HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Mike Carr, CMT

Stock markets appear to be overbought after the recent gains, but history tells us that could simply be pointing to more gains.

Position: N/A

Mike Carr, CMT

Mike Carr, CMT, is a member of the Market Technicians Association, and editor of the MTA's newsletter, Technically Speaking. He is also the author of "Smarter Investing in Any Economy: The Definitive Guide to Relative Strength Investing," and "Conquering the Divide: How to Use Economic Indicators to Catch Stock Market Trends."

PRINT THIS ARTICLE

STRATEGIES

Overbought Doesn't Mean Sell

07/25/09 10:51:17 AMby Mike Carr, CMT

Stock markets appear to be overbought after the recent gains, but history tells us that could simply be pointing to more gains.

Position: N/A

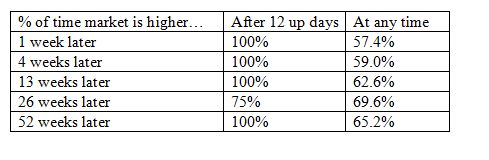

| On July 23, the NASDAQ Composite Index closed higher for the twelfth day in a row. This is only the fifth time in history this has happened. The other occurrences were in January 1985, February 1986, February 1988, and January 1992. Those events led to more market gains over the next year (Figure 1). While four events do not give us a statistically significant sample size, it does provide at least some information that may be useful to investors. |

|

| Figure 1: There is a significant bullish bias to the previous times the NASDAQ closed higher 12 days in a row. |

| Graphic provided by: Trade Navigator. |

| |

| After the gains in 1985, the NASDAQ traded 20% higher a year later and tested but never broke below the level reached at the end of that streak. A one year gain of 18% followed the 1986 run, but that was not as smooth as the earlier gains. A 16% gain by early summer was erased as prices bounced along the level attained during the 12-day run through the end of the year. |

| A 9% gain followed the 1988 example. And once again the top of the streak provided a support level for the rest of the year. January 1992 provides the lone example of a significantly lower low being reached in the year following 12-straight up days. The market fell by about 11% over 24 weeks before rebounding to show an 11% gain 52 weeks after the streak. |

| The historical record is brief, and statisticians would argue that it is meaningless. However, trading is a game of probabilities and it would seem that this is another piece of evidence supporting the bullish case for stocks over the intermediate term. |

Mike Carr, CMT, is a member of the Market Technicians Association, and editor of the MTA's newsletter, Technically Speaking. He is also the author of "Smarter Investing in Any Economy: The Definitive Guide to Relative Strength Investing," and "Conquering the Divide: How to Use Economic Indicators to Catch Stock Market Trends."

| Website: | www.moneynews.com/blogs/MichaelCarr/id-73 |

| E-mail address: | marketstrategist@gmail.com |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog