HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Donald W. Pendergast, Jr.

Still rising, the .OEX manages to tack on a bit more of a gain during Monday's trading action.

Position: N/A

Donald W. Pendergast, Jr.

Donald W. Pendergast is a financial markets consultant who offers specialized services to stock brokers and high net worth individuals who seek a better bottom line for their portfolios.

PRINT THIS ARTICLE

TECHNICAL ANALYSIS

PENDY'S PICKS: July 3, 2012

07/05/12 11:23:33 AMby Donald W. Pendergast, Jr.

Still rising, the .OEX manages to tack on a bit more of a gain during Monday's trading action.

Position: N/A

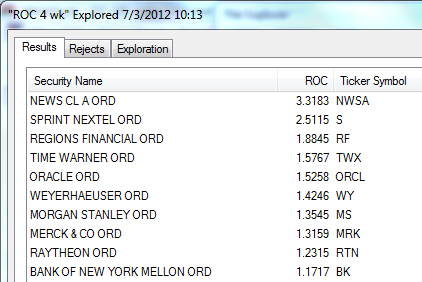

| The Standard & Poor's 100 (.OEX) enjoyed a bit more upside on Monday, closing up by a quarter of a percent (closing at 625.38). As mentioned in previous PENDY'S PICKS (PP), bullish 61-day and 16-week price cycles are now in primary control of the .OEX. Cycle analysis further suggests that the index stands an above-average chance of rising close to the price level of the May 1, 2012, swing high of 643.29 before these cycles peak and begin to roll over -- something of value to know, especially if you are a covered call or swing trader who needs to stay on the right side of a particular market trend. Figure 1 is a look at the strongest four-week relative strength (RS) performers in the .OEX. Sprint Nextel (S) has now moved down to second place in terms of RS rank, even as NewsCorp. (NWSA) has surged upward in the rankings. Notable by their most recent appearance in the strongest RS ranking are shares of pharma giant Merck (MRK) and Bank of New York (BK). |

|

| FIGURE 1: STRONGEST OEX COMPONENTS. Here are the 10 strongest S&P 100 (.OEX) components over the past month, as of Monday, July 2, 2012. |

| Graphic provided by: MetaStock. |

| Graphic provided by: MetaStock Explorer. |

| |

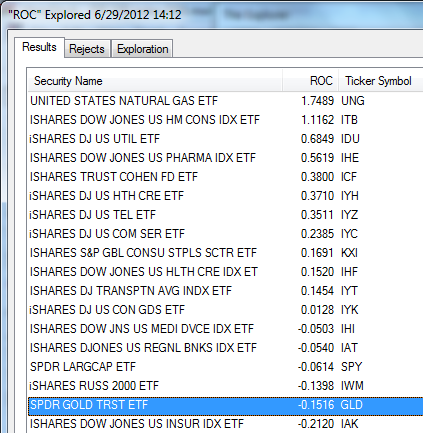

| Figure 2 is a look at the weakest four-week relative strength performers in the .OEX. There is very little change to report here; however, shares of Qualcomm (QCOM) have actually fired a new RMO swing buy signal, one that triggers a buy-stop entry on a near-term rise above 55.86 Again, when you see stocks at or near the top of the weak four-week RS list and such stocks start firing new RMO buy signals, you can be reasonably sure that you are witnessing either: A. a short-covering rally, or B. a trend reversal. Don't discount the simple logic of these deductions; the premise is simple but can yield especially powerful results to patient, highly disciplined traders who use effective mechanical trading models. Just think of the advantage you would have in the market if you knew that a stock you like to trade was very likely at the start of a substantial trend-reversal move higher, even as lesser-informed traders and investors get their own timing wrong because of missing the big picture. |

|

| FIGURE 2: WEAKEST OEX COMPONENTS. Here are the 10 weakest S&P 100 (.OEX) components over the past month, as of Monday, July 2, 2012. |

| Graphic provided by: MetaStock. |

| Graphic provided by: MetaStock Explorer. |

| |

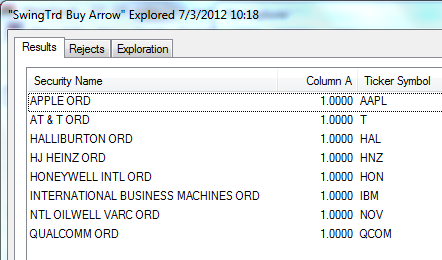

| Figure 3 shows the S&P 100 components giving RMO swing buy signals; 8% of the .OEX components issued new RMO swing buy signals on Monday and only one stock was issuing an RMO sell signal, United Health Group, Inc. (UNH). In my July 2, 2012, edition of PENDY'S PICKS, it was suggested that more tech giants might soon be firing bullish signals, and that's just what we see now, with names like Apple Inc. (AAPL), Honeywell (HON), and Qualcomm (QCOM) giving new swing buy signal alerts. This looks like a new sector rotation theme to follow, especially if all these buy signals are triggered on a rise above their respective highs made on Monday. It truly does look like the leadership (based on four-week RS rankings) in the market is gradually shifting away from the financial stocks and it is now the large cap techs that are gaining relative momentum -- the type of momentum that swing traders and covered call types may be able to profit from. |

|

| FIGURE 3: SWING BUY SIGNALS. Here are the S&P 100 (.OEX) components issuing RMO swing buy signals at the close of trading on Monday, July 2, 2012. During this session, 8% of all .OEX components fired buy signals, with only one new sell signal issued. |

| Graphic provided by: MetaStock. |

| Graphic provided by: MetaStock Explorer. |

| |

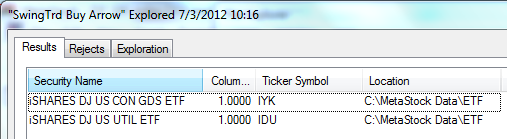

| Figure 4 shows the two exchange traded funds (ETFs) from major industry groups or sectors that are flashing new RMO swing buy signals. The iShares DJ US Consumer Goods and DJ US Utilities ETFs (IYK, IDU) will trigger new long entry signals on a rise above their respective Monday highs. If we also see various tech-related ETFs flashing buys in the next week, we will then have additional confirmation that the rotation into tech stocks is well underway. There were no new RMO swing sell signals in any of our ETFs as of the close of trading on Monday. |

|

| FIGURE 4: SWING BUY SIGNALS. Here are the ETFs that fired new RMO swing buy signals as of the close of trading on Monday, July 2, 2012. |

| Graphic provided by: MetaStock. |

| Graphic provided by: MetaStock Explorer. |

| |

| Bullish price cycles in the .OEX are attempting to move this index higher, possibly up toward the early May 2012 swing highs of 643.29. Bad news out of Europe (such as the new revelations of alleged misdeeds by Barclay's in the LIBOR market, and so on) could always throw a monkey wrench into the current market rally, but for now, the probabilities seem to favor more upside, at least until the 16-week and 61-day cycles in the .OEX peak and finally start to descend again. |

Donald W. Pendergast is a financial markets consultant who offers specialized services to stock brokers and high net worth individuals who seek a better bottom line for their portfolios.

| Title: | Writer, market consultant |

| Company: | Linear Trading Systems LLC |

| Jacksonville, FL 32217 | |

| Phone # for sales: | 904-239-9564 |

| E-mail address: | lineartradingsys@gmail.com |

Traders' Resource Links | |

| Linear Trading Systems LLC has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor