HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Alan R. Northam

QQQQ has now entered into wave (3) of 3, the crash wave, just in time for the worst two months of the year for the stock market. Expect QQQQ to sell off rapidly from here on out.

Position: N/A

Alan R. Northam

Alan Northam lives in the Dallas, Texas area and as an electronic engineer gave him an analytical mind from which he has developed a thorough knowledge of stock market technical analysis. His abilities to analyze the future direction of the stock market has allowed him to successfully trade of his own portfolio over the last 30 years. Mr. Northam is now retired and trading the stock market full time. You can reach him at inquiry@tradersclassroom.com or by visiting his website at http://www.tradersclassroom.com. You can also follow him on Twitter @TradersClassrm.

PRINT THIS ARTICLE

ELLIOTT WAVE

QQQQ Crash Coming?

09/03/08 08:57:47 AMby Alan R. Northam

QQQQ has now entered into wave (3) of 3, the crash wave, just in time for the worst two months of the year for the stock market. Expect QQQQ to sell off rapidly from here on out.

Position: N/A

| I have written several articles on the QQQQs, and I encourage those reading this article to refer back to them for background information. My last article entitled "QQQQ Rally Complete?" published on 5/22/08 describes the details of the Elliott wave analysis of the QQQQs from its market top in late October 2007 through early June 2008. |

| In the early 1900s, Ralph Nelson Elliott discovered that the stock market moved in identifiable waves. Basically, R.N. Elliott discovered that the major trend of the market moved in five waves and that corrective waves moved in three waves, but that these waves can take on more complex formations. From late October 2007 until early June 2008, QQQQ formed waves 1 and 2 of a five-wave impulse wave that defines the major direction of this market as downward (as described in my "QQQQ Rally Complete?"). |

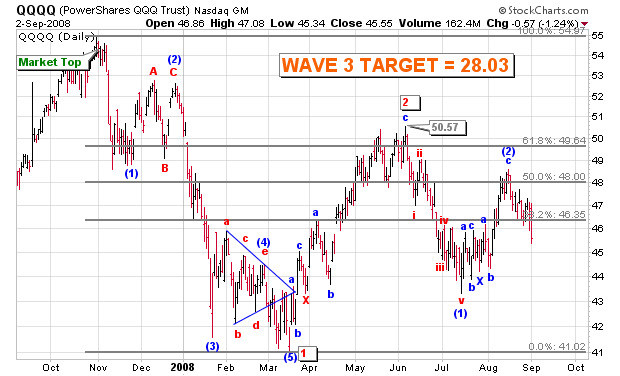

| The completion of wave 2 in early June 2008 marked the beginning of wave 3 down. Wave 3 typically travels the furthest distance in price in the shortest period of time. Wave 3 is also the wave that is typically extended. By "extended," it is meant that wave 3 usually unfolds in five smaller waves. This means that we can expect wave 3 to unfold in five waves labeled wave (1), (2), (3), (4), and (5). Further, wave (3) can extend into five waves labeled waves (i), (ii), (iii), (iv), and (v). From Figure 1, note that wave 2 is now in the process of extending, of which waves (1) and (2) are now complete. With the completion of wave (2), I want to draw your attention to the fact that wave (3) down is now starting to unfold. Recall from above that wave 3 typically traverses the furthest distance in price in the shortest period of time. So looking at the complete picture, QQQQ is now in wave 3 of (3). Both of these waves travel the furthest distance in price in the shortest period of time. What this further implies is that from now to the end of wave (3) down, the downward movement in price could occur quite rapidly. This is called the crash wave. |

|

| FIGURE 1: QQQQ, DAILY. This chart shows the Elliott wave count. |

| Graphic provided by: StockCharts.com. |

| |

| I have calculated the expected target price for the completion of the crash wave. This is done by taking the low price at the completion of wave 1 and subtracting it from the high price at the market top in October 2007. This difference is then multiplied by a common Fibonacci number of 1.618 for wave 3. This product is then subtracted from the high price of wave 2 in early June 2008. This difference then calculates to be $28.03. This then is a practical price target for the completion of wave 3. However, as waves (3), (4), and (5) unfold, a more accurate price target can be calculated. |

| In conclusion, what I find interesting about QQQQ having entered into its crash wave is in its timing. On average over the years, September and October have been the two worst months of the year for the stock market. Therefore, I would expect that during these two months we are about to witness an acceleration in the price decline of this market. Will this market hit its price target of $28.03 during the next two months? It's hard to tell. Trying to pinpoint the date at which a market will hit its expected target price is not as accurate as the calculation of the target price, so I am not going to try and calculate an expected date as to when wave 3 will be complete. However, I do expect to see a significant selloff during the next two months. |

Alan Northam lives in the Dallas, Texas area and as an electronic engineer gave him an analytical mind from which he has developed a thorough knowledge of stock market technical analysis. His abilities to analyze the future direction of the stock market has allowed him to successfully trade of his own portfolio over the last 30 years. Mr. Northam is now retired and trading the stock market full time. You can reach him at inquiry@tradersclassroom.com or by visiting his website at http://www.tradersclassroom.com. You can also follow him on Twitter @TradersClassrm.

| Garland, Tx | |

| Website: | www.tradersclassroom.com |

| E-mail address: | inquiry@tradersclassroom.com |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog