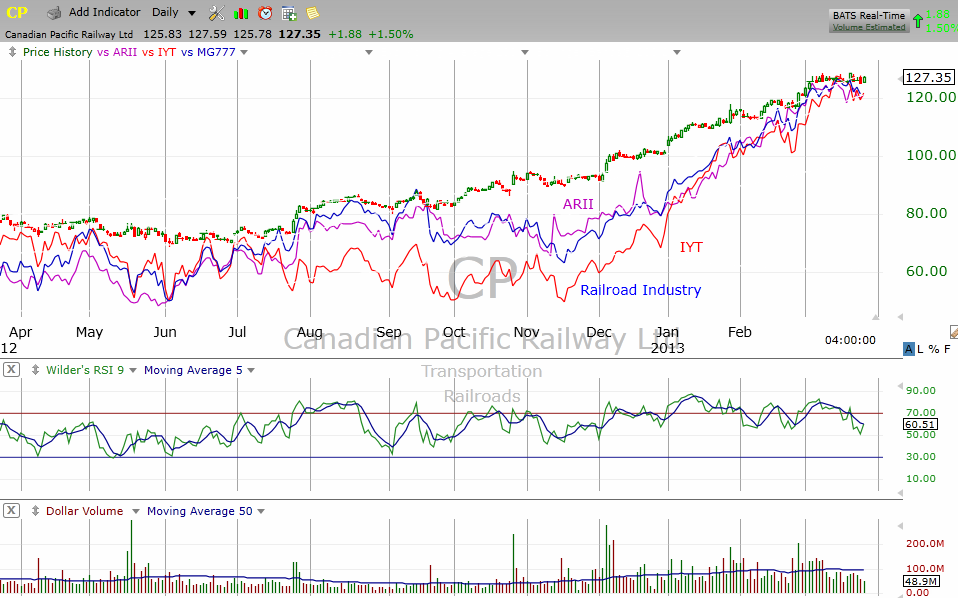

| In November 2009, Warren Buffett made a bold move with the purchase of rail giant Burlington Northern Santa Fe Corp. for more than $26 billion. It was his (and Berkshire Hathaway's) biggest purchase ever. According to a Bloomberg article it was Buffett's "all-in wager on the economic future of the United States." So far this bet has paid him well - since November 2009 the railroads industry (MG777) has more than doubled. Over the last year alone MG777 is up 30% in the last 12 months and some of the leading rail stocks like American Railroad Industries (ARII) (up 75%) and Canadian Pacific (CP) (up 65%) have paid investors well for being onboard. Is it too late to get in on the action? |

|

| Figure 1 – Daily chart of Canadian Pacific (CP), American Railroads (ARII), the Dow Jones Transports ETF (IYT) and the Railroad Industry (MG777) over the last year. |

| Graphic provided by: TC2000.com. |

| |

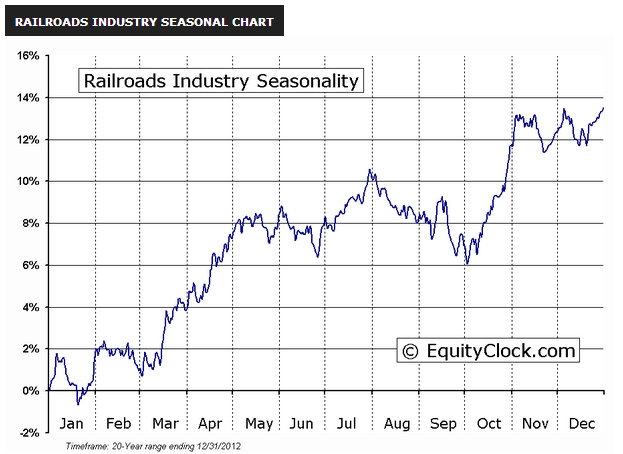

| Much will depend on where the market goes from here. Unfortunately there is not a railroad exchange traded fund that allows investors to focus on rail stocks for those looking to play this industry. However, the Dow Jones Transports ETF (IYT) is a relatively good proxy of both railroads and the overall market since transports have a habit of leading industrials in strong rallies. This ETF will also tell you when the rally is weakening for the same reason. From a seasonality perspective, the strongest time to be in rail stocks is from early March through July then from early October into early November according to EquityClock.com (see Figure 2). |

|

| Figure 2 – Seasonal chart of railroad stock performance over the last 20 years. |

| Graphic provided by: EquityClock.com. |

| |

| Railroads are as old as the stock market but just because the industry is old doesn't mean it can't still make you money. But even if railroads aren't your cup of tea, they can still provide a great stock market proxy to tell you when it's time to be invested and when it's time to head for the hills. |

Matt Blackman is a full-time technical and financial writer and trader. He produces corporate and financial newsletters, and assists clients in getting published in the mainstream media. He is the host of TradeSystemGuru.com. Matt has earned the Chartered Market Technician (CMT) designation. Find out what stocks and futures Matt is watching on Twitter at www.twitter.com/RatioTrade

| Company: | TradeSystemGuru.com |

| Address: | Box 2589 |

| Garibaldi Highlands, BC Canada | |

| Phone # for sales: | 604-898-9069 |

| Fax: | 604-898-9069 |

| Website: | www.tradesystemguru.com |

| E-mail address: | indextradermb@gmail.com |

Traders' Resource Links | |

| TradeSystemGuru.com has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

Comments

|

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog