HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Donald W. Pendergast, Jr.

It's been a sweet ride higher for bulls holding long positions in Krispy Kreme Doughnuts since August 2012, but the stock's key technicals are warning that the latest sugar buzz in the stock is fading fast, with a correction coming soon.

Position: N/A

Donald W. Pendergast, Jr.

Freelance financial markets writer and online publisher of the Trendzetterz.com S&P 500 Weekly Forecast service.

PRINT THIS ARTICLE

TECHNICAL ANALYSIS

Krispy Kreme: Is Its Sugar High Waning?

03/11/13 02:22:37 PMby Donald W. Pendergast, Jr.

It's been a sweet ride higher for bulls holding long positions in Krispy Kreme Doughnuts since August 2012, but the stock's key technicals are warning that the latest sugar buzz in the stock is fading fast, with a correction coming soon.

Position: N/A

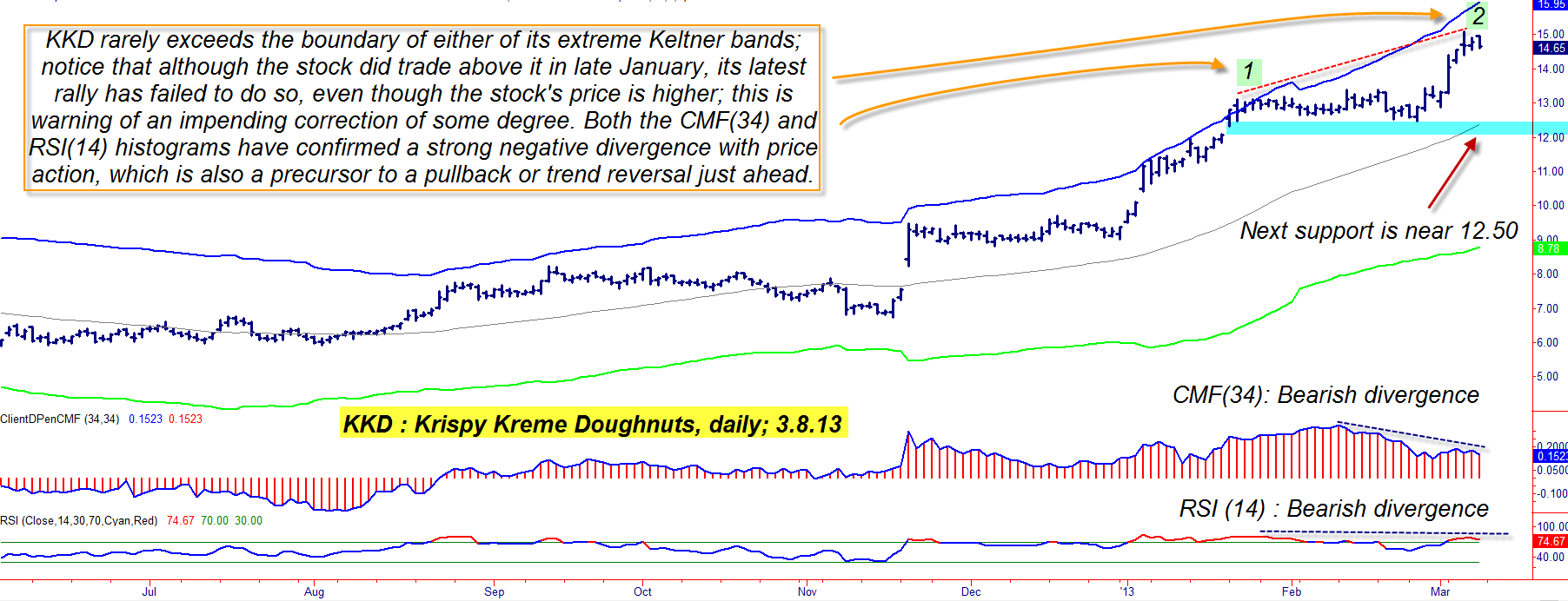

| Once Krispy Kreme (KKD) put in a double-bottom pattern last year (May to July, 2012), there was little doubt that a major multicycle low had been completed, with the possibility of sustained gains in the weeks and months following. No one could have accurately foreseen that KKD would go on to rise by more than 150% over the next seven months. Now that the stock has been driven up "so far-so fast", it is time to stand back and take an objective look at its daily chart to see what the true, unbiased state of its technical and fundamental situation is. The chart in Figure 1 suggests that KKD may soon experience a noticeable pullback and/or trend reversal. |

|

| Figure 1: While it's hard to imagine that a stock with such a bullish trend in place might be running on borrowed time, skilled chartists know that the three divergences depicted above are a clear warning to prepare for a correction in KKD. |

| Graphic provided by: TradeStation. |

| |

| As KKD gathered upward momentum on two occasions in 2012, notice that it never did touch - much less exceed - its upper Keltner band, one that is set 9.5 standard deviations away from its 50-period moving average; this confirmed that it was mostly short- to medium-term price cycles working together to move the stock's price higher and lower. But when the major, post-consolidation trend thrust erupted on December 31, 2012, the stock literally made a bee-line for the upper band, rising upward in tandem with it for three full weeks before a minor push above it ensued; this confirmed that a high-degree price cycle was at work and that there might be another run at a new high. After another five weeks of consolidation, sure enough, KKD rallied hard again, making another new five-year high. While doughnut lovers everywhere were probably pleased with this turn of events, savvy technicians were noticing that KKD's latest surge higher had failed to touch/exceed the upper Keltner band and that two other heavy-duty warnings of an impending correction and/or trend reversal had appeared on KKD's daily charts. |

|

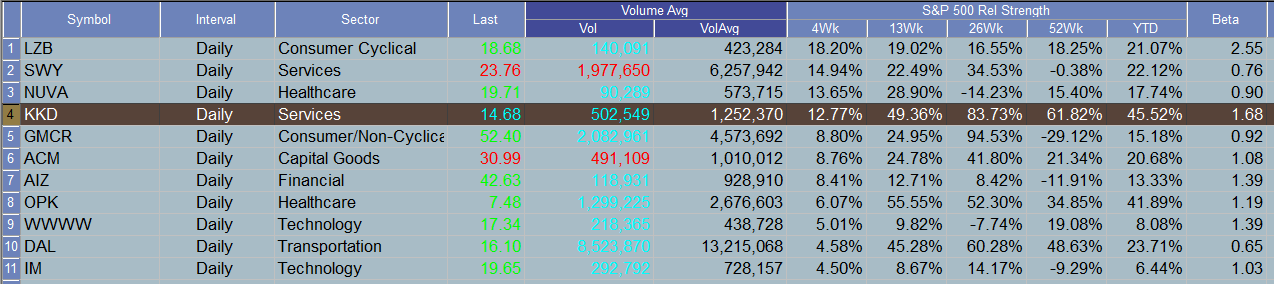

| Figure 2: KKD still has terrific relative strength performance numbers in relation to the S&P 500 index (.SPX). Note the wide variety of market sectors appearing in the above rankings; the latest market rally is indeed broad-based. |

| Graphic provided by: TradeStation. |

| Graphic provided by: TradeStation Radar Screen. |

| |

| Those two warning alerts are clearly seen at the bottom of the chart in Figure 1: 1. The 34-day Chaikin money flow (CMF)(34) histogram shows us an image of a stock that is under steady distribution - stock been sold by 'strong hands' into less experienced 'weak hands' - which is nearly always a warning of an upcoming decline. 2. The 'old reliable' RSI(14) indicator also shows us a picture of a stock quickly losing upward momentum. For both of these indicators to confirm such a bearish divergence at a time when the stock has failed to reach the upper band again suggests that anyone currently holding long positions in KKD should buy protective puts ASAP, if not actively beginning to scale out of such positions entirely. The next strong chart support level for KKD is near 12.50, and that is a long way below the stock's current price of 14.68. Bears who want to take a bite out of KKD on its anticipated selloff should consider buying the May '13 KKD $15.00 put option(s); the bid-ask spread is good, and the open interest on this put is only four contracts! This is telling us that traders/investors in KKD are unbelievably complacent and overconfident in KKD's long-term uptrend, and this could eventually be the pre-catalyst ingredient that will send KKD off the side of the stock market cliff faster than anyone can imagine. It may just take one bit of negative earnings news to help pop the KKD bubble - and in a big way - giving the bears a shot at making some fast cash as the king of grease 'n sugar donuts takes a probable slide southward toward 12.50 to 13.00 again. Put buyers should consider taking action if and when KKD drops below 14.43 (Wednesday's low) and use 13.00 as the initial profit target zone, keeping a portion of the position open for a possible decline to 12.50. If the put at any time declines in value by 50%, sell it for a loss and wait for a better trade setup; conversely, if it appreciates by 80, 90 or 100%, sell out and walk away happy - maybe visit your favorite donut shop for a cup of Joe and a cruller for your victory celebration. Trade wisely until we meet here again. |

Freelance financial markets writer and online publisher of the Trendzetterz.com S&P 500 Weekly Forecast service.

| Title: | Market consultant and writer |

| Company: | Trendzetterz |

| Address: | 81 Hickory Hollow Drive |

| Crossville, TN 38555 | |

| Phone # for sales: | 904-303-4814 |

| Website: | trendzetterz.com |

| E-mail address: | support@trendzetterz.com |

Traders' Resource Links | |

| Trendzetterz has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog