HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Donald W. Pendergast, Jr.

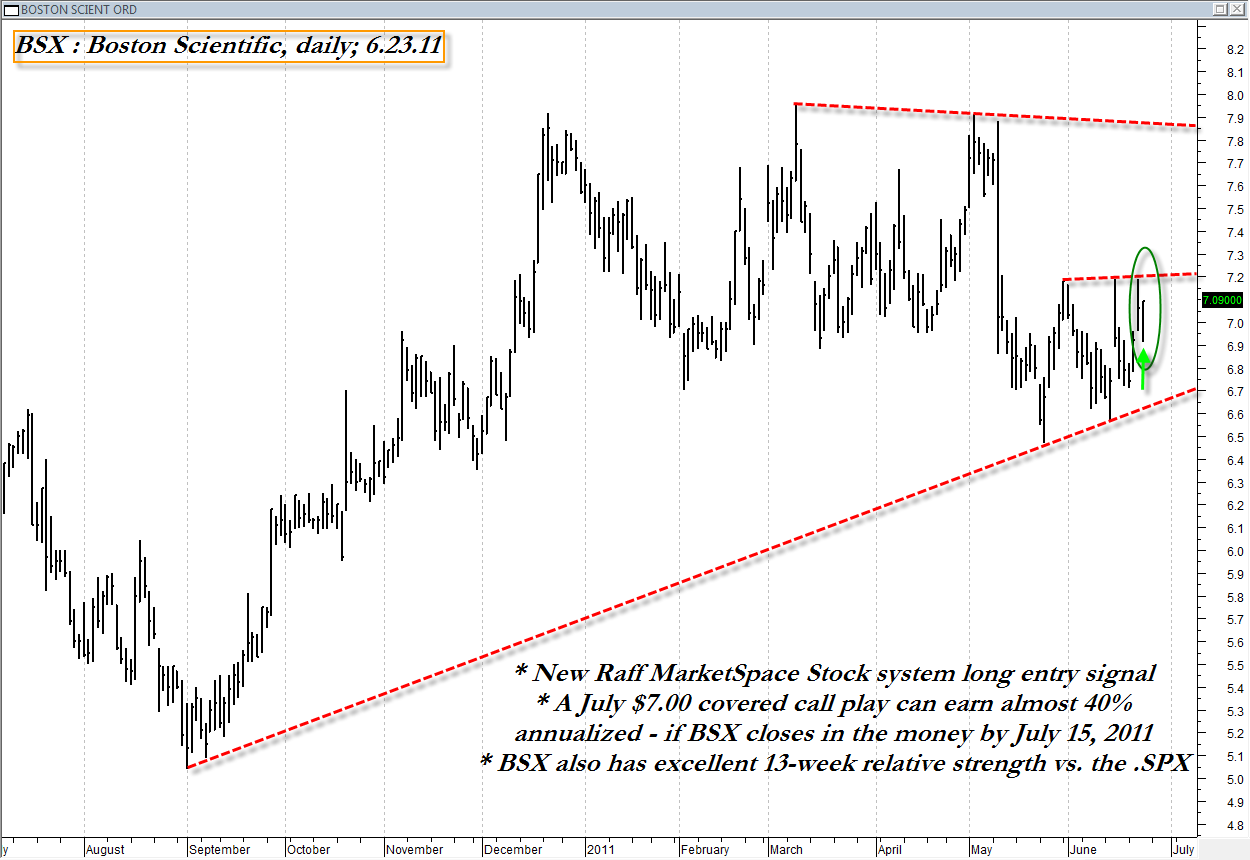

After a recent sell-off, Boston Scientific shares have seemingly found, and made a rebound from a key support level; can this stock reclaim the recent highs - and beyond?

Position: Accumulate

Donald W. Pendergast, Jr.

Donald W. Pendergast is a financial markets consultant who offers specialized services to stock brokers and high net worth individuals who seek a better bottom line for their portfolios.

PRINT THIS ARTICLE

SUPPORT & RESISTANCE

BSX : Breakout Beckoning?

06/23/11 08:48:28 PMby Donald W. Pendergast, Jr.

After a recent sell-off, Boston Scientific shares have seemingly found, and made a rebound from a key support level; can this stock reclaim the recent highs - and beyond?

Position: Accumulate

| Boston Scientific shares (BSX) have been chopping up and down in a major consilidation pattern for the better part of six months now, with a recent nasty shock sell-off also being part of the deal. Hoever, the stock does seem to have gained some solid footing after clashing with the strong support level at $6.50, and may actually be preparing to make an assault to levels above the nearby $7.19 resistance level. Here's a brief look at this potential long setup now. |

|

| Large cap stocks with clearly defined support/resistance levels and liquid option chains tend to make the very best covered call candidates. |

| Graphic provided by: MetaStock. |

| |

| The recent sell-off allowed a very nice, new up trend line to be plotted from the major September 2010 low; a small pennant is also forming, and it all appears to be a bullish technical layout. And since the stock has much stronger relative strength than the .SPX over the last calendar quarter (13-weeks), it might be a good short-term covered call candidate play. |

| The July 2011 BSX $7.00 covered call will generate nearly 40% annualized if the stock is called away by July 15, 2011, a mere 21 days from now; bid-ask spreads are close and option liquidity is also pretty good. Managing the position might involve nothing more complicated than using that major red up trend line as a defacto initial/trailing stop indicator; in trading as in life, keeping things logical and simple really helps you keep your trading focus, especially once your money is on the line. |

| Covered call trading is a great way to get into the world of trading, as it doesn't require a day trading mindset, intraday charts or a computer screen in your face all day long, either. All you really need are liquid, large-cap stocks with strong momentum/comparative relative strength and call options with tight bid-ask spreads. Once you get comfortable with determining valid support/resistance zones on your charts, you should easily be able to determine which stocks are likely to be the best covered call material. Try it if you haven't already - you may be pleasantly surprised. |

Donald W. Pendergast is a financial markets consultant who offers specialized services to stock brokers and high net worth individuals who seek a better bottom line for their portfolios.

| Title: | Writer, market consultant |

| Company: | Linear Trading Systems LLC |

| Jacksonville, FL 32217 | |

| Phone # for sales: | 904-239-9564 |

| E-mail address: | lineartradingsys@gmail.com |

Traders' Resource Links | |

| Linear Trading Systems LLC has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog