HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Donald W. Pendergast, Jr.

The .OEX rocketed higher on Friday, confirming the bullish strength of two of its key price cycles.

Position: N/A

Donald W. Pendergast, Jr.

Donald W. Pendergast is a financial markets consultant who offers specialized services to stock brokers and high net worth individuals who seek a better bottom line for their portfolios.

PRINT THIS ARTICLE

TECHNICAL ANALYSIS

PENDY'S PICKS: July 2, 2012

07/02/12 02:26:00 PMby Donald W. Pendergast, Jr.

The .OEX rocketed higher on Friday, confirming the bullish strength of two of its key price cycles.

Position: N/A

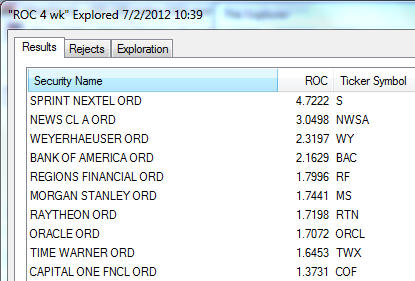

| The Standard & Poor's 100 (.OEX) had dramatic, bullish follow-through on Friday, June 29, closing up by more than 2.4% (closing at 623.82), a clear indication that the bullish 61-day and 16-week price cycles are now in primary control of this key large-cap market's near-term direction. A wide-range, bullish day like this is usually the precursor of further gains, but it would not be surprising to see at least a bit of back-and-fill price action before the move continues northward. Figure 1 is a look at the strongest four-week relative strength (RS) performers in the .OEX. Incredibly, Sprint Nextel (S) is still ranked right at the top of the list; NewsCorp. (NWSA) continues to remain strong, as does Weyerhaeuser (WY) and Regions Financial (RF). Of note is the emergence of Oracle (ORCL) into the top 10 RS list; it's the only tech sector stock outperforming the .OEX over the past month, but it wouldn't be surprising to see even more large-cap tech issues join the high-RS party soon. |

|

| FIGURE 1: STRONGEST OEX COMPONENTS. The 10 strongest S&P 100 (.OEX) components over the past month, as of Friday, June 29, 2012. |

| Graphic provided by: MetaStock. |

| Graphic provided by: MetaStock Explorer. |

| |

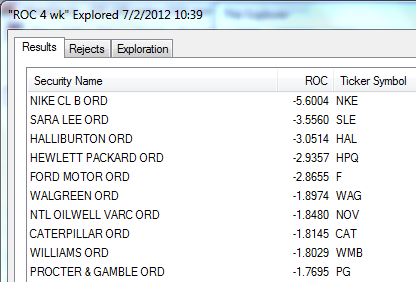

| Figure 2 is a look at the weakest four-week relative strength performers in the .OEX. Of these 10 weakest large caps, three of them are still hailing from the energy sector: Halliburton (HAL), National Oilwell Varco (NOV), and Williams Companies Inc. (WMB) all triggered new RMO long entries on Friday and may now be embarking on relief rallies — duration unknown. If you plan to trade these issues on the long side, be very nimble and quick to take a logical profit just in case any or all of these issues decide to do a fast retest of their recent lows. Ford Motor Co. (F), Walgreen's (WAG), and Proctor & Gamble (PG) are new additions to the unusually weak side of the four-week RS .OEX equation; watch this development to see if other automakers and consumer staples (the buy-or-die sector that offers products that consumers simply can't live without — transportation, pharmaceuticals, food, and everyday household products.) Interestingly, WAG and PG just fired RMO swing buy signals — remember, the RS ranking shows where a stock has been, whereas an RMO buy/sell signal offers insight into which direction a stock may soon intend to move in. Generally speaking, when you see stocks at the top of the weak four-week RS list and such stocks start firing new buy signals, you can be reasonably sure you are witnessing either: A. a short-covering rally, or B. a trend reversal. By the way, WAG and PG only trigger an actual long entry on a rise above each stock's Friday high. |

|

| FIGURE 2: WEAKEST OEX COMPONENTS. The 10 weakest S&P 100 (.OEX) components over the past month, as of Friday, June 29, 2012. |

| Graphic provided by: MetaStock. |

| Graphic provided by: MetaStock Explorer. |

| |

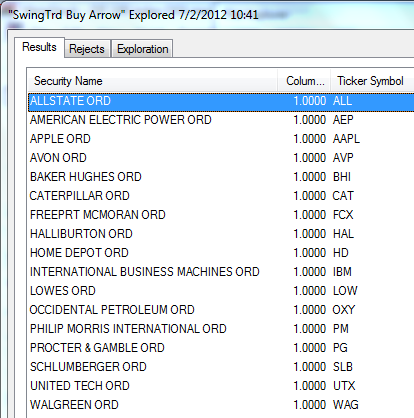

| Figure 3 shows the S&P 100 components giving RMO swing buy signals; there were no RMO swing sell signals as of Thursday's close. Amazingly, 17% of the .OEX components issued new RMO swing buy signals on Friday; there were no stocks issuing RMO swing sell signals, and this lopsided bullish bias certainly does seem to confirm this market's intention of recovering even more of its recent losses. Of the 17 stocks firing buy signals, four are from the energy sector (BHI, OXY, HAL, SLB), two are tech issues (AAPL and IBM), two are manufacturing giants (CAT and UTX), six are consumer staples (AVP, HD, LOW, WAG, PG, and PM), one is a metals miner (FCX), one is an insurer (ALL), and one is an electric utilities outfit (AEP). In other words, the reversal higher is broad-based, including many different industry groups and sectors. |

|

| FIGURE 3: SWING SELL SIGNALS.The S&P 100 (.OEX) components issuing RMO swing sell signals at the close of trading on Friday, June 29, 2012. During this session 17% of all .OEX components fired buy signals, with no new sell signals issued. |

| Graphic provided by: MetaStock. |

| Graphic provided by: MetaStock Explorer. |

| |

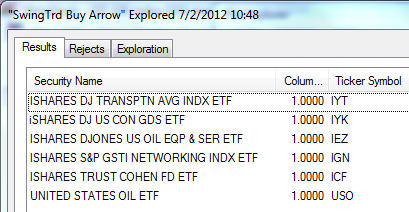

| Figure 4 shows the single exchange traded fund (ETF) from major industry groups or sectors that are flashing new RMO swing buy signals; five of the iShares ETFs (IYT, IYK, IEZ, IGN, ICF), plus the United States Oil Fund ETF (USO) will trigger new long entry signals on a rise above their respective Friday highs. This diverse mix of ETF buy setups also helps confirm the fact that we do indeed have a tradable bullish reversal/and or short-covering rally going in the .OEX and other major US stock indexes. There were no new RMO swing sell signals in any of the ETFs that this report regularly tracks. |

|

| FIGURE 4: SWING BUY SIGNALS. The six ETFs that fired new RMO swing buy signals as of the close of trading on Friday, June 29, 2012. |

| Graphic provided by: MetaStock. |

| Graphic provided by: MetaStock Explorer. |

| |

| The 16-week and 61-day price cycles in the .OEX are indeed taking charge, moving this key index still higher. Even the uncertainty in Europe seems unable to derail these powerful cyclical forces now at work; while no one truly knows just how much higher the .OEX will rise before correcting again, it might be wise to watch the 643.29 level (its May 1, 2012, swing high) as that should serve as a very significant resistance level, especially if the .OEX moves to challenge that area sooner rather than later. |

Donald W. Pendergast is a financial markets consultant who offers specialized services to stock brokers and high net worth individuals who seek a better bottom line for their portfolios.

| Title: | Writer, market consultant |

| Company: | Linear Trading Systems LLC |

| Jacksonville, FL 32217 | |

| Phone # for sales: | 904-239-9564 |

| E-mail address: | lineartradingsys@gmail.com |

Traders' Resource Links | |

| Linear Trading Systems LLC has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog