HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Donald W. Pendergast, Jr.

Shares of Buckeye Partners, LP are up by 34% since late December 2013, but technicals suggest that a pullback may be due soon.

Position: N/A

Donald W. Pendergast, Jr.

Freelance financial markets writer and online publisher of the Trendzetterz.com S&P 500 Weekly Forecast service.

PRINT THIS ARTICLE

CHART ANALYSIS

BPL: Money Flow Failing To Keep Up

03/12/13 02:40:19 PMby Donald W. Pendergast, Jr.

Shares of Buckeye Partners, LP are up by 34% since late December 2013, but technicals suggest that a pullback may be due soon.

Position: N/A

| Dividend-paying energy sector stocks, particularly the ones that make significant trending moves, are the darlings of investors who seek the safety of a high yield along with the opportunity to secure solid capital gains. One of the hottest dividend plays of late has been Buckeye Partners, LP, (BPL) a stock that offers a hefty 7% annual dividend payout and is also in its third month of a rally that has added more than 30% to its share price. The bulls in this stock appear to have it "made", so to speak, but several key technicals are warning of a high probability correction in the days and weeks just ahead. Here's a closer look now. |

|

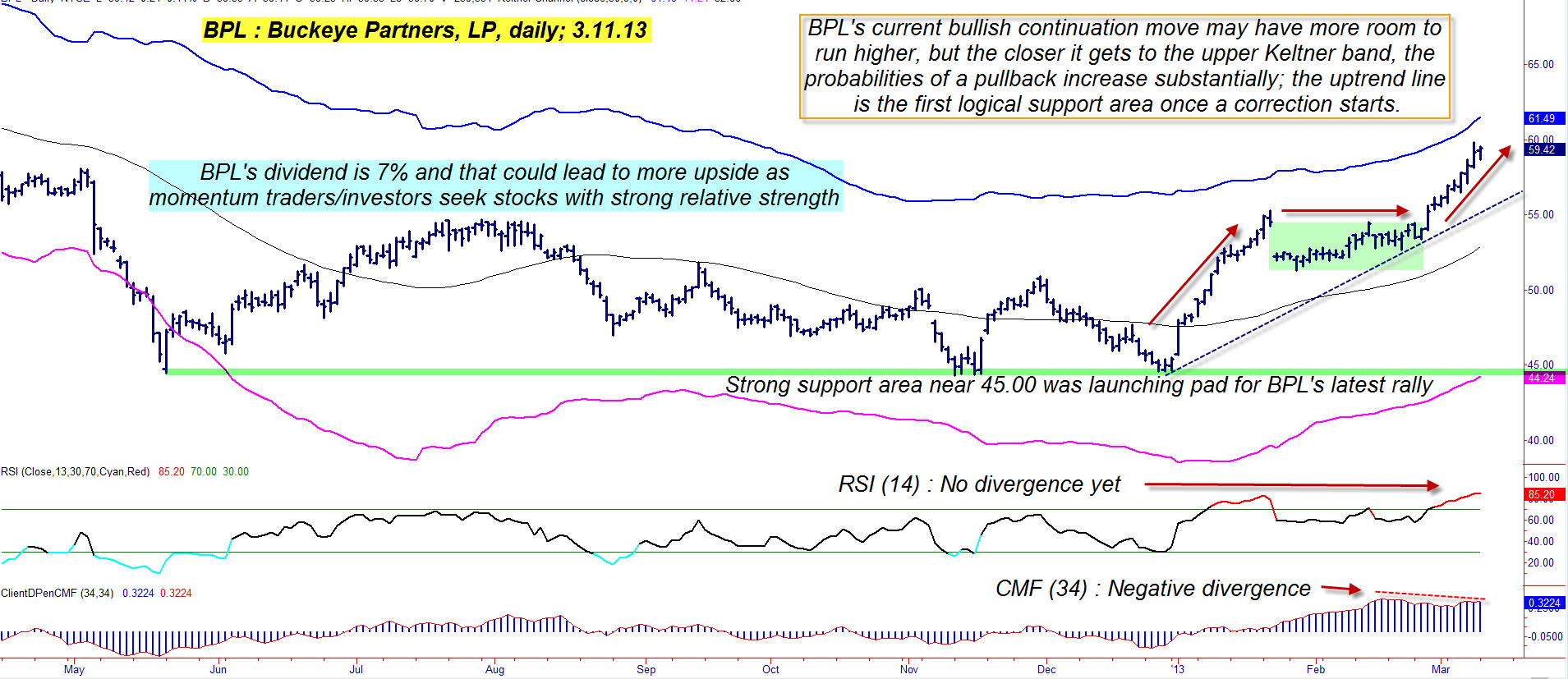

| Figure 1: BPL's daily chart features two terrific chart pattern examples - a key support/resistance line and that of a bullish continuation move. The latter pattern's initial target price is near 61.00, but could always run higher. |

| Graphic provided by: TradeStation. |

| |

| A good understanding of the technical dynamics of support/resistance is vital if an investor is to make consistently profitable discretionary trades, as it will help keep him or her on the "right" side of a given market, at least most of the time. For example, on BPL's daily chart in Figure 1, note the strong support zone that exists near 45.00 (see green horizontal line). Savvy market participants know that when a stock successfully tests two key support zones, the bulls will quickly take note and then frequently push the stock into what may be a tradable swing higher. Well, when BPL made its second test at 45.00 on December 21, 2012, it only took two trading sessions for the stock to break higher; the move ran all the way to early March 2013 (with a proportional consolidation at the halfway point of the move), with BPL gaining more than 34% at the high point of the move on March 8, 2013. Currently, BPL is approaching a price zone that will be the logical target area for its latest swing higher to level off (near 61.00), assuming both sides of the continuation pattern run-up will be approximately equal in length. What is interesting is that the 61.00 price target for the pattern is close to the upper Keltner band, which is set 9 standard deviations away from a 50-period moving average. It's rare for BPL to touch, much less exceed this important resistance level (it has been hit only twice in the past seven years), but given the powerful price cycles that are now driving the stock higher, we may see BPL hit/exceed the upper Keltner band within the next week or two. |

|

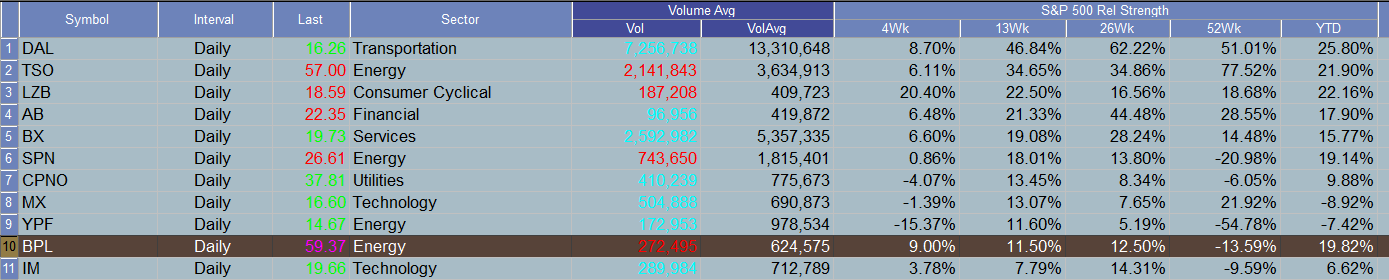

| Figure 2: Buckeye Partners LP (BPL) has outperformed the .SPX over the most recent 4-, 13- and 26-week periods, but has also significantly underperformed the same index over the past 52 weeks. |

| Graphic provided by: TradeStation. |

| Graphic provided by: TradeStation Radar Screen. |

| |

| Of course, there are a couple of other indicators that are flashing warning signals, with BPL having put in such a tremendous quarterly performance: 1. The 34-day Chaikin money flow (CMF) histogram at the bottom of the chart in Figure 1 clearly depicts mild distribution underway - it made a lower high even as BPL kept moving up. 2. The 14-day RSI is now in 'nosebleed' territory (over 85), and even though it has not yet confirmed a negative divergence with price, you can bet that once it does, bears will take notice - especially if such a bearish development occurs near either the 61.00 area or after touching the top Keltner band. |

| Swing traders with long BPL positions need to be considering their exit strategy and should be running a close trailing stop, while long-term holders should consider buying at-the-money puts with at least four months of time value. Speculative bears might consider shorting BPL once the RSI(14) finally confirms a bearish divergence, entering a short position on a break below the daily price bar that confirms it. Once in the trade, a two to three bar trailing stop of the daily highs should be used and the initial profit target for at least half your position should be the latest uptrend line on the chart - currently near the 56.50 area. Skilled option traders might consider the same basic trade setup, using slightly in-the-money puts with two to three months time value. Finally, remember to keep your per-trade risks small on this or any other stock or option trade you decide to take. Trade wisely until we meet here again. |

Freelance financial markets writer and online publisher of the Trendzetterz.com S&P 500 Weekly Forecast service.

| Title: | Market consultant and writer |

| Company: | Trendzetterz |

| Address: | 81 Hickory Hollow Drive |

| Crossville, TN 38555 | |

| Phone # for sales: | 904-303-4814 |

| Website: | trendzetterz.com |

| E-mail address: | support@trendzetterz.com |

Traders' Resource Links | |

| Trendzetterz has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog