HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Matt Blackman

This is a clear example of how shorts, both legal and naked, can decimate the value of a stock. It is also an example of the explosive short squeeze rally that a heavily shorted stock can experience when positive news is combined with compelling technicals.

Position: Buy

Matt Blackman

Matt Blackman is a full-time technical and financial writer and trader. He produces corporate and financial newsletters, and assists clients in getting published in the mainstream media. He is the host of TradeSystemGuru.com. Matt has earned the Chartered Market Technician (CMT) designation. Find out what stocks and futures Matt is watching on Twitter at www.twitter.com/RatioTrade

PRINT THIS ARTICLE

SHORT SQUEEZE

Is Force Protection A Textbook Short Squeeze In Action?

12/14/07 04:06:00 PMby Matt Blackman

This is a clear example of how shorts, both legal and naked, can decimate the value of a stock. It is also an example of the explosive short squeeze rally that a heavily shorted stock can experience when positive news is combined with compelling technicals.

Position: Buy

| If you haven't had a chance to watch the Bloomberg special entitled Phantom Shares, I highly recommend it. You can view the 25-minute special at http://tinyurl.com/yrbnn3, which casts a revealing spotlight on a questionable Wall Street practice that for years has allowed a few well-heeled players to short stock without having to first borrow it. While this is neither the time nor place to argue the ethics, suffice it to say that naked shorting has been responsible for putting more than a few public companies out of business and costs investors billions per day in losses, according to Bloomberg. |

|

| FIGURE 1: FRPT, INTRADAY. This chart shows the bearish head & shoulders top pattern with and drop of stock to long-term support at $5. Note the volume capitulation that started to build at the beginning of December and then a huge move as the stock rallied from $4.99 on December 12 to more than $7.00 intraday on December 14, a 40% move! Chart OmniTrader.com. SqueezeTrigger courtesy www.Buyins.net |

| Graphic provided by: OmniTrader.com, SqueezeTrigger, www.Buyins.net. |

| |

| After much lobbying, the Securities and Exchange Commission (SEC) enacted legislation in an attempt to curtail naked shorting called RegSHO (Regulation Short-Sales) in January 2005, which requires that shares sold short that do not have corresponding proof of share ownership within 13 days of being shorted are listed as "failed-to-deliver" (FTD) and added to the RegSHO threshold list. This is supposed to mandate that these shares be delivered, but we only have to look at a stock like Overstock.com (OSTK) that has been on this list with shares that have FTD for more than 600 days to see that somehow the naked shorts have found a way to avoid this costly requirement. According to a news release issued by Buyins.net on December 14, 2007 Force Protection (FRPT) is just another of more than 175 naked short victims with undelivered shares outstanding — it has been on the RegSHO threshold list for 122 consecutive days and counting. |

|

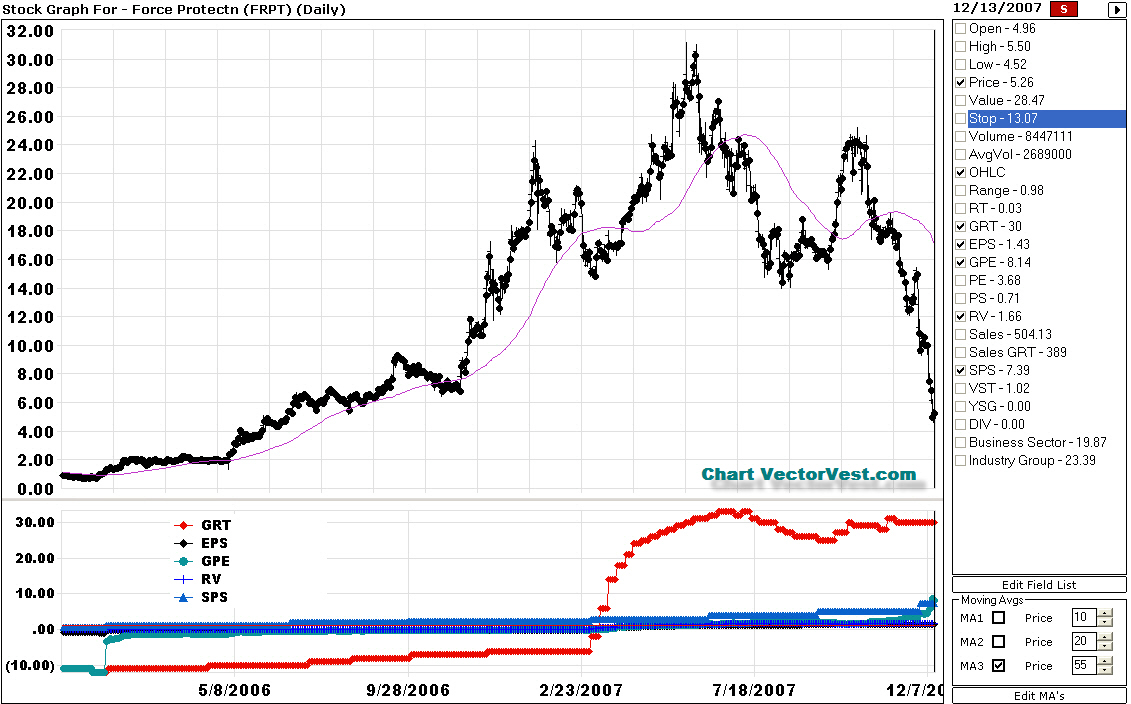

| FIGURE 2: FRPT, DAILY. This time, the fundamentals can be seen. While the stock has been heavily shorted, it is currently showing forecasted earnings growth (GRT) of 30%, a growth to P/E (GPE) of 8.14 (a value of one or greater is good), a sales growth rate (sales GRT) of 389%, sales per share (SPS) of 7.39 with a /E of just 3.68. |

| Graphic provided by: VectorVest.com. |

| |

| A glance at Figure 1 shows how the stock has been decimated since May 2007, dropping from $31 to $4.99 on December 12. According to Buyins.net, short interest as a percentage of the FRPT float is a whopping 31% and it is well below both its long-term SqueezeTrigger of $19.81 (volume-weighted average price at which shorts sold the stock over the long haul) and the most recently monthly SqueezeTrigger price of $15.55. A bearish head & shoulders top pattern formed on the stock over the last 12 months may have been one reason why the stock had been shorted so enthusiastically. But when a heavily shorted stock rallies, shorts watch their profits shrink and then turn to losses as a short squeeze begins to build. As we see from the last two candles in Figure 1, this looks exactly like what happened, and with SqueezeTriggers at $15.55 and $19.81, shorts have a lot of pain ahead if this stock continues to rally. Another bullish contributor is the corporate fundamentals that on this stock are anything but bearish, helping to set the stage for what came next. |

| Then on December 14, the company issued a news release to dispel rumors that were circulating about company difficulties, rumors that Force Protection claims are false. That combined with the company's strong fundamental position set the stage for an explosive short squeeze rally, driving the stock up more than 35% in just a few hours. |

| Shorts borrow a stock and sell it in the hopes that the price will drop so they can buy it back and keep the difference as profit. But naked shorting allows a few specially privileged institutions and professional traders to sell a stock without ever having to borrow it, and this is a revealing case of this detrimental practice in action. Much like the counterfeiter produces fake currency, the effect is the same and the few profit at the expense of the many. Anticipating the reversal of a stock in freefall can be a dangerous practice, aptly named 'trying to catch a falling knife." But unless this stock suffers a devastating corporate meltdown and goes out of business, even the biggest shorts at some point will have to deliver stock certificates, which means buying the stock back and this can have explosive ramifications. In the event that FRPT continues to come through with stellar profits and earnings (as current earnings forecasts suggest the stock will), buyers could continue to pile in, which would see this short squeeze accelerate as shorts are panicked into a mass buying spree. As we saw recently, it has the potential to provide those who correctly anticipate this situation and buy the stock with a very wild and profitable balloon ride. |

Matt Blackman is a full-time technical and financial writer and trader. He produces corporate and financial newsletters, and assists clients in getting published in the mainstream media. He is the host of TradeSystemGuru.com. Matt has earned the Chartered Market Technician (CMT) designation. Find out what stocks and futures Matt is watching on Twitter at www.twitter.com/RatioTrade

| Company: | TradeSystemGuru.com |

| Address: | Box 2589 |

| Garibaldi Highlands, BC Canada | |

| Phone # for sales: | 604-898-9069 |

| Fax: | 604-898-9069 |

| Website: | www.tradesystemguru.com |

| E-mail address: | indextradermb@gmail.com |

Traders' Resource Links | |

| TradeSystemGuru.com has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

Comments

Date: 12/16/07Rank: 4Comment:

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog