HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Chaitali Mohile

The German DAX Composite has reached a make or break situation.

Position: N/A

Chaitali Mohile

Active trader in the Indian stock markets since 2003 and a full-time writer. Trading is largely based upon technical analysis.

PRINT THIS ARTICLE

HEAD & SHOULDERS

DAX Likely To Tumble?

07/22/10 02:30:48 PMby Chaitali Mohile

The German DAX Composite has reached a make or break situation.

Position: N/A

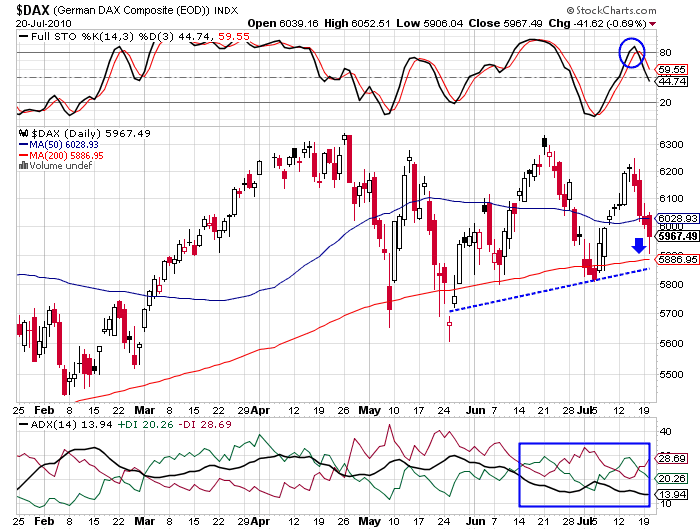

| After many volatile sessions, the German DAX Composite ($DAX) is once again retracing towards an ascending trendline support. The ascending trendline signifies that the $DAX is forming a higher bottom. However, the three peaks revealed a bearish reversal story. On the chart in Figure 1 the support line resembles the neckline, the highest top is the head and the other two are the left & right shoulders. Therefore, a short-term head & shoulder pattern is being constructed on the daily time frame of $DAX. The recent bearish rally has moved much closer to the 200-day moving average (MA) support which is marginally above the neckline. However, the weak average directional index (ADX) and the equal pressure from the buyers and sellers would challenge both the support lines. |

|

| FIGURE 1: $DAX, DAILY. |

| Graphic provided by: StockCharts.com. |

| |

| The declining full stochastic (14,3,3) shows diminishing momentum. The oscillator is forming a head & shoulder top pattern as well. The highlight in Figure 1 is that the price has not breached the 200-day MA support in the past six months and the stochastic oscillator was not oversold for a long time. The indicator sprang immediately from the 20 levels. Hence, we would closely watch a confirmed bearish breakout below 5800 levels. If the breakout occurs, $DAX would plunge to 5300 (6300-5800=500-5800=5300) |

|

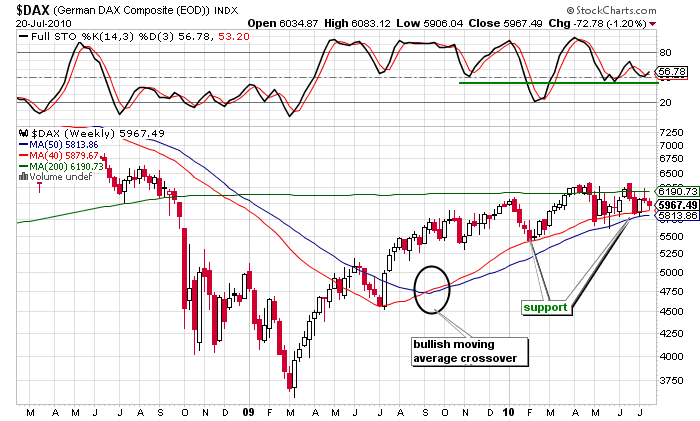

| FIGURE 2: $DAX, WEEKLY. |

| Graphic provided by: StockCharts.com. |

| |

| In Figure 2 I have added 40-week MA to the weekly time frame to understand more about the support-resistance of $DAX. After a bullish crossover of the 40 and 50-week MAs, both the supports converged and ascended. The index has been rallying with the support of the two MAs and under the resistance of 200-week MA. The stochastic oscillator is moving with the support of the center line. Since mid 2009, the MA supports were very well respected by the index. In such a scenario, $DAX would not breach the 40 and 50-period MA supports. |

| Thus, $DAX is unlikely to break the head & shoulder pattern downwards. The index is likely to sustain above the support levels. |

Active trader in the Indian stock markets since 2003 and a full-time writer. Trading is largely based upon technical analysis.

| Company: | Independent |

| Address: | C1/3 Parth Indraprasth Towers. Vastrapur |

| Ahmedabad, Guj 380015 | |

| E-mail address: | chaitalimohile@yahoo.co.in |

Traders' Resource Links | |

| Independent has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog