HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Scott W. Barrie

Using limit moves to forecast future direction

Position: N/A

Scott W. Barrie

Scott Barrie is President of Commodity Futures and Equity Analytics, LLC. For more informational analysis of the futures markets, visit his websites at www.grainguide.com, and www.commodityseasonals.com He can be reached at barrie@grainguide.com

PRINT THIS ARTICLE

TECHNICAL ANALYSIS

Limit Moves in the Futures Market

03/27/01 01:29:31 PMby Scott W. Barrie

Using limit moves to forecast future direction

Position: N/A

| Howe's Limit Rule Limit Trading is the maximum advance or decline-- from the previous day's settlement-- permitted for a contract in one trading session by the rules of the exchange. Extraordinary market technician and analyst Robert Howe observed that: "A price at the limit of a tradable daily range, once reached, becomes an objective which the market will again test and ultimately exceed," at least briefly and usually sooner rather than later. |

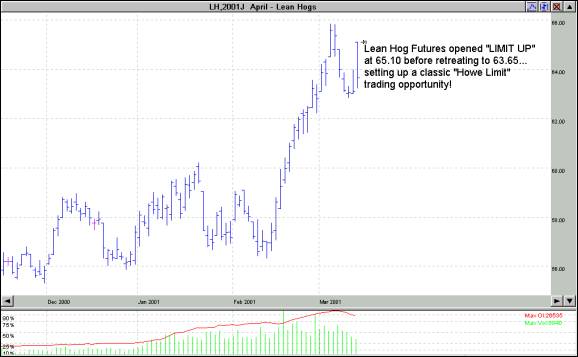

| Recent Examples in the Lean Hog Market Since the first confirmed outbreak of foot-and-mouth disease in the county of Essex, UK, the livestock futures markets have been volatile. In reaction to the March 13th USDA announcement of a temporary prohibition on the importation of animals and animal products from the European Union into the United States, April Lean Hog futures open up the daily permissible limit of +2.00 cents per hundred weight (cwt). Shortly after opening limit up, April Lean Hog futures sold off, settling the day at up +0.55 cents at 63.65, setting up a classic example of applying Howe's Limit Rule. As Howe stated, "A price at the limit of a tradable daily range, once reached, becomes an objective which the market will again test and ultimately exceed." |

|

| Figure 1: April Lean Hogs Daily March 13th, 2001 |

| Graphic provided by: Gecko Software. |

| |

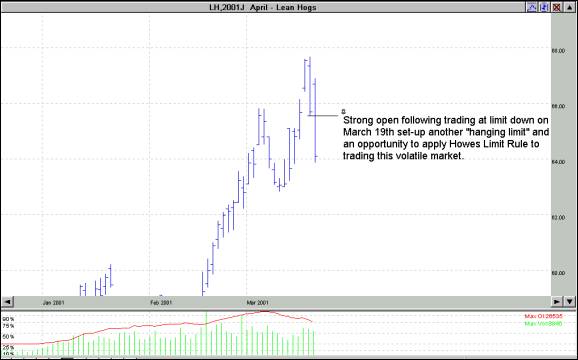

| History shows that limit prices are usually exceeded in the first three days following the event. According to a study done by Moore Research Center, following the last 1,039 limit up moves in Lean Hogs, 853 instances saw the limit up price exceeded within three trading days (82%). Based upon this concept, a trader could have purchased April Lean Hogs at 63.65, with an upside objective of 65.10 (the "hanging limit"). Shortly after the open on March 15th, April Lean Hogs managed to penetrate the hanging limit of 65.10, before sky-rocketing higher to settle the day at 65.675 --score one for Howe's Limit Rule.  Figure 2: April Lean Hogs Daily March 15th, 2001 |

| As the foot-and-mouth crisis in Europe continued, market concerns began to build about supply build-ups in cold storage being dumped on the world market once the USDA ban on EU animal and animal products imports is lifted. In reaction to this, on March 19th, 2001 April Lean Hogs traded down the permissible daily limit of -2.00 cwt at 65.55, though it settled slightly off limit at 65.70. March 20th's strong open up +1.00 cwt at 66.70, set-up another classic Howe Limit Trade, this time to the downside. Following the last 1,190 instances where prices have touched limit down in the Hog futures market, the limit down level was exceeded to the downside 956 times in the next three trading days (80.3%). By the settlement of trade on March 20th, prices had retreated from being +1.00cwt higher to settle the session 64.10, down -.1.60 cwt.  Figure 3: April Lean Hog Futures Daily March 20th, 2001 |

| Summary of Howe's Limit Rule One of the major functions of the futures markets - besides risk transference from those wishing to avoid risk (hedgers) to those willing to accept it (speculators) - is price discovery. A market artificially interrupted in its pursuit of current value leaves a void in price discovery because of this artificial limit on prices. For example, if a market were to touch limit up, that means that a buyer(s) was willing to pay at least that much for the contract and a seller(s) was unwilling to sell at that price. Logic dictates that if the buyer wants the contract he/she will pay a higher price, as the seller will demand a higher price. Thus this level becomes a magnet. For instance, if a market trades at a "limit up" price: - Short-term traders may more confidently buy into any pullback (whether intraday or during subsequent trading days) - Traders already long may be encouraged to maintain their positions - Prospective short-sellers may be discouraged from taking immediate action and wait until the price level is exceeded. For instance, if a market trades at a "limit down" price: - Short-term traders may more confidently sell into any rally (whether intraday or during subsequent trading days) - Traders already short may be encouraged to maintain their positions - Prospective buyers may be discouraged from taking immediate action and wait until the price level is exceeded. Applying Howe's Limit Rule to your trading can help the astute speculator make informed decisions during chaotic times, and take advantage of opportunities which other speculators may pass upon. |

Scott Barrie is President of Commodity Futures and Equity Analytics, LLC. For more informational analysis of the futures markets, visit his websites at www.grainguide.com, and www.commodityseasonals.com He can be reached at barrie@grainguide.com

| Company: | Commodity Futures & Equity Analytics, LLC. |

| Address: | 777 NE 7th Street, suite #214 |

| Grants Pass, OR 97526 | |

| Phone # for sales: | 541-472-1975 |

| Website: | www.grainguide.com |

| E-mail address: | barrie@grainguide.com |

Traders' Resource Links | |

| Commodity Futures & Equity Analytics, LLC. has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

Comments

Date: 04/03/01Rank: 4Comment:

|

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog