HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Mike Carr, CMT

Futures prices are directly related to the price consumers pay at the pump.

Position: Sell

Mike Carr, CMT

Mike Carr, CMT, is a member of the Market Technicians Association, and editor of the MTA's newsletter, Technically Speaking. He is also the author of "Smarter Investing in Any Economy: The Definitive Guide to Relative Strength Investing," and "Conquering the Divide: How to Use Economic Indicators to Catch Stock Market Trends."

PRINT THIS ARTICLE

CHART ANALYSIS

Gas Prices at the Pump Should Fall under $3.10

06/28/11 11:58:27 AMby Mike Carr, CMT

Futures prices are directly related to the price consumers pay at the pump.

Position: Sell

| Many government agencies offer useful economic data and research. The Federal Reserve offers a well known data base at http://research.stlouisfed.org/fred2/. Recent upgrades to the site allow you to add moving averages to data or compare several data series in customized charts. While this may sound like long-term investing, Federal Reserve operations are very important to the stock market, and trends in economic data can help keep you on the right side of stock and bond trades. |

| Less well known is the data and research offered by the Energy Information Administration. In a long forgotten weekly report, they wrote that gasoline pump prices average about $0.70 more a gallon that spot futures prices. Those interested can read the report at http://www.eia.gov/oog/info/twip/twiparch/110511/twipprint.html. This is not an exact relationship and the value ranged from $0.21 to $1.17 a gallon in 2008. |

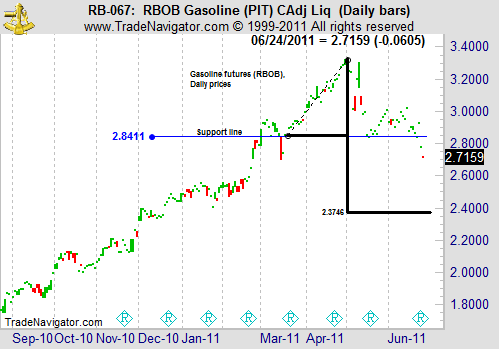

| Figure 1 shows the price history for August unleaded gasoline futures. Stock traders can use an ETF, United States Gasoline (UGA). Support near 2.84 will now offer resistance. A price target of $2.37 is shown, based on the idea that markets move with symmetry. The support line shown in the chart can also be thought of as the neckline in a head and shoulders pattern, ignoring the single down spike in March of this year. Especially in futures, price spikes can occur and should be largely ignored by pattern traders. Chart patterns are a guide, not an exact science. |

|

| Figure 1: Gas prices have turned lower in the past few weeks. |

| Graphic provided by: Trade Navigator. |

| |

| Measuring the move from the support line to the high, and subtracting that distance from the support line establishes a price target of 2.37, and the typical pump premium yields a price target of $3.07 for regular unleaded gas in the near future. |

| Traders can benefit by shorting gasoline futures, and consumers will benefit from the nearly 25% drop in prices in the past couple months. |

Mike Carr, CMT, is a member of the Market Technicians Association, and editor of the MTA's newsletter, Technically Speaking. He is also the author of "Smarter Investing in Any Economy: The Definitive Guide to Relative Strength Investing," and "Conquering the Divide: How to Use Economic Indicators to Catch Stock Market Trends."

| Website: | www.moneynews.com/blogs/MichaelCarr/id-73 |

| E-mail address: | marketstrategist@gmail.com |

Click here for more information about our publications!

PRINT THIS ARTICLE

|

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog