HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Kevin Hopson

Median lines can act as good reversal points, as illustrated by Calpine Corp.

Position: N/A

Kevin Hopson

Kevin has been a technical analyst for roughly 10 years now. Previously, Kevin owned his own business and acted as a registered investment advisor, specializing in energy. He was also a freelance oil analyst for Orient Trading Co., a commodity futures trading firm in Japan. Kevin is currently a freelance writer.

PRINT THIS ARTICLE

TECHNICAL ANALYSIS

Median Line Support for Calpine Corp.

05/06/04 05:12:07 PMby Kevin Hopson

Median lines can act as good reversal points, as illustrated by Calpine Corp.

Position: N/A

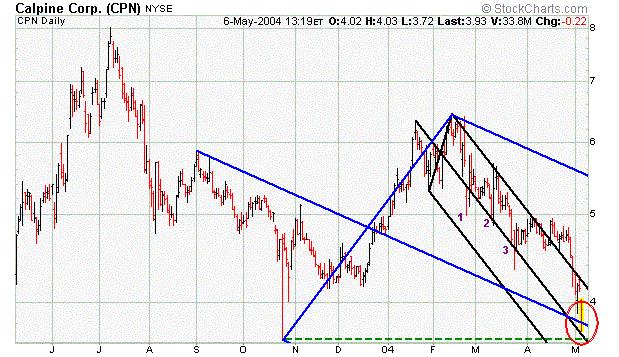

| Calpine Corp. (CPN) is an independent power producer who has seen its stock price decline significantly over the past two months. However, Calpine is currently testing key support, which could act as a temporary bouncing point for the stock in the near-term. More specifically, notice how the blue median line and black median line have both converged in the $3.70 to $3.80 range. Additionally, Calpine's 52-week low ($3.66) - which is illustrated by the dotted green line - is right below this. As a result, there is a nice confluence of support in the $3.65 to $3.80 range. |

| While this may be a good entry point for a trade, it is important to understand the dynamics of median lines. For example, if you focus on the black pitchfork, you will notice that prices have bounced off the median line several times during the stock's current downtrend. This is not much of a surprise, as median lines tend to act as significant support when prices are trading above them. However, identifying volatile situations can make the risk/reward more favorable. |

|

| Graphic provided by: Stockcharts.com. |

| |

| More specifically, when prices sell-off, the median line acts as an even bigger springboard. For example, notice how Calpine bounced higher each of the previous three times that the stock tested the black median line, as illustrated by the 1, 2 and 3 pivot points. Though the stock overshot the median line on two of the three occasions, this trend line acted as a temporary reversal point for prices. Just to note, overshoots are common with big price swings, which is why it is important to watch for these short-term bear traps. |

| However, when prices are hovering along the median line, you tend to see a much smaller bounce. This is why volatility is your friend when it comes to median lines. Had you gone long at median line support and sold along the top black parallel line, which has acted as resistance during the current downtrend, you would have realized 5 to 15 percent gains on each of these trades. Now that Calpine has proceeded to test median line support, the stock could make its way back up to the top black parallel line, which comes in around the $4.20 level. If you are long from the recent bounce, this might be a good place to take short-term profits. |

Kevin has been a technical analyst for roughly 10 years now. Previously, Kevin owned his own business and acted as a registered investment advisor, specializing in energy. He was also a freelance oil analyst for Orient Trading Co., a commodity futures trading firm in Japan. Kevin is currently a freelance writer.

| Glen Allen, VA | |

| E-mail address: | hopson_1@yahoo.com |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog