HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Donald W. Pendergast, Jr.

Once one of the uranium mining industry's high-flying stocks, Uranium Resources may be staging a convincing turnaround.

Position: Accumulate

Donald W. Pendergast, Jr.

Donald W. Pendergast is a financial markets consultant who offers specialized services to stock brokers and high net worth individuals who seek a better bottom line for their portfolios.

PRINT THIS ARTICLE

MOVING AVERAGES

URRE Big-Volume Break Above 200-Day EMA

06/08/09 01:15:36 PMby Donald W. Pendergast, Jr.

Once one of the uranium mining industry's high-flying stocks, Uranium Resources may be staging a convincing turnaround.

Position: Accumulate

| Uranium Resources, Inc. (URRE), based in Lewisville, TX, has been processing uranium since the 1980s and owns various uranium-rich properties in Texas and New Mexico. URRE is one of the few companies that relies on "in-situ" extraction of uranium from the ground; essentially, high-pressure, specially oxidized groundwater is injected into known ore veins, causing the radioactive materials to be drawn out for further processing. The process eliminates many of the human hazards associated with traditional forms of underground mining (mine cave-ins and lung disease) and also eliminates the decades-old problem of radioactive tailings (the chemically contaminated waste solids that result from typical underground extraction techniques). URRE has actually produced seven million pounds of uranium using these in-situ extraction methods. URRE's common share price has had quite a journey since its days as a penny stock (selling for $0.08 a share in July 2003), having progressively risen to nearly $15 per share in late 2007. Then the "irrational exuberance" that drove uranium from $6 per pound all the way to $145 per pound began to fizzle, sending shares of uranium miners into a major tailspin, one that didn't really end until a few months ago. The good news for uranium mining bulls is that it appears that the bear market in this particular market has finally ended; URRE has likely formed a major low and has begun the path toward at least a partial restoration of its formerly lofty stock price. A brief examination of the stock's daily chart reveals that there is a lot to like about this miner's chart patterns. See Figure 1. |

|

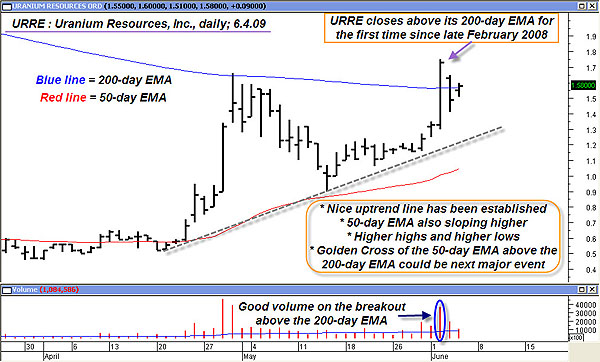

| FIGURE 1: URRE, DAILY. Sub-$5 stocks aren't typically followed by institutions, but URRE's daily chart still presents a compellingly longer-term trade setup. Note how both the daily ranges and trade volumes have increased dramatically since late April 2009. |

| Graphic provided by: MetaStock. |

| |

| No question about it; most of the time (especially when the broad markets are in a generally bullish configuration, like now), when a stock makes a daily close above its 200-day exponential moving average (EMA) on heavy volume, particularly when the stock is emerging from a prolonged bear market, it's a very big deal. Such is the situation with URRE today. Even better for uranium mining bulls, the stock also features a bullish uptrend line, a series of higher highs and higher lows, and it's also blessed with a rising 50-day exponential moving average (EMA) as well. Helping to confirm all of this bullish price action is the solid recovery across the entire global commodity complex; everything from crude oil to natural gas, copper, gold, and silver have made major gains since bottoming out in late 2008 to early 2009. Uranium ore prices (currently hovering near $50 per pound) have also begun to recover, a major factor in helping drive URRE's stock price back up from the dust of the bargain bin. Knowing all of this is fine and dandy, but is there a practical low-risk way to put it to work, hopefully allowing traders/investors a shot at reaping some gains from this miner? Perhaps there is, but it will require some patience, along with a firm belief in the future prospects for the uranium mining industry. |

| First off, there are no options available on URRE, so selling covered calls is a no-go. However, why not take advantage of this significant 200-day EMA break like this: Risking no more than 1% of your account value, calculate how many shares you can acquire if you use URRE's 50-day EMA (red line) as an initial stop/trailing stop. Right now, the 50-day EMA is at $1.04, so why not set a stop-loss a couple of ticks below the EMA at, say, $1.02. With the shares currently near $1.58, you could buy nearly 450 shares of the stock if you have a $25,000 trading account (no margin assumed in this calculation) and still limit your total risk to 1% of your account value, even if URRE stops out right away. Since the trend dynamics of this chart (and of the uranium mining industry) are so favorable, if you simply trail your stop two ticks below the 50-day EMA for the life of the trade, you most likely will not be stopped out right away. If the stock begins to attract more attention due to the 200-day EMA break, it could move significantly; the last time it closed above the 200-day EMA, the stock ran for three and a half months, gaining nearly $3 a share ($5.40 all the way to $8.30) before stopping out on a daily close below its 50-day EMA. While no one knows if such a move is in the cards right now, this still appears to be a good trade from a risk-to-reward ratio. |

| Finally, watch URRE in the weeks to come. If the red 50-day EMA can cross above the blue 200-day EMA, a golden cross will have been completed. If that crossover occurs, consider adding more to your position (about half the size of the original position) after the first significant daily pullback move toward the red EMA line, as the chances will be very good for the stock to move higher in the wake of such a bullish moving average crossover. |

Donald W. Pendergast is a financial markets consultant who offers specialized services to stock brokers and high net worth individuals who seek a better bottom line for their portfolios.

| Title: | Writer, market consultant |

| Company: | Linear Trading Systems LLC |

| Jacksonville, FL 32217 | |

| Phone # for sales: | 904-239-9564 |

| E-mail address: | lineartradingsys@gmail.com |

Traders' Resource Links | |

| Linear Trading Systems LLC has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

Comments

Date: 06/09/09Rank: 3Comment:

Date: 06/10/09Rank: 5Comment:

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog