HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Matt Blackman

High yield corporate bonds, better known as junk bonds, are under appreciated which may have something to do with their popular handle. But have they been given a bum rap?

Position: N/A

Matt Blackman

Matt Blackman is a full-time technical and financial writer and trader. He produces corporate and financial newsletters, and assists clients in getting published in the mainstream media. He is the host of TradeSystemGuru.com. Matt has earned the Chartered Market Technician (CMT) designation. Find out what stocks and futures Matt is watching on Twitter at www.twitter.com/RatioTrade

PRINT THIS ARTICLE

DIVERGENCE INDEX

Are High Yield Corporate Bonds An Asset Class Worth Considering?

02/26/13 12:47:18 PMby Matt Blackman

High yield corporate bonds, better known as junk bonds, are under appreciated which may have something to do with their popular handle. But have they been given a bum rap?

Position: N/A

| Prior to the late 1970s before high yield corporate bonds were introduced to the market en mass, speculative companies without an investment-grade credit rating found it nearly impossible to raise money. Today, the story is much different and debt for U.S. speculative companies with ratings of the BBB-/Baa3 or below is approximately $1 trillion, based on the Barclays US Corporate High Yield Index. |

|

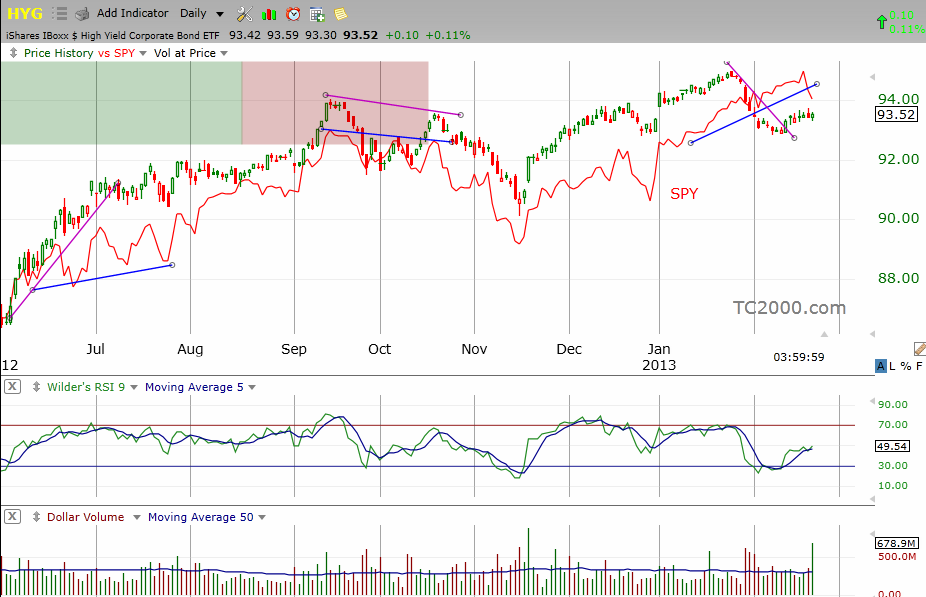

| Figure 1 – Daily chart of the iShares IBoxx High Yield Corporate Bond ETF HYG together with the SPDRS S&P 500 Trust Series ETF SPY (red) showing the relationship between the two. Note that the HYG has tended to lead SPY in both up moves and down, which is a concern given the recent negative divergence by HYG which began in late January. |

| Graphic provided by: TC2000.com. |

| |

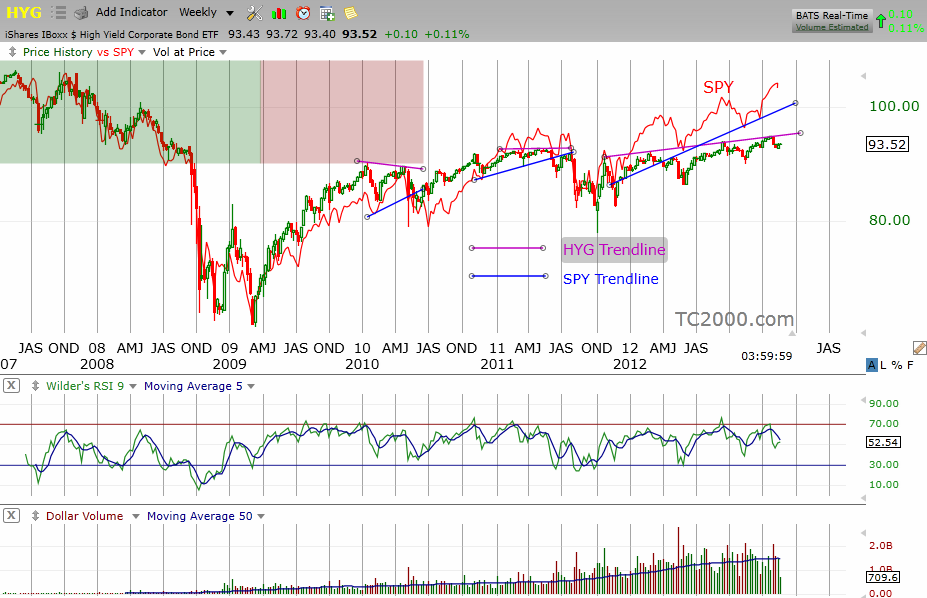

| According to a special report entitled "High Yield ETF Behavior in Stressed Markets" (see link below), 15 high yield fixed income ETFs available in today's market are worth about $33 billion in market cap of which approximately 90% resides in two ETFs - the iShares IBoxx High Yield Corporate Bond ETF (HYG) and the Barclays Capital High Yield Corporate Bond ETF (JNK). By my count, HYG is a portfolio of more than 700 high yield corporate bonds. In Figure 2 we see the longer term relationship between SPY and HYG on the weekly chart dating back to early 2007. By mid 2007 the HYG began to show divergence with SPY putting in a lower high compared to the SPY which posted a higher high in the fall of 2007. We can also see that the latest negative divergence in HYG began to appear in the fall of 2012. |

| But beyond using high yield corporate bonds and ETFs as a leading indicator of stocks, this asset class is one all investors should consider as part of their portfolios. A long-term study of the Bank of America Merrill Lynch High Yield Masters II Index showed that not only has this asset class provided reasonably good advance warning of impending stock market moves, the index has outperformed the S&P500 by a margin of two to one since the mid-1990s. As well, the index suffered about half of the draw-downs of stocks during the 2007-8 financial crisis. |

|

| Figure 2 – Weekly chart comparing HYG and SPY since early 2007. |

| Graphic provided by: TC2000.com. |

| |

| Once the realm of professional money managers, institutions and hedge funds, this asset class is now readily available to all traders and investors thanks to the introduction of high yield corporate ETFs. But before jumping in, it is recommended that you do your homework, starting with the paper listed in suggested reading below. |

| Suggested Reading: Tucker, Matthew and Laipply, High Yield ETF Behavior in Stressed Markets http://goo.gl/p0LOL |

Matt Blackman is a full-time technical and financial writer and trader. He produces corporate and financial newsletters, and assists clients in getting published in the mainstream media. He is the host of TradeSystemGuru.com. Matt has earned the Chartered Market Technician (CMT) designation. Find out what stocks and futures Matt is watching on Twitter at www.twitter.com/RatioTrade

| Company: | TradeSystemGuru.com |

| Address: | Box 2589 |

| Garibaldi Highlands, BC Canada | |

| Phone # for sales: | 604-898-9069 |

| Fax: | 604-898-9069 |

| Website: | www.tradesystemguru.com |

| E-mail address: | indextradermb@gmail.com |

Traders' Resource Links | |

| TradeSystemGuru.com has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

Comments

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog