HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Donald W. Pendergast, Jr.

For aggressive traders who are hopeful of an eventual turnaround in General Motors, ultra-high volatility opens up the possibility of acquiring GM shares very cheaply very soon.

Position: Accumulate

Donald W. Pendergast, Jr.

Donald W. Pendergast is a financial markets consultant who offers specialized services to stock brokers and high net worth individuals who seek a better bottom line for their portfolios.

PRINT THIS ARTICLE

IMPLIED VOLATILITY

High Volatility Makes GM A Purchase Possibility

12/16/08 11:54:45 PMby Donald W. Pendergast, Jr.

For aggressive traders who are hopeful of an eventual turnaround in General Motors, ultra-high volatility opens up the possibility of acquiring GM shares very cheaply very soon.

Position: Accumulate

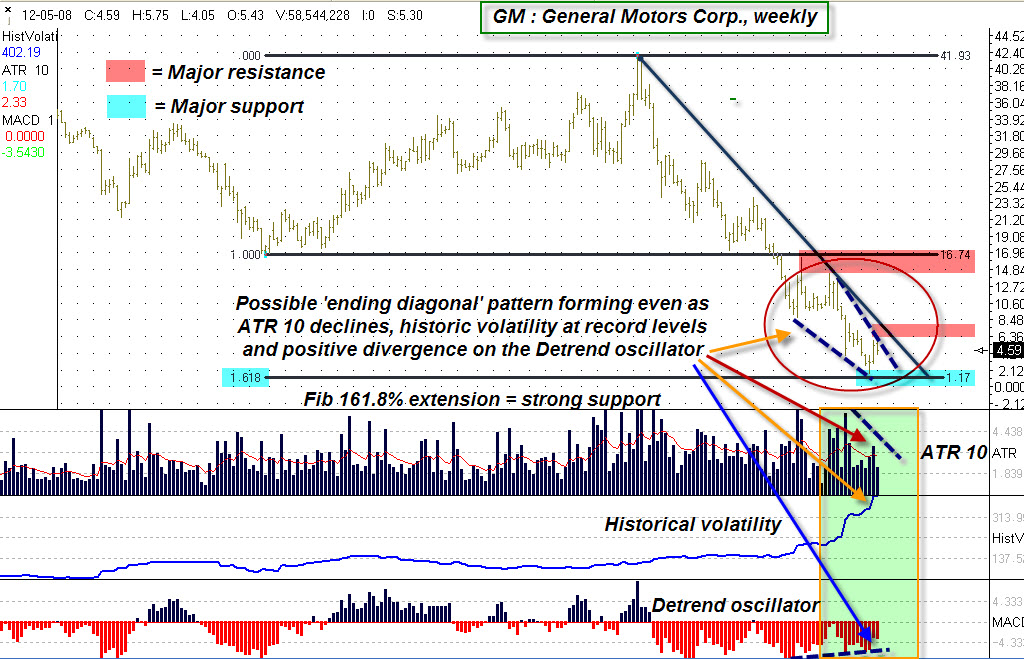

| GM's weekly chart (Figure 1) is noteworthy, no matter how bad the company's business woes. First, see how the stock price reversed just above the Fibonacci 161.8% extension, even as a potential ending diagonal pattern begins to take shape. The bullish divergence on the detrend oscillator is another plus, as is the declining average true range of the last 10 weeks, which suggests that the stock is starting to settle down as it seeks to establish a meaningful low. With a relatively strong Fibonacci 161.8% support level near $1.20, it will be interesting to see if this level holds on a retest of the recent low. The second indicator in the subwindow, historical volatility, tells us that option premiums are likely at insane levels. So we see that GM shares may be due for a reversal. How can we play this if we're optimistic that GM will either be bailed out (a la Chrysler, 1979-80) or finds some other way of righting its ineffective business model? |

|

| FIGURE 1: GM, WEEKLY. Volatile GM stock bounces off of support as an ending diagonal pattern takes shape. |

| Graphic provided by: Ensign Windows. |

| |

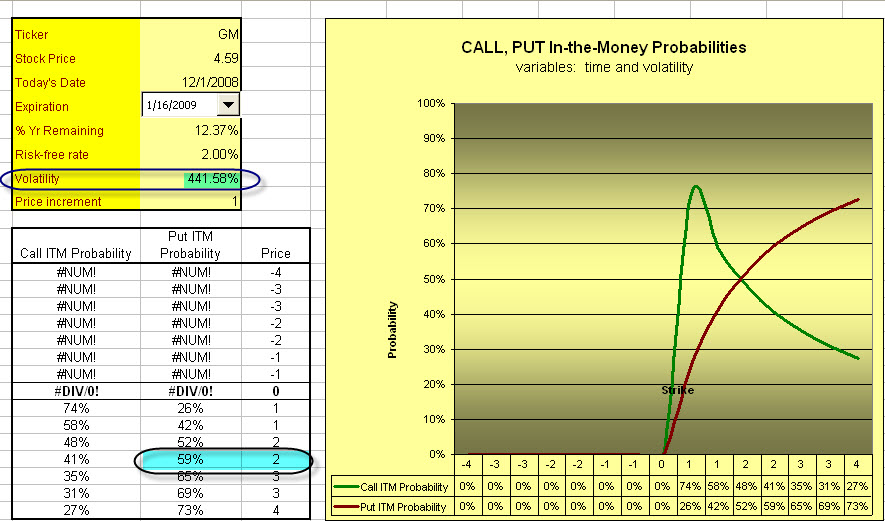

| An optimist who likes what he sees on GM's weekly chart and decides to take a shot at acquiring GM shares at $2.50 could consider selling a January 2009 $2.50 put option for about $1.05. With an expiration only 45 days away, time decay will rapidly erode the time value of the put, and since implied volatility (IV) is so extreme, a reversion to normal IV levels will also help shrivel the option's premium, allowing nimble traders to buy back the short put at a profit, especially if GM shares either stop falling and/or actually rise. Longer-term investors who actually wouldn't mind having the opportunity to pick up GM shares at $1.45 ($2.50 strike price, less $1.05 in premiums received from the short put) each would simply hold the puts to expiration, hoping that GM falls below $2.50 by January 16, 2009. If the company survives, these longer-term optimists will also collect whatever (if any) dividend that the company pays to common shareholders. It's currently $1.00 per share, but that could always change. See Figure 2. |

|

| FIGURE 2: GM AND IV. Using current January 2009 $2.50 put option IV of 441%, GM has a 59% chance of expiring in the money at expiration. Calculated with historical volatility (319%), the probability drops to 43% |

| Graphic provided by: Option Wizard Online. |

| |

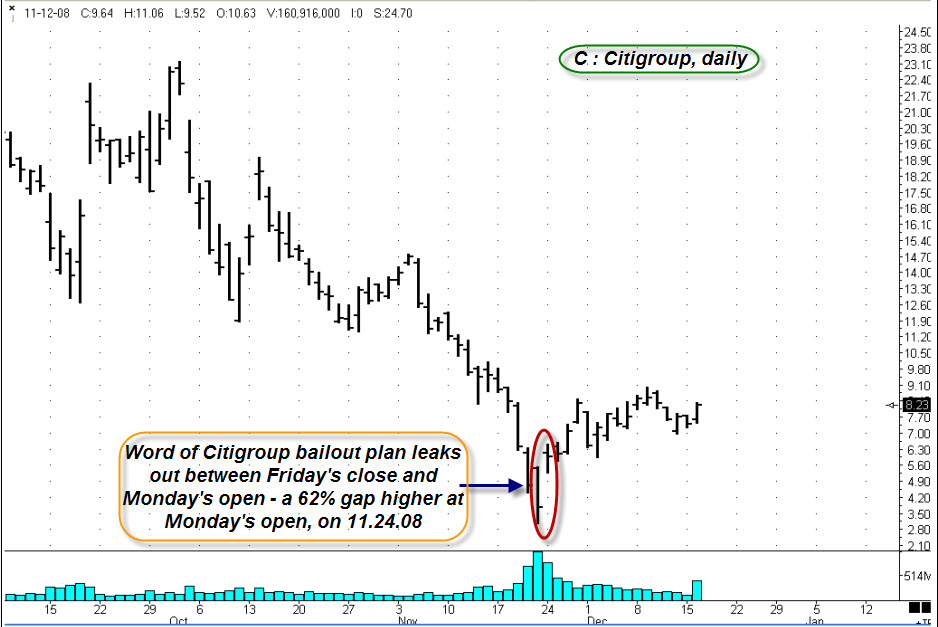

| For those who think this strategy is unrealistic, especially when played with small numbers of option contracts, consider what happened to Citigroup last week when its bailout was announced (Figure 3). Those who sold $2.50 puts nine days ago were handsomely rewarded as the stock quickly rebounded to almost $8.50 from the low $3 range. Will something like that happen to GM? No one knows. But for conservative gamblers and longer-term investors, this could be a risk worth taking, depending on their level of comfort with risk, account size, and trading temperament. |

|

| A dramatic rebound as plans for a government bailout are announced. |

| Graphic provided by: Ensign Windows. |

| |

Donald W. Pendergast is a financial markets consultant who offers specialized services to stock brokers and high net worth individuals who seek a better bottom line for their portfolios.

| Title: | Writer, market consultant |

| Company: | Linear Trading Systems LLC |

| Jacksonville, FL 32217 | |

| Phone # for sales: | 904-239-9564 |

| E-mail address: | lineartradingsys@gmail.com |

Traders' Resource Links | |

| Linear Trading Systems LLC has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

Comments

Date: 12/06/08Rank: 4Comment:

Date: 12/30/08Rank: 4Comment: We are dealing with the closed-end world of financial services , where all is seen through Alice s Looking Glass and all unions are viewed - by financial wizards - as the underlings to the Wicked Witch of the East. These sentiments complicate the purely technical analysis provided here and are summed in the phrase no one knows . There exists a strong sentiment to punish the corporation which once viewed itself as What is good for General Motors is good for America. It is a potentially long fall, while Citigroup still retains a bit of its varnish due, at least in small part, to Every Person s continuing infatuation with Wm. Clinton Jefferson and his dodging the al-Qaeda bullet so that fat America could still believe that the grandparents paid for everything and I can use it for free! Wow! Just me!

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog