HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Donald W. Pendergast, Jr.

The .OEX pulled back during Friday's session, rebounding strongly; the next move may very likely be a final swing move higher into the end of August.

Position: N/A

Donald W. Pendergast, Jr.

Donald W. Pendergast is a financial markets consultant who offers specialized services to stock brokers and high net worth individuals who seek a better bottom line for their portfolios.

PRINT THIS ARTICLE

TECHNICAL ANALYSIS

Pendy's Picks : August 13, 2012

08/13/12 11:42:45 AMby Donald W. Pendergast, Jr.

The .OEX pulled back during Friday's session, rebounding strongly; the next move may very likely be a final swing move higher into the end of August.

Position: N/A

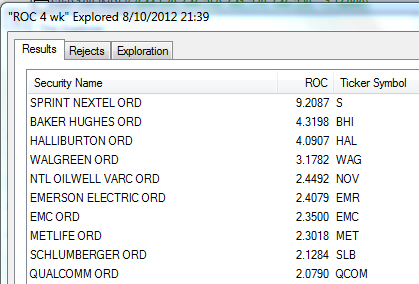

| The .OEX (Standard and Poor's 100) finished Friday's trading session at 644.66, closing up by .24%, and with its technical posture looking as if it wants to run higher once again. At this point, the best educated guess is that the index is going to make one final swing higher - taking out the recent high of 646.86 -before petering out somewhere between 655.00 and 660.00 by the end of this month. September should see the .OEX pullback sharply - perhaps in the first leg down of a multimonth decline - and traders and investors should already be actively protecting any open long positions they currently have in the market. Figure 1 show us the strongest 4-week relative strength (RS) performers in the .OEX; energy sector stocks continue to own this list, with Baker Hughes (BHI), Halliburton (HAL) and National Oilwell Varco (NOV) now being joined by Schlumberger (SLB) once again. Sprint Nextel (S) may be setting up for its final, parabolic rise prior to a substantial yet proportional retracement move along with the rest of the US broad markets. Walgreen's (WAG) also appears to be preparing for a continuation move toward higher prices - at least until the .OEX begins to correct once again. To repeat from Friday's edition of PP: "At this late stage in a ten-month old bull run you need to pick your new long positions very wisely, so make sure you are comfortable with the output of your favorite short-term mechanical trading strategy and try to stay away from holding long term positions now that we are within weeks of a noticeable trend reversal in the broad US markets." |

|

| Figure 2: The 10 strongest S&P 100 (.OEX) components over the past month, as of Friday, August 10, 2012. |

| Graphic provided by: MetaStock. |

| Graphic provided by: Metastock's Explorer. |

| |

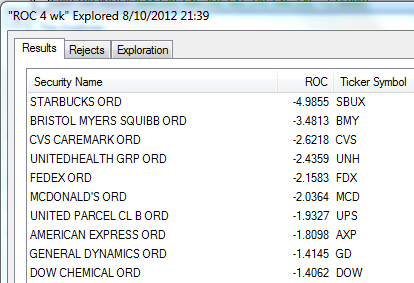

| Figure 2 is a look at the weakest 4-week relative strength performers in the .OEX; Starbucks (SBUX) continues to severely lag the rest of its large cap brethren; Bristol Myers Squibb (BMY), CVS Caremark (CVS) and United Health Group (UNH) all remain mired on the poor performing list, too. UPS and FDX are still the two weak transports on the list, but since the price of crude oil is expected to fall back into the mid-to-upper $80 range by late September, these two issues may soon disappear from this list for a well-deserved vacation. The presence of McDonald's (MCD) is a revealing testimony of the weakness of the US and global economies; if people are cutting back on fast food and beverages, what else are they going to start lightening up on? |

|

| Figure 1: The 10 weakest S&P 100 (.OEX) components over the past month, as of Friday, August 10, 2012. |

| Graphic provided by: MetaStock. |

| Graphic provided by: Metastock's Explorer. |

| |

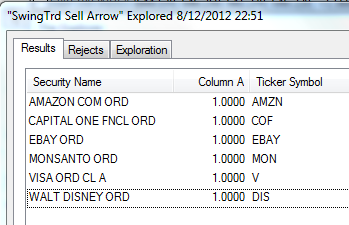

| Figure 3 are the S&P 100 components giving RMO swing sell setup signals; 6% of the .OEX components issued new RMO swing sell signals on Friday; there were no new swing buy setups at all. American Express (AXP) and Visa International (V) are still waiting to trigger new short entries - if they drop below their lows of Friday, that is - and with Capital One Financial (COF) now joining these two financials with a sell setup signal of its own, it will be interesting to see if it will be the financials and transports that will be the first sectors to make sharp pullbacks as the .OEX begins to peak after a more than ten-month old rally terminates. Ebay (EBAY), Monsanto (MON) and Disney (DIS) will also trigger new short entries if they drop below their Friday lows within the next couple of sessions. |

|

| Figure 3: The S&P 100 (.OEX) components issuing RMO swing sell signals at the close of trading on Friday, August 10, 2012; 6% of all .OEX components fired swing sell setup signals during this session, with no new swing buy setup signals being issued. |

| Graphic provided by: MetaStock. |

| Graphic provided by: Metastock's Explorer. |

| |

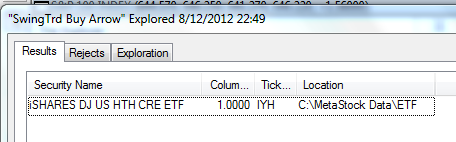

| One ETF flashed a swing buy setup signal on Friday; the iShares US Healthcare Sector Index (IYH); this etf will trigger a new long entry on a rise above its Friday high of 81.06; there was one new swing sell setup in the iShares Transportation (IYT) ETF. As mentioned earlier in this article, cycle analysis suggests that the price of crude oil is likely to decline sometime in the next 3 to 5 weeks, possibly bringing its price per barrel down into the mid-to-upper $80 range; IYT and its components might see a bit a bit of a rebound if this occurs. |

|

| Figure 4: The one ETF that fired a new RMO swing buy setup signal as of the close of trading on Friday, August 10, 2012; there was also one new RMO swing sell setup signal on Friday. |

| Graphic provided by: MetaStock. |

| Graphic provided by: Metastock's Explorer. |

| |

| The .OEX moved slightly higher on Friday - after testing intraday support levels - and now looks to be in prime position to stage a minor bullish continuation rally. At this late stage of the major rally that began on October 4, 2012 your best offense as a wise trader and investor is to play a solid defense; you should be actively protecting open positions with tight trailing stops or put options and may even want to be scaling out of and/or exiting positions that have already blessed you with a substantial return. Bearish trend reversals sometimes begin with a sudden 'bang' - usually when you are lulled into complacency by the optimism and euphoria that a strong bull market can fill your mind with. So, your job is to be prepared just like a good Boy Scout would be, ready and able to handle anything that the mean old Bear can throw your way. As always, trade wisely until we meet here again. |

Donald W. Pendergast is a financial markets consultant who offers specialized services to stock brokers and high net worth individuals who seek a better bottom line for their portfolios.

| Title: | Writer, market consultant |

| Company: | Linear Trading Systems LLC |

| Jacksonville, FL 32217 | |

| Phone # for sales: | 904-239-9564 |

| E-mail address: | lineartradingsys@gmail.com |

Traders' Resource Links | |

| Linear Trading Systems LLC has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog