HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Donald W. Pendergast, Jr.

Up by more than 80% since late November 2012, shares of Hewlett Packard may still have a bit more to run before a meaningful pullback hits.

Position: N/A

Donald W. Pendergast, Jr.

Freelance financial markets writer and online publisher of the Trendzetterz.com S&P 500 Weekly Forecast service.

PRINT THIS ARTICLE

KELTNER CHANNELS

Hewlett-Packard: More Gains Likely?

03/06/13 02:04:56 PMby Donald W. Pendergast, Jr.

Up by more than 80% since late November 2012, shares of Hewlett Packard may still have a bit more to run before a meaningful pullback hits.

Position: N/A

| Several of the 'legacy' PC and notebook manufacturers have seen their earnings and stock prices tumble over the past couple of years as the world continues to gradually shift to a 'tablet and cloud' computing environment; Hewlett-Packard (HPQ) and Dell Computer (DELL) were among the hardest hit in the sector, but after enduring technical downtrends of severe magnitude, the stocks have rebounded nicely. Here's a look at HPQ's latest key technicals, which are still surprisingly bullish after an 80%-plus rise in just 3 1/2 months. |

|

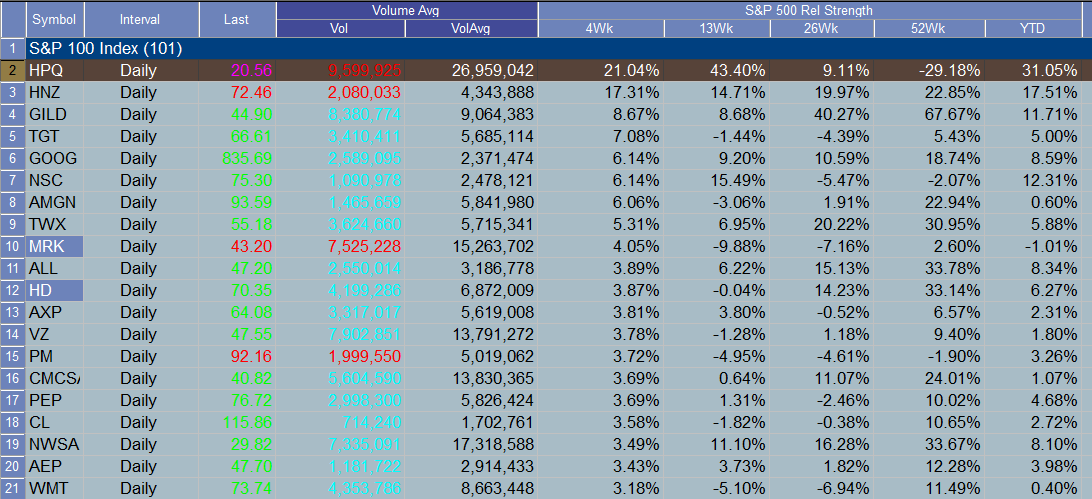

| FIGURE 1: Hewlett Packard (HPQ) has the best all-around combination of short-, medium-, and longer-term price performance against the .SPX out of all 100 .OEX components stocks. |

| Graphic provided by: TradeStation. |

| Graphic provided by: TradeStation Radar Screen. |

| |

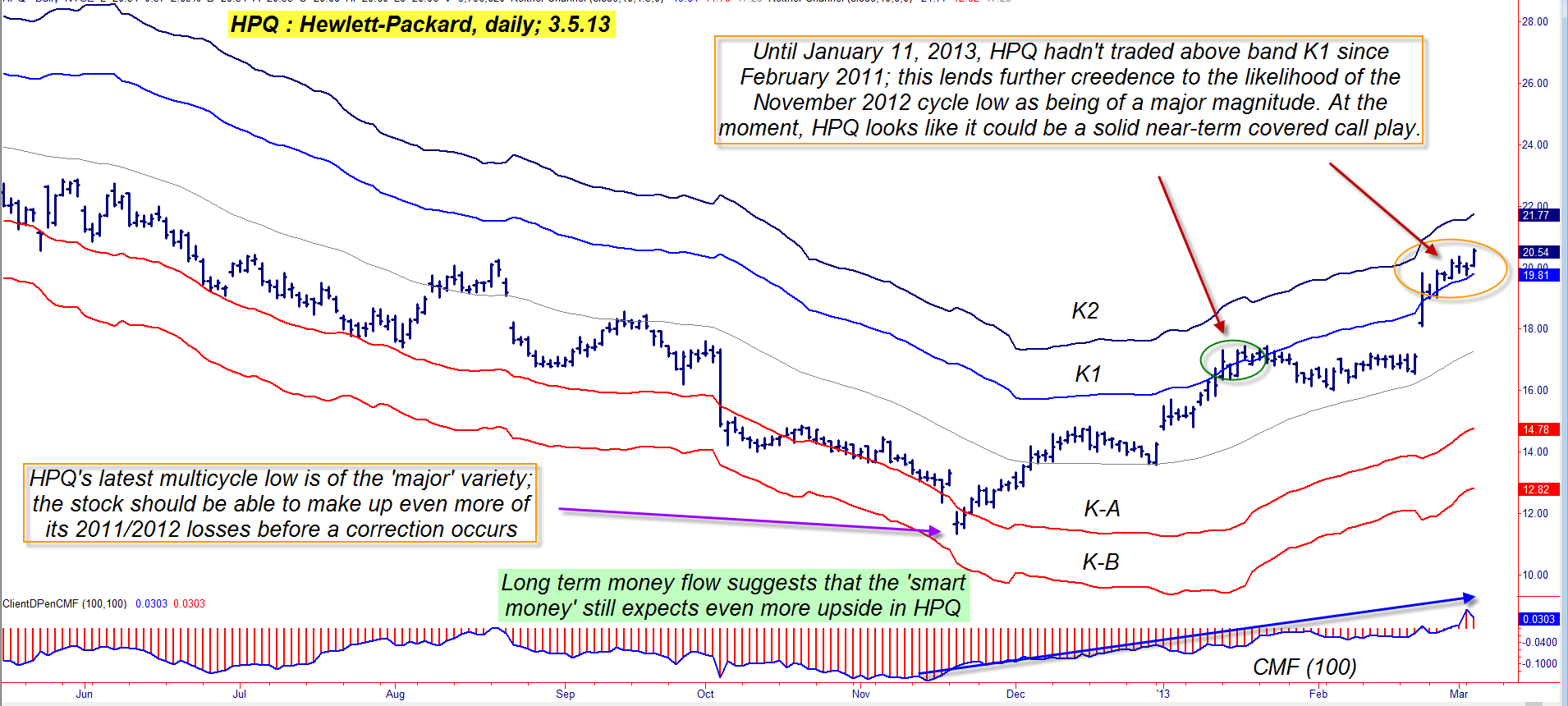

| Every large trend has a terminal zone and after HPQ managed to slide all the way from 54.75 (April 2010) to 11.35 in November 2010, it may have been hard for tech sector bulls to believe that the final low had truly been achieved. Now, after having rocketed higher since making that major low, there is no room for doubt that a major low is now in place. Long-term money flow (the 100-day Chaikin Money flow)continues to improve and as of today there is no sign of negative price/money flow divergence apparent. Even more bullish is that HPQ is now trading above Keltner band K1 for only the second time in two years; the stock has exceptionally strong comparative relative strength rankings vs. the S&P 500 index (.SPX) and is also looking very strong in the earnings per share growth rate department. All told, this looks like a stock that is a 'buy high/sell higher' kind of play and one of the lower-risk ways to ride HPQ's upward momentum is to put on a near-term covered call trade. |

|

| FIGURE 2: Strong technicals and improving fundamentals may be paving the way for even more near-term gains in Hewlett-Packard (HPQ). |

| Graphic provided by: TradeStation. |

| |

| Many times, when a fundamentally or technically strong momentum stock rises above band K1, the odds are very good that it will remain above that band for a period of time. In some cases, the move above K1 is only the first stage of a large-scale bullish run that can go all the way to the upper Keltner band (K2). While it is never wise to assume that will be the case, it is much safer to do a covered call with the expectation that the stock will stay above band K1 through the expiration of the call option sold as part of a buy-write strategy and that is probably the best plan of attack now for HPQ bulls. The April 2013 20.00 call has a good bid-ask spread of only .01 and an open interest figure of more than 15,000 contracts; theta (daily time decay) is only $1/day per contract, but that will ratchet up during the last 30 days of the call's life. The trading plan here is simple: 1. Buy the April '13 HPQ $20.00 covered call. 2. Hold the trade through April options expiration or until you see a daily close below band K1. If the stock closes at 20.01 or above at expiration, it will be called away and you will have a net gain on the trade of about $62 per covered call. If it doesn't close in the money but hasn't been stopped out, you keep the stock and the option premium and can choose to sell another call. If you get stopped out early, you'll have a modest loss on the trade. All told, this is a modest reward - modest risk trade, that has a healthy slate of bullish technicals and fundamentals working in its favor; do not risk more than 2% of your account equity on this or any other trade, no matter how bullish/bearish your personal sentiments are towards it. Trade wisely until we meet here again. |

Freelance financial markets writer and online publisher of the Trendzetterz.com S&P 500 Weekly Forecast service.

| Title: | Market consultant and writer |

| Company: | Trendzetterz |

| Address: | 81 Hickory Hollow Drive |

| Crossville, TN 38555 | |

| Phone # for sales: | 904-303-4814 |

| Website: | trendzetterz.com |

| E-mail address: | support@trendzetterz.com |

Traders' Resource Links | |

| Trendzetterz has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog