HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Mike Carr, CMT

Every trader knows they shouldn't fight the trend but most seem to prefer trying to call tops and bottoms rather than profiting from the easy to spot trend.

Position: N/A

Mike Carr, CMT

Mike Carr, CMT, is a member of the Market Technicians Association, and editor of the MTA's newsletter, Technically Speaking. He is also the author of "Smarter Investing in Any Economy: The Definitive Guide to Relative Strength Investing," and "Conquering the Divide: How to Use Economic Indicators to Catch Stock Market Trends."

PRINT THIS ARTICLE

STRATEGIES

Don't Fight the Trend

10/09/09 09:30:34 AMby Mike Carr, CMT

Every trader knows they shouldn't fight the trend but most seem to prefer trying to call tops and bottoms rather than profiting from the easy to spot trend.

Position: N/A

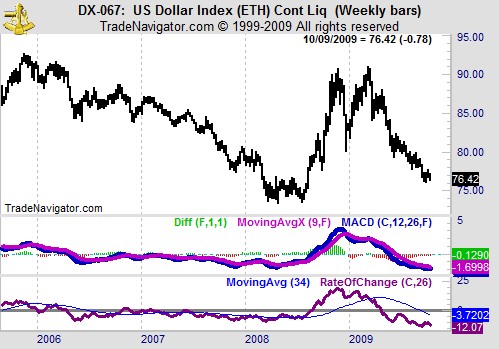

| Is the dollar at a bottom? Pundits are busily following foreign exchange markets so that they can definitively say that the long decline in the greenback is over. Technicians can loom at a chart, like we have in Figure 1, and quickly realize that the Dollar Index is still in a downtrend. |

|

| Figure 1: The weekly chart of the dollar shows no sign of a bottom. |

| Graphic provided by: Trade Navigator. |

| |

| We can see that MACD is bearish and the 26-week rate of change is below its moving average. These indicators tend to be bullish when large price moves occur. Until they turn up, investors are really just bottom fishing. |

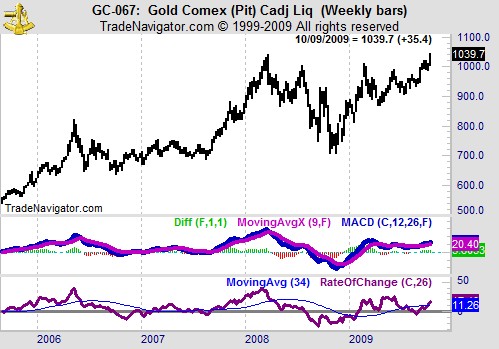

| Gold, as seen in Figure 2, is bullish. Both MACD and the rate of change are on buy signals. |

|

| Figure 2: Gold is clearly in an uptrend on this weekly chart and the daily chart can be used to time trades. |

| Graphic provided by: Trade Navigator. |

| |

| The daily chart can be used to time entries and exits, and in this case would have been bullish in early September, just as the big move began. Trading with the trend can be boring, but profitable. |

Mike Carr, CMT, is a member of the Market Technicians Association, and editor of the MTA's newsletter, Technically Speaking. He is also the author of "Smarter Investing in Any Economy: The Definitive Guide to Relative Strength Investing," and "Conquering the Divide: How to Use Economic Indicators to Catch Stock Market Trends."

| Website: | www.moneynews.com/blogs/MichaelCarr/id-73 |

| E-mail address: | marketstrategist@gmail.com |

Click here for more information about our publications!

Comments

Date: 10/12/09Rank: 5Comment:

Request Information From Our Sponsors

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor