HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Donald W. Pendergast, Jr.

A well-tested trading system can help make the decision making process less stressful, but every trader needs to determine his or her tolerance for risk and drawdown before committing to a mechanical trading process.

Position: N/A

Donald W. Pendergast, Jr.

Donald W. Pendergast is a financial markets consultant who offers specialized services to stock brokers and high net worth individuals who seek a better bottom line for their portfolios.

PRINT THIS ARTICLE

TRADING SYSTEMS

Measuring Your Trading Temperament

03/06/09 09:41:14 AMby Donald W. Pendergast, Jr.

A well-tested trading system can help make the decision making process less stressful, but every trader needs to determine his or her tolerance for risk and drawdown before committing to a mechanical trading process.

Position: N/A

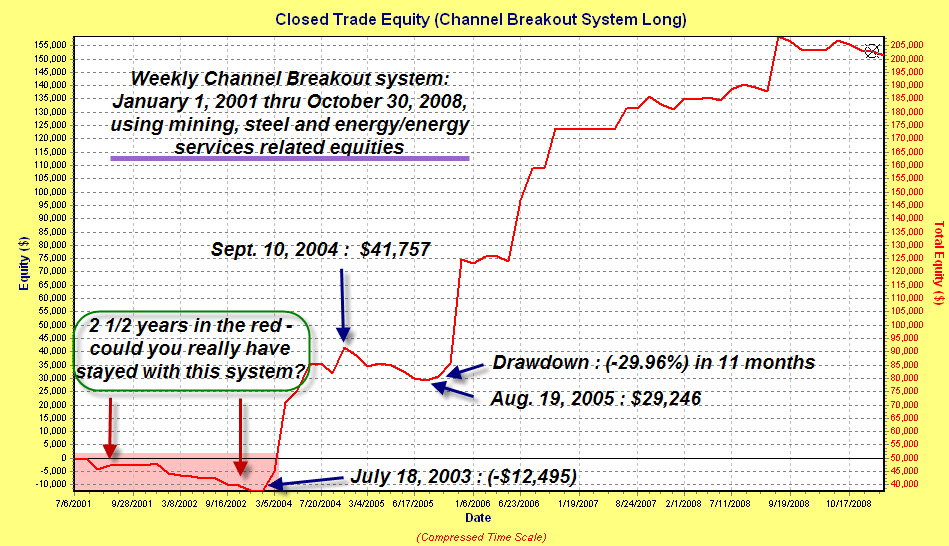

| Name the trading style, and there's probably a trading system designed to take advantage of specific kinds of market behavior. Daytraders might prefer a scalp or opening gap reversal system, while long-term trend-followers might be more comfortable with a breakout system that trades commodities or sector funds. The main thing is that the trading system chosen fits well with the personality and the financial goals of the trader using it. I'll show details of a long-term trend-following system, one that was tested with a basket of mining, steel, and energy/energy services stocks over a 7-3/4 year period beginning on January 1, 2001. Stocks like HAL, AKS, APA, and NEM are typical of the equities used in testing. Only long trades were taken, no margin was used, and the starting hypothetical account balance was $50,000. The commission rate was a penny per share both for the entry and the exit. Although this system was very profitable, there were extended periods of time that a trader's patience would have been tested. My intention is to highlight those troublesome, faith-testing periods of drawdown and reversal, contrasting it against the backdrop of profitable systems that generated both the profits and the inevitable drawdowns. |

|

| While this system made good money during its 7 3/4 year backtest, notice how long and deep the initial drawdown was. Could you really have stayed with this trend-following system? |

| Graphic provided by: Compuvision's TradeSim Enterprise. |

| |

| Here's the equity line for the system's nearly eight-year run; it's very profitable, returning at an average annual compounded rate of more than 19%, even though it boasts more losing trades than winners. Here's the big idea, one that you need to consider before launching into the world of systems trading with a big bankroll and stars in your eyes -- this system earned more than $151,000 in net profits, yet it spent the first two and a half years completely under water! Look at the graph -- right off the bat, you would have had to watch your initial $50,000 in account equity shrivel down to less than $38,000, even though you were following a well-tested system, using stop-losses, sizing positions wisely, and so on. Could you really have maintained your composure after a quarter decade of running this system, with nothing to show for it but red ink, or would you have cast it aside after the first series of losing trades, running to yet another system? At one time, that's exactly what I would have done, and if you're honest, you probably would have, too. But now, let's look at the performance of this system, pretending that we're analyzing backtested results and want to know if we should risk our trading capital on this system going forward. |

|

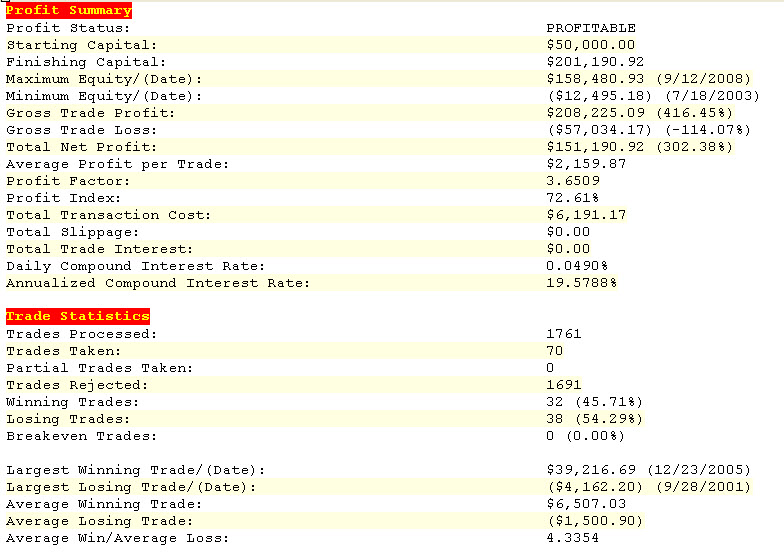

| This weekly channel breakout system (long only) produced good back tested results on a mix of mining, steel and energy/energy services stocks from January 2001 thru October 2008. Notice how high the profit factor is - 3.65. |

| Graphic provided by: Compuvision's TradeSim Enterprise. |

| |

| The stats look great -- the average trade returned $2,160, the profit factor is 3.65, and the average win/average loss ratio is well above 4.30. While the system only wins about 46% of the time, that's a very typical win rate for a trend-following system like this. The 19%+ annual average return sure beats the return on a passbook savings account, too. All of this is wonderful, but if you hadn't also looked at some other stats like maximum peak to valley drawdown, for example, you might have overlooked the possibility of a huge and disturbing period of drawdown, and that right off the bat, no less. |

|

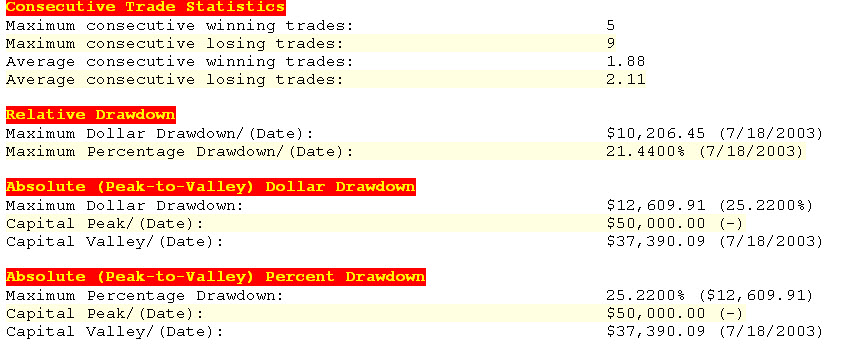

| Not a system for those who need instant gratification, the draw downs have been substantial at times. Losing streaks last about 80% longer than winning streaks, too. Could you handle this, emotionally? |

| Graphic provided by: Compuvision's TradeSim Enterprise. |

| |

| Here are some of those other stats, the ones that reveal that trading this system will likely require a large dose of patience and foresight. Note how long the string of winning trades (five) versus losing trades (nine) is, along with the average number of winning trades (1.88) versus losing trades (2.11) is. Clearly, if you constantly need the emotional gratification that comes from a high win percentage system, you're going to be disappointed if you choose to trade this method. And once again, there are those drawdown stats, too -- a 25% drawdown right from the start, not to mention the 2004-05 drawdown that loppped another 29% off that rapidly rising equity line. So that was then and this is now. What about launching with this system right now? After all, it has a profitable track record, healthy stats, and it trades stock with a penchant for dramatic trending moves -- what's to be concerned about? Nothing, really, except for the fact that the future is unknowable and you could start trading this system tomorrow and go right into a three-year long drawdown. It could happen, and you would need to be mentally and financially prepared for such a possibility. Always make sure that you make a full and thorough investigation of the performance and drawdown characteristics of any system you are considering before you part with your cash. That would be a wise investment of your time. |

| This system could also be configured to take short trades. I have tested it as such, but the results are much more modest than the long-only version described. The combined equity curves are only marginally more profitable, and since selling stocks short involves margin costs, dividend payment liabilities, the danger of violent short squeezes, and higher commission costs (versus a long-only system), trading this channel breakout system on the short side may not be worth the hassle. Regardless, it's nice to know that such old-line systems as the channel breakout can still hold their own in today's trading arena. |

Donald W. Pendergast is a financial markets consultant who offers specialized services to stock brokers and high net worth individuals who seek a better bottom line for their portfolios.

| Title: | Writer, market consultant |

| Company: | Linear Trading Systems LLC |

| Jacksonville, FL 32217 | |

| Phone # for sales: | 904-239-9564 |

| E-mail address: | lineartradingsys@gmail.com |

Traders' Resource Links | |

| Linear Trading Systems LLC has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

Comments

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog