HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Billy Williams

The market is on the move again and investor sentiment is growing more positive while this one group is leading the way.

Position: Buy

Billy Williams

Billy Williams has been trading the markets for 27 years, specializing in momentum trading with stocks and options.

PRINT THIS ARTICLE

STOCKS

Housing, Soaring Price Highs, Contrarianism

03/25/13 02:59:22 PMby Billy Williams

The market is on the move again and investor sentiment is growing more positive while this one group is leading the way.

Position: Buy

| The markets traded higher on positive news on Cyprus as well as strong numbers coming in from the housing market, the engine of the U.S. economy. But, reading tea leaves is mandatory in today's market if you want to keep your investment capital in positive territory while gains still have to be won by being smarter than the guy you are trading against and an industry that is swayed by a propaganda campaign from the major players, especially the Federal Reserve. Federal Reserve Chairman Ben Bernanke has said that he is optimistic on news of moderate growth in the economy but will continue with his policy of QE Forever by printing money and pouring it into the economy. The combination of inflation and hyper-liquidity is starting to be felt as the dollar's strength will ebb lower and lower as its purchasing power declines and cost of goods become more expensive especially in food and fuel, the mainstays of the U.S. middle class. |

|

| Figure 1 - Lennar homes announced some stunning numbers for the first quarter of 2013. Over the last several months, the stock has been in a noticeable uptrend helping the SPX make its way to break above the 1575 resistance level. |

| Graphic provided by: www.freestockcharts.com. |

| |

| The excess liquidity will likely end up in the stock market similar to the 1990s and create another asset bubble followed by another crash. But, the market is likely to continue on its sugar-high from cheap money and cheaper credit as companies offer zero-interest financing on everything from bunk-beds to automobiles ranging from six months to as long as six years. This will help companies bolster the bottom line while consumers lock in loans with no interest expense even as the dollar is likely to end up cheaper during the loan's term and benefiting smart borrowers. More accessible credit is also benefiting home-builders as companies like Lennar Corp. (Figure 1), DR Horton, Pulte Group Inc. (Figure 2), and others are reporting improved revenues and earnings. Those who had excess inventory or lots waiting to be built upon back in 2008 felt the harsh effects of the sub-prime meltdown but have been disciplined in avoiding over-exposure through a combination of selective asset liquidation and new developments. |

|

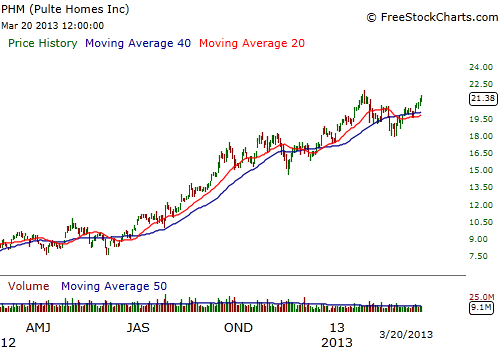

| Figure 2 - Pulte Homes is another strong homebuilder that survived the subprime meltdown in 2008 and has positioned itself as a leader in its investment group. Attractively priced and positioned in the overall market, this stock could help the market break higher as it trades into new territory in the near future. |

| Graphic provided by: www.freestockcharts.com. |

| |

| Today, Lennar reported net earnings of 26 cents a share in the first quarter of 2013 and beat prior year's quarterly earnings by 225% with revenue rising over 42%. Home builders have been doing well and KB Homes (KBH) will be reporting their earnings tomorrow. It's important to watch this group as a whole because it can serve as a good indicator on how the economy and stock market is doing. The reason is because home building affects the mortgage industry, building materials, banking, furniture sales, lawncare, lumber supplies, and more as new homeowners acquire their homes and settle in. The SPX is still trending higher and approaching the 1575 price level, the all-time price high for the SPX, which hasn't been hit since October 2007 before suffering a steep decline. |

| Now that the market is on the move again, investor sentiment is becoming more positive and with a depressed rate market where banks offer less than 1% for 1-year CD's, many investors are considering stocks once again. And, with many home builders leading the way while still being attractively priced, they could offer a good opportunity in the years to come as both investment sectors - real estate and equities - have recovered to attract new investment capital by those seeking higher returns once again. |

Billy Williams has been trading the markets for 27 years, specializing in momentum trading with stocks and options.

| Company: | StockOptionSystem.com |

| E-mail address: | stockoptionsystem.com@gmail.com |

Traders' Resource Links | |

| StockOptionSystem.com has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog