HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Donald W. Pendergast, Jr.

Oil States International shares are fast approaching their major uptrend line, signaling a short-term buying opportunity. Will the long-term trend remain intact, or is this the start of a major round of selling?

Position: Buy

Donald W. Pendergast, Jr.

Donald W. Pendergast is a financial markets consultant who offers specialized services to stock brokers and high net worth individuals who seek a better bottom line for their portfolios.

PRINT THIS ARTICLE

TRADING SYSTEMS

OIS Possible Long Pullback Entry

07/30/09 08:43:44 AMby Donald W. Pendergast, Jr.

Oil States International shares are fast approaching their major uptrend line, signaling a short-term buying opportunity. Will the long-term trend remain intact, or is this the start of a major round of selling?

Position: Buy

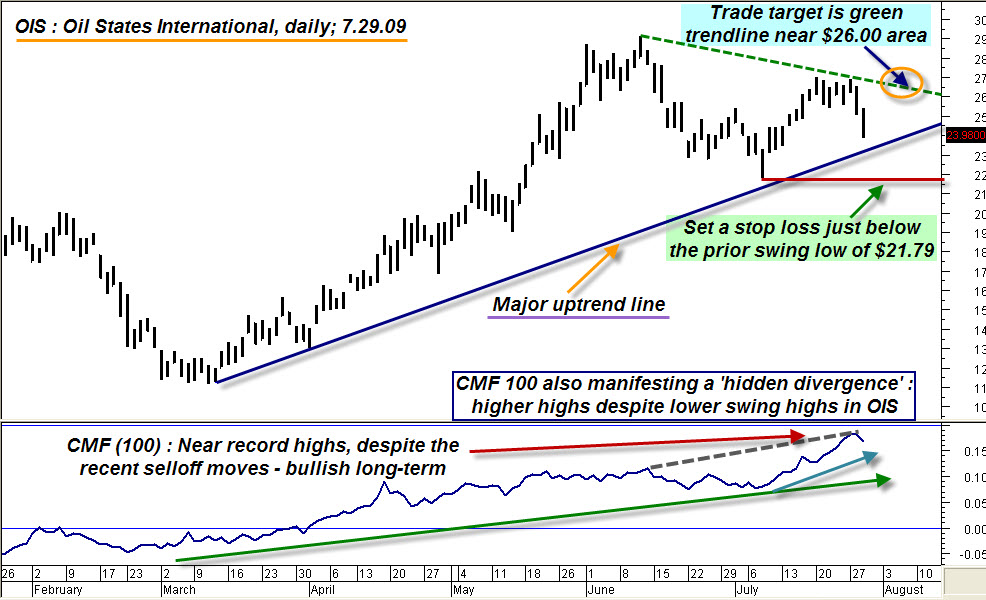

| Oil States International (OIS) is engaged in the oilfield services and support industry, and its stock had been doing quite well in the aftermath of March's massive turnaround in the broad markets, up a staggering 155% from March 6 to June 11. Now, however, the stock has traced out an extended series of retracement swings and is in very close proximity to the long-term uptrend line that is anchored at the base of the last major reversal in this stock. Even more interesting, a very reliable short-term mechanical trading system has just fired a short-term buy signal for OIS. A glance at the OIS daily chart (Figure 1) will provide some additional technical background for this particular trade entry. |

|

| FIGURE 1: OIS, DAILY. This short-term mechanical buy signal features a decent risk to reward ratio; traders able to enter close to the blue uptrend line may be also able to enhance the nominal risk-reward ratio of the trade setup. |

| Graphic provided by: MetaStock. |

| |

| The technicals are mixed; on a long-term basis the trend is bullish, while the medium-term trend (since early June) is down. On a short-term basis, however, OIS may be offering short-term swing traders a good long entry as the stock inches toward the major uptrend line. The particular trading system issuing the system is based on a very simple oscillator-derived indicator that ranges between zero and 100, with buy/sell trigger lines placed at the 20 and 75 areas, respectively. You could probably use something like a five- to seven-period relative strength index (RSI), commodity channel index (CCI), or stochRSI indicator to come up with similar buy/sell triggers of your own; trading isn't rocket surgery. It is a game of common sense, probability, and risk aversion, and the following trade setup appears to fulfill all of these requirements for logical and potentially profitable short-term trading: * The stock is in a confirmed long-term uptrend. * The long-term money flow trend is exceptionally strong. * A mechanical system with a 67% win ratio has just issued a short-term swing buy signal, one occurring near a major support level. * The trade features a favorable risk to reward ratio (RRR). |

| The system normally enters at the next session's opening price (ask your broker about using a market on open order, also known as MOO), so if the trade gets filled at a price close to today's close -- let's say $24 -- you'd have an initial $2.00 price target that coincided at the upper green trendline (near $26) followed by a second price target at the prior swing high at $26.91. The intitial stop for the trade should be placed just below the prior swing low at $21.79, giving the trade a nominal RRR of about 1.3 to 1. Traders hoping to get a better fill than tomorrow's opening price might wait for a possible intraday pullback toward the long-term uptrend line (blue line on chart), which if obtained will give the trade an outstanding RRR. Trade management is very straightforward; if the initial stop is hit, you're out of the trade. If the trade moves in your favor, consider taking all of the trade off when your short-term oscillator (as detailed before) rises above the upper trigger line (in this case 75). Optionally, if you believe OIS has enough of a fire burning beneath it to propel it all the way up to the prior swing high, you could always take half of the trade off at either the oscillator's 75-80 level and/or the upper green trendline target (near $26) and then simply trail the rest of the trade with a two-bar trailing stop of the daily lows. Remember, this is a short-term mechanical buy signal, so it might be more prudent to take any gains sooner rather than later, allowing your short-term oscillator to determine your best time to exit stage left. |

| The combination of a mechanical timing signal with strong chart technicals (as interpreted by your own subjective view) may not be as easy to backtest as a pure mechanical system can be, but from my own experience I've learned that such combinations of computer intelligence and human judgment frequently lead to profitable trade outcomes. Try it on your own and see how well this kind of hybrid trading works for you. You'll be pleasantly surprised at the results that can be obtained over time. |

Donald W. Pendergast is a financial markets consultant who offers specialized services to stock brokers and high net worth individuals who seek a better bottom line for their portfolios.

| Title: | Writer, market consultant |

| Company: | Linear Trading Systems LLC |

| Jacksonville, FL 32217 | |

| Phone # for sales: | 904-239-9564 |

| E-mail address: | lineartradingsys@gmail.com |

Traders' Resource Links | |

| Linear Trading Systems LLC has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog