HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Kevin Hopson

Starbucks' bullish trading range and "out-of-favor" status with Wall Street may indicate higher prices ahead.

Position: Accumulate

Kevin Hopson

Kevin has been a technical analyst for roughly 10 years now. Previously, Kevin owned his own business and acted as a registered investment advisor, specializing in energy. He was also a freelance oil analyst for Orient Trading Co., a commodity futures trading firm in Japan. Kevin is currently a freelance writer.

PRINT THIS ARTICLE

CHANNEL LINES

Why the Rally in Starbucks May Not be Over

05/06/04 05:09:15 PMby Kevin Hopson

Starbucks' bullish trading range and "out-of-favor" status with Wall Street may indicate higher prices ahead.

Position: Accumulate

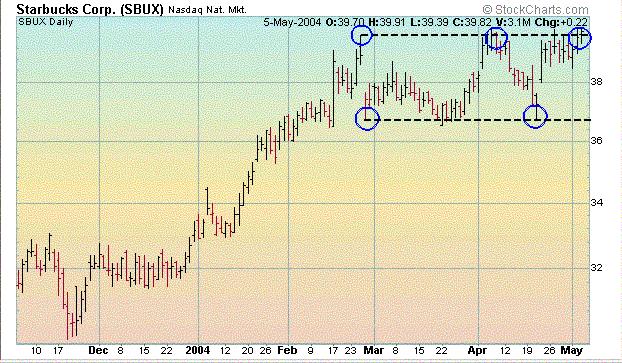

| Starbucks Corp. (SBUX) has seen its stock price appreciate over 70 percent in the last twelve months. However, the stock has failed to make much headway recently, as prices have continued to move sideways. More specifically, Starbucks has formed a two-month trading range between the $37.00 and $40.00 levels. Since trading ranges tend to act as continuation patterns and the long-term trend is positive, Starbucks could see another significant move to the upside in the near-term. |

| If so, the stock could eventually make its way up to the $46.00 to $49.00 range. I calculated this price target by taking the number of times that the stock has tested the upper channel line in alternate sequence, multiplying this number (3) by the width of the trading range ($40.00-$37.00=$3.00) and then adding this figure ($3.00x3=$9.00) to the bottom ($37.00+$9.00=$46.00) and top ($40.00+$9.00=$49.00) channel lines. This price target assumes that Starbucks will break to the upside without testing the bottom channel line again. |

|

| Graphic provided by: Stockcharts.com. |

| |

| The $40.00 level is home to significant call option open interest, which is why the stock has found continued resistance here. However, given current pessimism towards the stock, Starbucks appears to have sufficient buying power to overcome this hurdle. For example, short interest in the stock - as of April 7 - was 15.2M shares, or roughly 5.0x average daily volume. Additionally, two-thirds of the analysts covering Starbucks currently have a "hold" or "sell" rating on the stock. Since pessimistic market sentiment rarely occurs at tops and Starbucks' bullish trading range supports higher prices, I would look to accumulate shares in the near-term. |

Kevin has been a technical analyst for roughly 10 years now. Previously, Kevin owned his own business and acted as a registered investment advisor, specializing in energy. He was also a freelance oil analyst for Orient Trading Co., a commodity futures trading firm in Japan. Kevin is currently a freelance writer.

| Glen Allen, VA | |

| E-mail address: | hopson_1@yahoo.com |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog